Hello friends, Do you want to know about the future value of DLF share price target? So you have come to the right page. DLF share price on NSE as of 16 August 2024 is 866.20 INR. On this page, you will find DLF Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as DLF news today, DLF share news today, DLF share price target tomorrow, DLF share price target 2030, and more Information.

DLF Ltd. Company Details

DLF Ltd is one of India’s largest and most renowned real estate companies, with a rich history dating back to its founding in 1946. The company is known for developing high-quality residential, commercial, and retail properties across the country. DLF has played a significant role in shaping India’s urban landscape, particularly in cities like Delhi and Gurgaon. With a focus on innovation, sustainability, and customer satisfaction, DLF continues to be a leader in the real estate sector, offering modern living and working spaces that cater to the evolving needs of its clients.

| Official Website | dlf.in |

| Founded | 4 July 1946 |

| Founder | Ch. Raghvendra Singh |

| Headquarters | DLF Gateway Tower, Phase 2, Gurugram, Haryana, India |

| Key people | Kushal Pal Singh (retd. Chairman) Rajiv Singh (Chairman) |

| Number of employees | 2,507 (2024) |

| Category | Share Price |

Overview of DLF Share Price

- Open: ₹835.50

- High: ₹874.00

- Low: ₹830.40

- Market Capitalization: ₹2.15LCr

- P/E Ratio: 75.35

- Dividend Yield: 0.58%

- fifty two-Week High: ₹967.60

- fifty two-Week Low: ₹465.30

DLF Share Price Target Tomorrow

| DLF Share Price Target Years | Target Price |

| DLF Share Price Target 2024 | ₹1,056.8 |

| DLF Share Price Target 2025 | ₹1,550 |

| DLF Share Price Target 2026 | ₹1,774 |

| DLF Share Price Target 2027 | ₹2,031 |

| DLF Share Price Target 2028 | ₹2,325 |

| DLF Share Price Target 2029 | ₹2,660 |

| DLF Share Price Target 2030 | ₹3,044 |

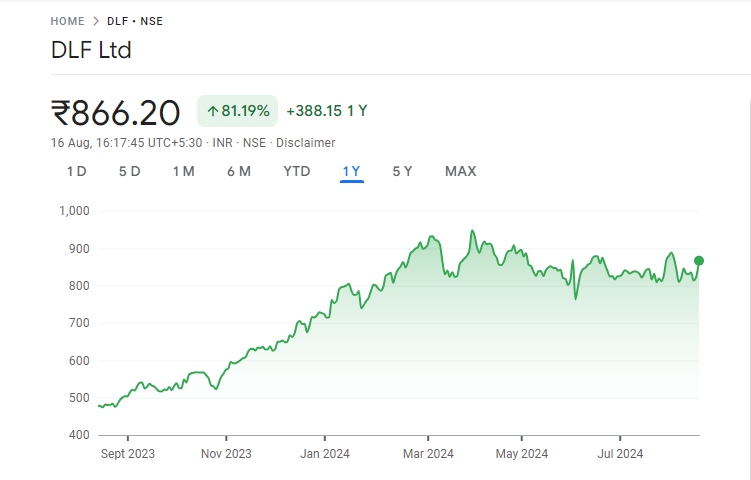

DLF Share Price Recent Graph

Read Also:- Biocon Share Price Target 2024, 2025, 2026, 2027 to 2030 Forecast

DLF Shareholding Pattern

- Promoters: 74.08%

- Foreign Institutions: 16.16%

- Retail and Others: 4.95%

- Mutual Funds: 3.46%

- Other Domestic Institutions: 1.35%

Factors Affecting DLF Share Price Growth

1. Real Estate Market Trends

DLF’s share price is closely tied to the overall performance of the real estate market. Factors like property demand, real estate prices, and urban development trends play a significant role. When the real estate market is booming, with high demand for residential and commercial properties, DLF’s share price is likely to see growth. However, a slowdown in the market or a decline in property prices can negatively impact its stock.

2. Company Performance and Financial Health

DLF’s financial performance, including revenue growth, profit margins, and earnings per share (EPS), directly influences its share price. Consistent financial results and profitability suggest a stable and growing company, which can lead to an increase in share price. On the other hand, financial challenges or declining profits may result in a decrease in the stock price.

3. Government Policies and Regulations

The real estate sector is heavily influenced by government policies and regulations, such as housing incentives, interest rates, and changes in real estate laws. Favorable policies, such as tax incentives for homebuyers or lower interest rates, can boost demand for DLF’s properties, positively impacting its share price. Conversely, stricter regulations or unfavorable government decisions may create challenges for the company, affecting its stock price growth.

4. Expansion and Development Projects

DLF’s share price growth is also driven by its ongoing and upcoming development projects. Successful completion and sale of major projects, as well as strategic land acquisitions and expansions, can enhance investor confidence and lead to share price growth. However, delays, cost overruns, or unsuccessful projects might lead to concerns about the company’s future profitability, potentially impacting its stock negatively.

5. Market Sentiment and Investor Confidence

Market sentiment, shaped by news, analyst ratings, and media coverage, plays a vital role in DLF’s share price movement. Positive news, such as strong quarterly results or successful project launches, can boost investor confidence and drive up the share price. Conversely, negative news, market rumors, or unfavorable analyst reviews can lead to a decline in investor confidence and a drop in the stock price.

Read Also:-

- Adani Total Gas Share Price Target

- Canara Bank Share Price Target

- Reliance Share Price Target

- Central Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.