Divi’s Laboratories Ltd. (NSE: DIVISLAB) is surely considered one of India’s main pharmaceutical businesses, specializing in the manufacturing of Active Pharmaceutical Ingredients (APIs) and intermediates. This agency has made a huge mark within the global pharmaceutical enterprise, catering to every home and international market. Known for its awesome manufacturing competencies, Divi’s Laboratories is a key player in the pharma organization.

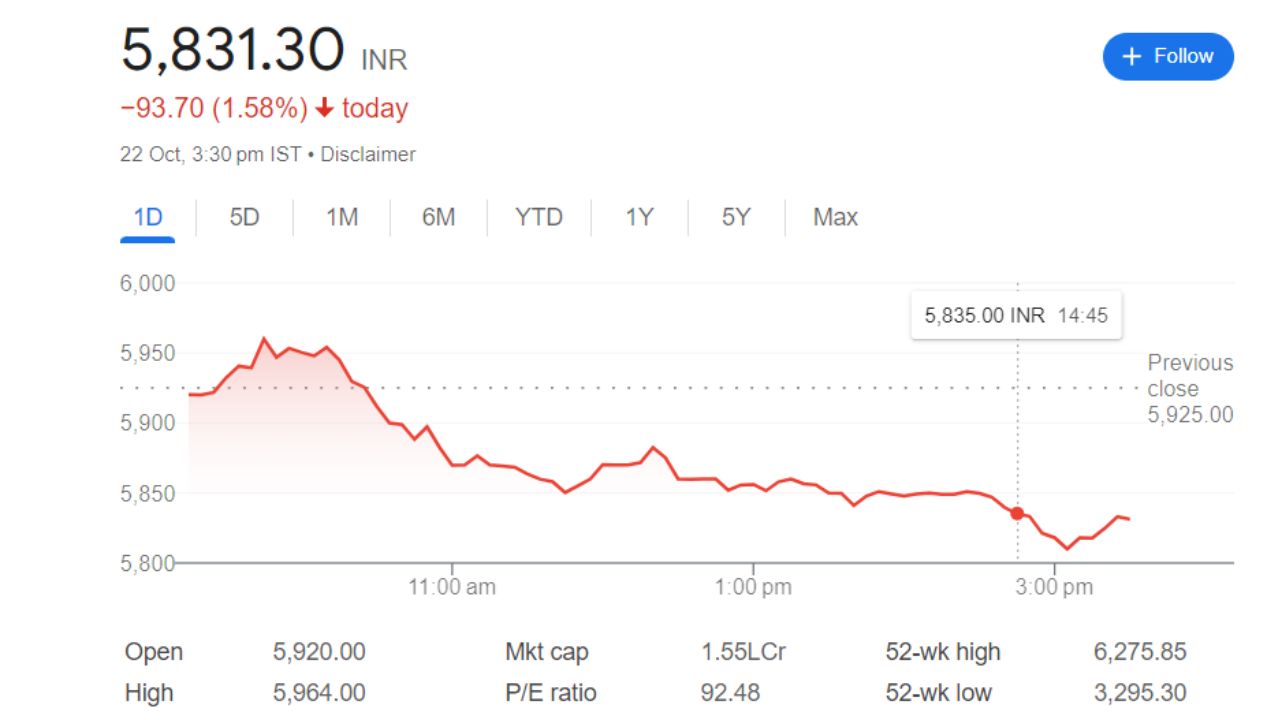

Overview of Divi’s Laboratories Share Price

- Open – 6,150.00

- High – 6,275.85

- Low – 6,020.35

- Mkt cap – 1.62LCr

- P/E ratio – 96.98

- Div yield – 0.49%

- 52-wk high – 6,275.85

- 52-wk low – 3,295.30

- Current Price: ₹5,831.30

Stock Holding Patterns For Divi’s Laboratories Share Price

- Promoters: 51.90%

- Foreign Institutions (FII/FPI): 16.16%

- Mutual Funds: 13.10%

- Retail and Others: 10.18%

- Other Domestic Institutions: 8.67%

Divis Share Price Current Graph

Divis Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 6436 |

| 2025 | 7000 |

| 2026 | 7366 |

| 2027 | 8430 |

| 2028 | 9646 |

| 2029 | 11039 |

| 2030 | 12633 |

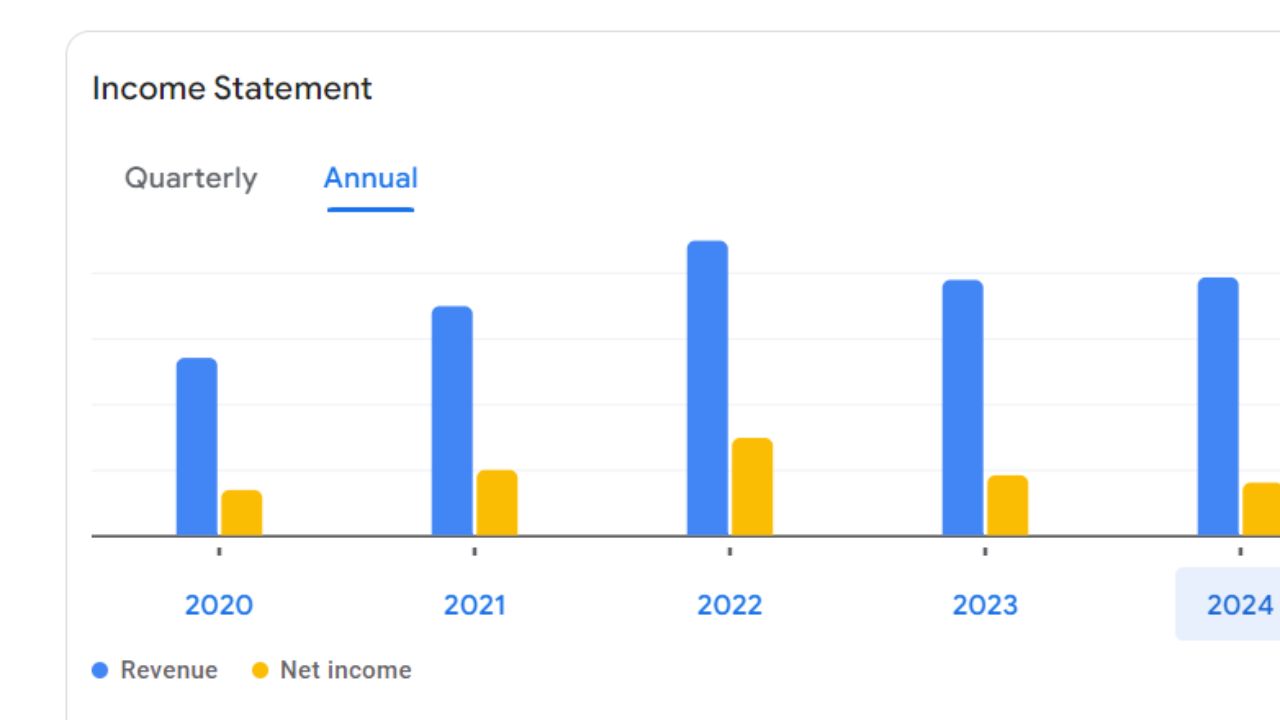

Divis Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 21.18 B | +19.12 % |

| Operating Expenses | 7.39 B | +8.84 % |

| Net Income | 20.30 | +1.40 % |

| Net Profit Margin | 4.30 B | +20.79 % |

| Earning Per Share | 16.20 | +20.80 |

| EBITDA | 6.20 B | N/A |

| Effective Tax Rate | 28.81 % | N/A |

Risks And Challenges For Divi’s Share Price

While Divi’s Laboratories is poised for a prolonged-time period boom, consumers ought to be aware of capability dangers:

1. Regulatory Risks

As a pharmaceutical agency, Divi’s Laboratories is concerned with stringent recommendations in each home and worldwide market. Any delays in regulatory approvals ought to affect the organization’s growth trajectory.

2. Currency Fluctuations

Divi’s Laboratories earns a big part of its revenue from exports. As a cease-quit result, fluctuations in alternate prices need to affect the business enterprise’s profitability.

3. Competitive Pressures

The pharmaceutical industry is, in all fairness, competitive, with numerous players vying for marketplace percentage. Divi’s Laboratories needs to keep innovating and hold its competitive side to live earlier in the competition.

4. Supply Chain Disruptions

The international delivery chain for pharmaceutical elements is complex, and any disruptions may additionally need to have an impact on Divi’s Laboratories’ production abilities and, consequently, its profits.