Deep Diamond India Ltd is an Indian company involved in the diamond and jewelry industry. Deep Diamond India Share Price on BSE as of 21 September 2024 is 9.96 INR. On this page, you will find Deep Diamond India Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Deep Diamond Share good to buy, Deep Diamond India share price target Motilal Oswal, Deep Diamond India share price target tomorrow, Deep diamond India share price target 2030, and more Information.

Deep Diamond India Ltd Company Details

Deep Diamond India Ltd is an Indian company involved in the diamond and jewelry industry. It specializes in trading and manufacturing polished diamonds, offering a wide range of diamond products to domestic and international markets. Known for its quality craftsmanship, the company aims to meet the growing demand for diamonds and jewelry by delivering precision-cut, high-grade diamonds.

| Official Website | deepdiamondltd.com |

| Founded | 1994 |

| Headquarters | India |

| Number of employees | 7 (2023) |

| Category | Share Price |

Current Market Overview Of Deep Diamond India Share Price

- Open Price: ₹9.96

- High Price: ₹9.96

- Low Price: ₹9.69

- Market Capitalization: ₹47.86 Crores

- P/E Ratio: 24.82

- Dividend Yield: N/A

- 52-Week High: ₹11.74

- 52-Week Low: ₹5.17

- Current Price: ₹9.96

Deep Diamond India Share Price Today Chart

Deep Diamond India Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Deep Diamond India for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Deep Diamond India Share Price Target Years | SHARE PRICE TARGET |

| 1 | Deep Diamond India Share Price Target 2024 | ₹13 |

| 2 | Deep Diamond India Share Price Target 2025 | ₹18 |

| 3 | Deep Diamond India Share Price Target 2026 | ₹24 |

| 4 | Deep Diamond India Share Price Target 2027 | ₹30 |

| 5 | Deep Diamond India Share Price Target 2028 | ₹37 |

| 6 | Deep Diamond India Share Price Target 2029 | ₹48 |

| 7 | Deep Diamond India Share Price Target 2030 | ₹56 |

Read Also:- Cressanda Solutions Share Price Target 2024, 2025 To 2030

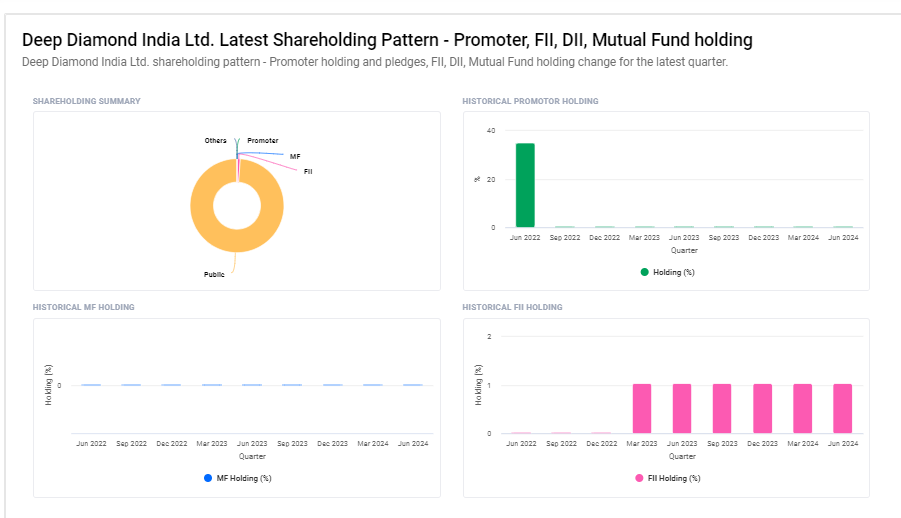

Deep Diamond India Ltd Shareholding Pattern

- Retail and Others: 98.88%

- Foreign Institutions: 1.04%

- Promoters: 0.08%

Key Factors Affecting Deep Diamond Share Price Growth

Here are seven key factors that can affect Deep Diamond India Ltd’s share price growth:

- Demand for Diamonds and Luxury Goods: The demand for diamonds, especially in the luxury segment, plays a crucial role in driving Deep Diamond’s revenues. As consumer spending on high-end products increases, particularly in growing economies like India and China, the company’s sales will likely rise. A higher demand for diamond jewelry positively impacts Deep Diamond’s performance, leading to growth in share prices.

- Global Economic Conditions: The diamond industry is sensitive to global economic trends. During economic stability and growth periods, consumers tend to spend more on luxury goods such as diamonds. A strong global economy encourages higher spending on luxury jewelry, which boosts the company’s sales and earnings. Conversely, economic downturns can reduce demand and negatively impact the share price.

- Export Growth and International Market Expansion: Deep Diamond India’s expansion into international markets can be a significant growth driver. By increasing its presence in key diamond-consuming regions like the US, Europe, and the Middle East, the company can tap into larger markets, leading to higher export revenues. Growth in exports typically reflects positively on the company’s financial performance and can result in a rising share price.

- Raw Material Costs: The price of rough diamonds is a key cost factor for Deep Diamond. Fluctuations in diamond prices can significantly affect the company’s profitability. If the price of rough diamonds remains stable or declines, it helps Deep Diamond maintain healthy profit margins. A rise in profit margins makes the company more attractive to investors, thereby boosting its share price.

- Brand Reputation and Customer Trust: Deep Diamond’s reputation for delivering high-quality, ethically sourced diamonds enhances customer trust and brand loyalty. A strong brand reputation not only helps attract new customers but also ensures repeat business. Investors often view companies with solid reputations positively, which can increase confidence in the stock and drive share price growth.

- Trends in the Jewelry Industry: The diamond and jewelry sector is heavily influenced by fashion trends. Changes in consumer preferences, such as an increasing focus on unique designs or sustainability in sourcing, can impact demand for specific types of jewelry. If Deep Diamond can align itself with evolving trends, it can capitalize on new market opportunities, leading to higher sales and stock price appreciation.

-

Currency Fluctuations: Since Deep Diamond operates in the global market and exports a significant portion of its products, changes in currency exchange rates can impact its profitability. A weaker Indian rupee compared to major currencies like the US dollar can make Indian exports more competitive, leading to higher sales and better profit margins. This, in turn, supports the company’s share price growth.

Read Also:-

- Sarveshwar Foods Share Price Target

- Premier Energies Share Price Target

- Nandan Denim Share Price Target

- Laurus Labs Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.