Cressanda Railway Solutions Ltd is an Indian company that provides innovative technology and software solutions for the railway sector. Cressanda Solutions Share Price on NSE as of 21 September 2024 is 13.84 INR. On this page, you will find Cressanda Solutions Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Cressanda Solutions News, Cressanda Solutions share price target tomorrow, Cressanda Solutions Share price target 2025 In Hindi, Cressanda Solutions share price target 2030, and more Information.

Cressanda Railway Solutions Ltd Company Details

Cressanda Railway Solutions Ltd is an Indian company that provides innovative technology and software solutions for the railway sector. The company offers services like digital communication, data management, and automation systems, aiming to improve the efficiency and safety of railway operations.

Cressanda’s expertise lies in integrating modern technology into transportation infrastructure, helping railways adopt advanced solutions for better management and customer service. With its focus on innovation, the company plays a crucial role in enhancing the overall performance of railway systems in India.

| Official Website | cressanda.com |

| Headquarters | India |

| Number of employees | 14 (2024) |

| Subsidiaries | Mastermind Advertising Private Limited, Lucida Technologies Private Limited, Cressanda Solutions, Inc |

| Category | Share Price |

Current Market Overview Of Cressanda Solutions Share Price

- Open Price: ₹13.84

- High Price: ₹13.84

- Low Price: ₹13.84

- Current Price: ₹13.84

- Market Capitalization: ₹585.63 Crores

- P/E Ratio: 43.99

- Dividend Yield: Not Applicable (NA)

- 52-Week High: ₹28.10

- 52-Week Low: ₹9.55

Cressanda Solutions Share Price Today Chart

Read Also:- CEAT Share Price Target 2024, 2025, 2026 To 2030 Prediction

Cressanda Solutions Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Cressanda Solutions for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Cressanda Solutions Share Price Target Years | SHARE PRICE TARGET |

| 1 | Cressanda Solutions Share Price Target 2024 | ₹23 |

| 2 | Cressanda Solutions Share Price Target 2025 | ₹30 |

| 3 | Cressanda Solutions Share Price Target 2026 | ₹38 |

| 4 | Cressanda Solutions Share Price Target 2027 | ₹46 |

| 5 | Cressanda Solutions Share Price Target 2028 | ₹52 |

| 6 | Cressanda Solutions Share Price Target 2029 | ₹60 |

| 7 | Cressanda Solutions Share Price Target 2030 | ₹67 |

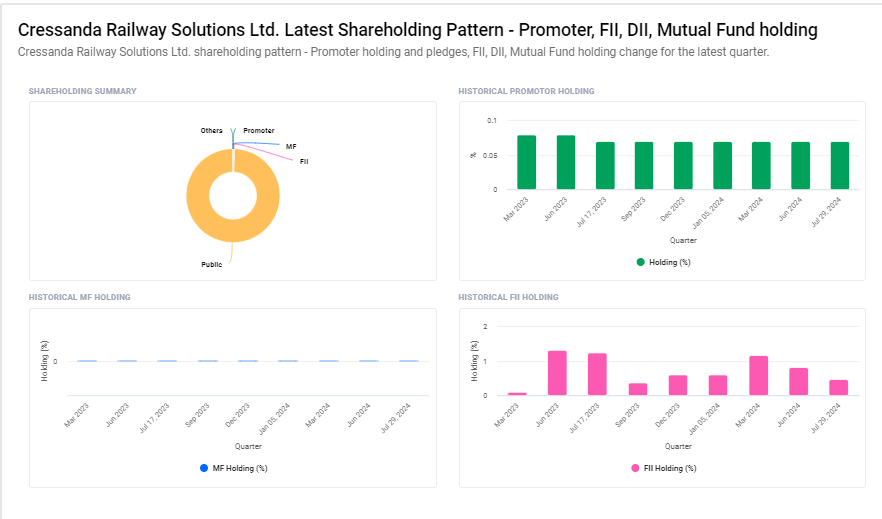

Cressanda Railway Solutions Ltd Shareholding Pattern

- Retail and Others: 99.45%

- Foreign Institutions: 0.46%

- Promoters: 0.07%

- Other Domestic Institutions: 0.02%

Major Factors Affecting Cressanda Solutions Share Price Share Price

Here are seven major factors that can affect Cressanda Solutions’ share price:

- Technological Innovation: Cressanda’s ability to develop and implement cutting-edge technology solutions for the railway sector can attract investor interest and positively impact its share price.

- Government Contracts: Securing contracts from the Indian Railways or other government bodies can significantly boost Cressanda’s revenue, leading to potential share price growth.

- Industry Demand: Rising demand for modernization and digitalization in the transportation sector can create more opportunities for Cressanda, contributing to stock price appreciation.

- Project Execution: Successfully delivering projects on time and meeting client expectations can strengthen the company’s reputation and increase its stock value.

- Partnerships and Collaborations: Strategic partnerships with other tech or infrastructure firms can help Cressanda expand its market reach and positively affect its share price.

- Regulatory Policies: Favorable government policies promoting digital infrastructure and railway modernization can benefit Cressanda’s business and support stock growth.

-

Economic Conditions: A growing economy and increased investment in infrastructure projects can create more opportunities for Cressanda, boosting its financial performance and share price.

Read Also:-

- Raymond Share Price Target

- Morepen Share Price Target

- SEPC Share Price Target

- BHEL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.