When considering investments in CG Power, understanding its share price target can be crucial for making informed decisions. For the upcoming years, analysts forecast the CG Power share price to show promising growth. CG Power Share Price on NSE as of 20 September 2024 is 746.85 INR. This article will provide more details on CG Power Share Price Target 2024, 2025, 2026 to 2030.

CG Power Company Details

CG Power and Industrial Solutions Ltd., commonly known as CG Power, is a leading name in India’s electrical equipment industry. Founded in 1970, the company specializes in manufacturing various products, including transformers, switchgear, and electrical machines.

The company is renowned for its expertise in providing solutions for power generation, transmission, and distribution. It caters to diverse industries such as power, transportation, and infrastructure, contributing to numerous high-profile projects nationwide.

CG Power’s commitment to innovation and quality has positioned it as a key player in its sector, with a strong reputation for reliability and technological advancement. The company’s products are widely used in critical applications, reflecting its significant role in supporting India’s growing energy needs.

| Official Website | cgglobal.com |

| Industry | Electrical |

| Founded | 1937 |

| Founders | R. E. B. Crompton James Greaves |

| Headquarters |

Mumbai, Maharashtra, India

|

| Products | Transformers, pump, HT & LT Motors, DC Motors, Railway Signaling |

| Category | Share Price |

Read Also:-

- BEL Share Price Target

- Mazagon Dock Share Price Target

- Maharashtra Bank Share Price Target

- South Indian Bank Share Price Target

- Rail Vikas Nigam Share Price Target

Current Overview Of CG Power Share Price

- Open – INR 732.00

- High – INR 752.00

- Low – INR 726.10

- Current Price – INR 746.85

- Mkt cap – 1.14LCr

- P/E ratio – 77.91

- Div yield – 0.17%

- 52-wk high – INR 783.75

- 52-wk low – INR 359.20

CG Power Share Price Recent Graph

CG Power Share Price Target Tomorrow

Here are the estimated share prices of CG Power for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S.No. | CG Power Share Price Target Years | CG Power Share Price |

| 1 | CG Power Share Price Target 2024 | Rs 759 |

| 2 | CG Power Share Price Target 2025 | Rs 980 |

| 3 | CG Power Share Price Target 2026 | Rs 1210 |

| 4 | CG Power Share Price Target 2027 | Rs 1402 |

| 5 | CG Power Share Price Target 2028 | Rs 1530 |

| 6 | CG Power Share Price Target 2029 | Rs 1675 |

| 7 | CG Power Share Price Target 2030 | Rs 1725 |

CG POWER: NSE Financials 2023

- CG Power Market Capitalisation: 73,159.26 Crores INR

- CG Power Reserves and Borrowings: 2,124.63 Cr INR and 2.87 Cr INR (March 2023) Respectively

- CG Power 52 Week High-Low: Rs 503.45 – Rs 276.65

| Revenue | 69.73 Billion INR | ⬆ 27.22% YOY |

| Operating expense | 11.75 Billion INR | ⬆ 17.32% YOY |

| Net Income | 9.63 Billion INR | ⬆ 5.30% YOY |

| Net Profit Margin | 13.81 | ⬇-17.06% YOY |

| Earnings Per Share | 4.99 | ⬆ 54.18% |

| EBITDA | 9.63 Billion INR | ⬆ 58.88% |

| Effective Tax Rate | 20.54% |

|

| Total Assets | 46.29 Trillion INR | ⬆ 9.54% YOY |

| Total Liabilities | 28.38 Trillion INR | ⬇-11.93% YOY |

| Total Equity | 17.91 Billion INR | |

| Return on assets | 12.69% | |

| Return on Capital | 35.34% | |

| P/E Ratio | 45.23 | |

| Dividend Yield | 0.27% |

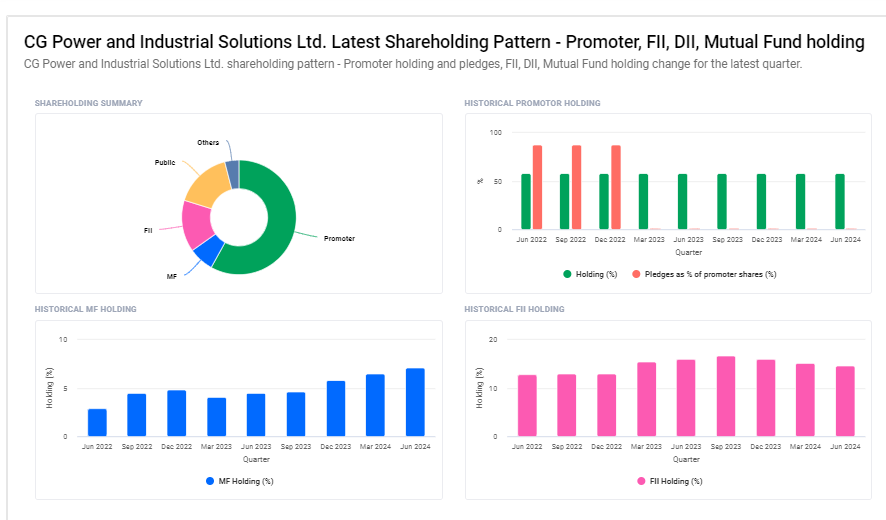

CG Power Ltd Shareholding Pattern

- Promoters: 58.11%

- FII: 16.05%

- DII: –

- Retail & Others: 20.02%

- Mutual Funds: 5.82%

Risks and challenges to CG POWER share price

Here are five risks and challenges that could affect the share price of CG Power:

- Market Competition: CG Power operates in a highly competitive market. If competitors introduce more advanced or cost-effective products, it could reduce CG Power’s market share and negatively impact its share price.

- Economic Slowdown: A downturn in the global or domestic economy can lead to reduced demand for CG Power’s products, especially from sectors like manufacturing and infrastructure, which are sensitive to economic conditions. This could lead to lower revenues and a drop in share price.

- Raw Material Costs: Fluctuations in the cost of raw materials, such as copper and steel, can impact the company’s profit margins. Rising raw material costs without a corresponding increase in product prices can squeeze profits and affect the share price.

- Regulatory Changes: Changes in government policies, regulations, or tax laws related to the power and industrial sectors can create uncertainty and affect CG Power’s operations. Regulatory challenges can lead to increased costs or operational hurdles, impacting the share price.

-

Debt Levels: High levels of debt can be a concern for investors, as it indicates higher financial risk. If CG Power struggles with debt repayment or interest obligations, it could affect the company’s profitability and lead to a decline in share price.

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.