CESC Ltd is a leading power utility company. CESC Share Price on NSE as of 16 September 2024 is 195.80 INR. On this page, you will find CESC Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Cesc share price target tomorrow, CESC share price 900, CESC latest news, CESC share buy or Sell, CESC share price target 2030, and more Information.

CESC Ltd Company Details

CESC Ltd is a leading power utility company in India, responsible for generating and distributing electricity. Based in Kolkata, CESC provides power to millions of consumers, including residential, commercial, and industrial sectors. The company operates several thermal power plants and focuses on delivering reliable and affordable electricity. With a history spanning over a century, CESC is committed to innovation and efficiency in the power sector, contributing to the growth and development of the regions it serves.

| Official Website | cesc.co.in |

| Founded | 24 July 1879, Kolkata |

| Founder | R. P. Goenka |

| Headquarters | Kolkata, India |

| Chairman | Sanjiv Goenka |

| Number of employees | 6,087 (2024) |

| Category | Share Price |

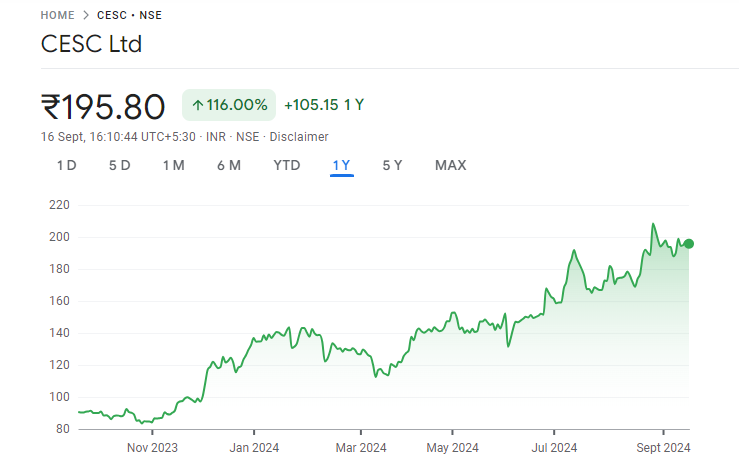

Current Market Overview Of CESC Share Price

- Open: ₹198.50

- High: ₹198.69

- Low: ₹194.40

- Current: ₹195.80

- Mkt cap: ₹25.94KCr

- P/E ratio: 18.45

- Div yield: NA

- 52-wk high: ₹210.00

- 52-wk low: ₹82.30

CESC Share Price Today Chart

Read Also:- ZUDIO Share Price Target 2024, 2025 To 2030 and More Details

CESC Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of CESC for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | CESC Share Price Target Years | SHARE PRICE TARGET |

| 1 | CESC Share Price Target 2024 | ₹247 |

| 2 | CESC Share Price Target 2025 | ₹272 |

| 3 | CESC Share Price Target 2026 | ₹309 |

| 4 | CESC Share Price Target 2027 | ₹355 |

| 5 | CESC Share Price Target 2028 | ₹406 |

| 6 | CESC Share Price Target 2029 | ₹462 |

| 7 | CESC Share Price Target 2030 | ₹528 |

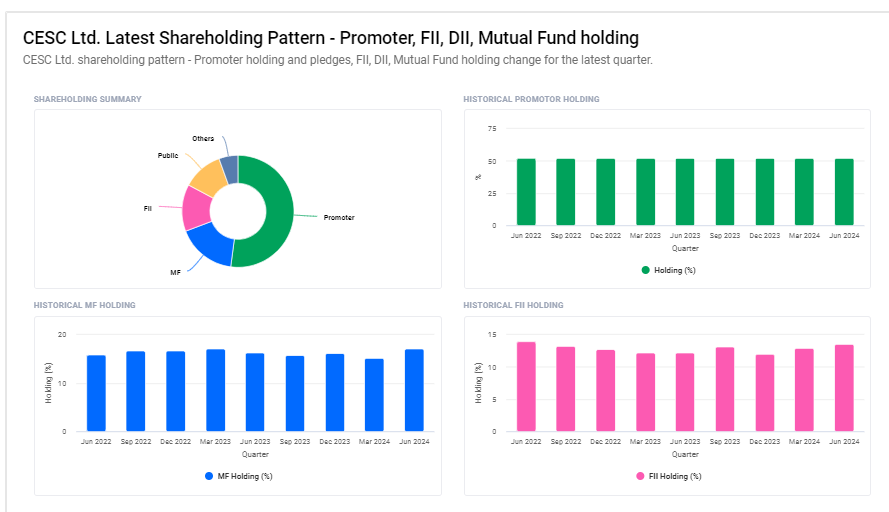

CESC Ltd Shareholding Pattern

- Promoters: 52.11%

- Mutual Funds: 17.17%

- Foreign Institutions: 13.56%

- Retail and Others: 11.70%

- Other Domestic Institutions: 5.47%

Factors Influencing CESC Share Price

Here are five key factors influencing CESC Ltd’s share price:

- Regulatory Environment and Tariff Changes: CESC’s revenue is largely dependent on electricity tariffs, which are regulated by government authorities. Any changes in tariff rates, either increases or decreases, directly impact the company’s earnings. Favorable tariff revisions can boost revenue, positively influencing the share price, while unfavorable ones may reduce profitability and put downward pressure on the stock.

- Power Generation Capacity and Expansion: CESC’s ability to expand its power generation capacity is crucial for long-term growth. Investments in new power plants or renewable energy sources, as well as efficient utilization of existing resources, can increase the company’s output and revenue. Successful expansion can lead to higher investor confidence, driving up the share price.

- Fuel Prices and Supply Costs: The cost of coal and other fuels used in CESC’s thermal power plants is a significant factor affecting profitability. Fluctuations in fuel prices or supply disruptions can impact operating costs. If CESC manages to keep fuel costs stable or lower, it can improve margins and boost the share price, while rising fuel costs may reduce profitability.

- Operational Efficiency and Reliability: The company’s ability to maintain a stable and reliable electricity supply is crucial for its reputation and financial health. Efficient operations, low transmission losses, and timely maintenance can result in better financial performance, which investors look for. Consistently strong operational performance can lead to a steady increase in the company’s share price.

-

Economic Growth and Power Demand: CESC’s share price is also influenced by the overall economic growth and demand for electricity. During periods of strong economic activity, industrial and commercial demand for power increases, which can boost the company’s sales and earnings. Conversely, a slowdown in economic growth may reduce demand, affecting revenue and putting pressure on the stock price.

Read Also:-

- HDFC AMC Share Price Target

- Federal Bank Share Price Target

- GRSE Share Price Target

- Franklin Industries Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.