CEAT is a leading Indian tire manufacturer known for producing a wide range of tires for vehicles. CEAT Share Price on NSE as of 11 September 2024 is 2,858.00 INR. On this page, you will find CEAT Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Why Ceat share price is falling today, CEAT share News today, Ceat Share Price target 2040, Ceat share price target tomorrow, Ceat share price target Motilal oswal, Ceat share price target 2030, and more Information.

CEAT Ltd Company Details

CEAT Ltd is a leading Indian tire manufacturer known for producing a wide range of tires for vehicles, including cars, motorcycles, trucks, and buses. Established in 1958, CEAT has built a strong reputation for delivering durable and high-performance tires that cater to both domestic and international markets.

The company focuses on innovation, safety, and sustainability in its tire production. CEAT’s commitment to quality and its continuous efforts to develop advanced products have made it one of the top players in the tire industry, serving the needs of millions of customers globally.

| Official Website | ceat.com |

| Founded | 1958, Turin, Italy |

| Founders | Virginio Bruni Tedeschi |

| Headquarters | Worli, Mumbai, India |

| Chairman | Harsh Goenka |

| MD & CEO | Arnab Banerjee |

| Number of employees | 8,593 (2024) |

| Category | Share Price |

Current Market Overview Of CEAT Share Price

- Open: ₹2,868.90

- High: ₹2,906.35

- Low: ₹2,839.25

- Market Cap: ₹11.56K Crores

- P/E Ratio: 17.73

- Dividend Yield: 1.05%

- 52-Week High: ₹3,032.90

- 52-Week Low: ₹2,056.35

- Current Price: ₹2,858.00

CEAT Share Price Today Chart

Read Also:- TCS Share Price Target 2024, 2025 To 2030 and More Details

CEAT Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of CEAT for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | CEAT Share Price Target Years | SHARE PRICE TARGET |

| 1 | CEAT Share Price Target 2024 | ₹3440 |

| 2 | CEAT Share Price Target 2025 | ₹4735 |

| 3 | CEAT Share Price Target 2026 | ₹5412 |

| 4 | CEAT Share Price Target 2027 | ₹6190 |

| 5 | CEAT Share Price Target 2028 | ₹7090 |

| 6 | CEAT Share Price Target 2029 | ₹8115 |

| 7 | CEAT Share Price Target 2030 | ₹9284 |

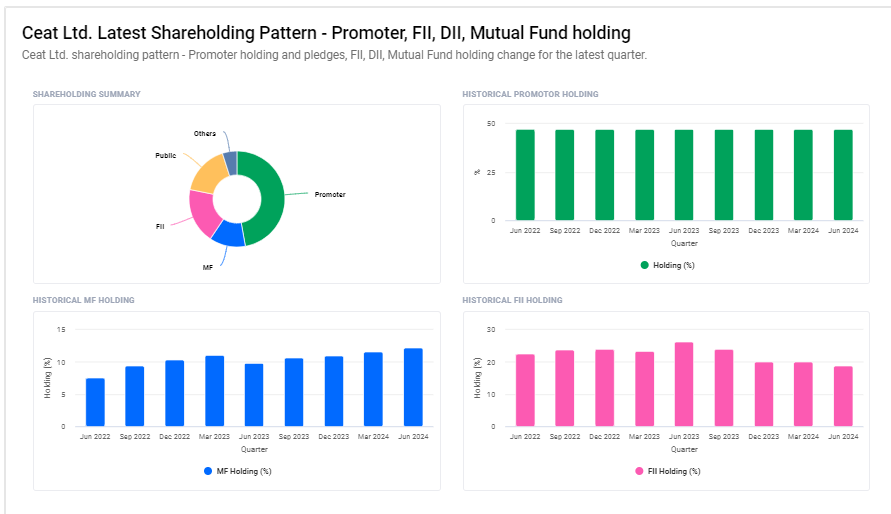

CEAT Ltd Shareholding Pattern

- Promoters: 47.21%

- Foreign Institutions: 18.76%

- Retail and Others: 16.93%

- Mutual Funds: 12.20%

- Other Domestic Institutions: 4.90%

Risks and Challenges to CEAT Share Price

Here are eight risks and challenges that could affect CEAT Ltd’s share price:

- Raw Material Costs: Fluctuations in the prices of key raw materials like rubber and oil can increase production costs, affecting profitability and potentially lowering the share price.

- Competition: Intense competition from both domestic and international tire manufacturers can pressure CEAT’s market share and profit margins, influencing the stock price.

- Economic Slowdowns: A slowdown in the overall economy or the automotive industry can reduce demand for tires, impacting CEAT’s revenue and share price.

- Currency Fluctuations: As CEAT exports to various countries, currency exchange rate fluctuations can affect its profitability, especially when the Indian rupee strengthens against other currencies.

- Environmental Regulations: Stricter environmental regulations regarding manufacturing processes or waste disposal could increase operational costs for CEAT, which may impact its financial performance and stock price.

- Technological Advancements: Rapid changes in technology, especially in electric vehicles (EVs), may require significant investment in new tire designs and production processes, posing a challenge to CEAT’s current business model.

- Supply Chain Disruptions: Any disruption in the global supply chain, such as delays in sourcing raw materials or shipping products, can impact CEAT’s production and sales, affecting the share price.

-

Interest Rate Changes: Rising interest rates can increase borrowing costs for CEAT, potentially affecting profitability and discouraging investors, which can lower the stock price.

Read Also:-

- GMR Power Share Price Target

- Nestle India Share Price Target

- Mangalam Cement Share Price Target

- Bajaj Hindusthan Sugar Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.