Hello friends, Do you want to know about the future value of BSE Ltd share price target? So you have come to the right page. BSE Ltd share price on NSE as of 20 September 2024 is 3984.95 INR. On this page, you will find BSE Ltd Share Price Target 2024, 2025 to 2030 as well as BSE Ltd Share Price target tomorrow, BSE share price list, BSE Ltd share price target 2030 Motilal Oswal, and more Information.

BSE Ltd. Details

BSE Ltd., also known as the Bombay Stock Exchange, is Asia’s oldest stock exchange, established in 1875 in Mumbai, India. It plays a central role in India’s financial markets, providing a platform for trading stocks, bonds, and other securities.

BSE is known for its fast and efficient trading systems, as well as its benchmark index, the SENSEX, which tracks the performance of 30 major companies. Over the years, BSE has grown to become one of the largest stock exchanges in the world, continuing to support the growth of the Indian economy through transparent and reliable financial services.

| Official Website | bseindia.com |

| CEO | Sundararaman Ramamurthy (4 Jan 2023–) |

| Founded | 9 July 1875, Dalal Street, Mumbai |

| Founder | Premchand Roychand |

| Headquarters | Mumbai, India |

| Number of employees | 518 (2024) |

| Category | Share Price |

BSE Ltd. Share Price Target Tomorrow

| BSE Ltd. Share Price Target Years | SHARE PRICE TARGET |

| BSE Ltd. Share Price Target 2024 | ₹4100 |

| BSE Ltd. Share Price Target 2025 | ₹5500 |

| BSE Ltd. Share Price Target 2026 | ₹6700 |

| BSE Ltd. Share Price Target 2027 | ₹7900 |

| BSE Ltd. Share Price Target 2028 | ₹9200 |

| BSE Ltd. Share Price Target 2029 | ₹10,500 |

| BSE Ltd. Share Price Target 2030 | ₹11,800 |

Overview of BSE Ltd. Share Price

- MARKET CAP: ₹53, 946KCr

- Current Price: ₹3984.95

- OPEN: ₹3, 735.00

- HIGH: ₹4, 050.00

- LOW: ₹3, 679.05

- P/E RATIO: 59.23

- DIVIDEND YIELD: 0.58%

- 52 WEEK HIGH: ₹4, 050.00

- 52 WEEK LOW: ₹1, 154.80

Read Also:- CG Power Share Price Target 2024, 2025, 2026 to 2030 Prediction

BSE Ltd. Share Price Recent Graph

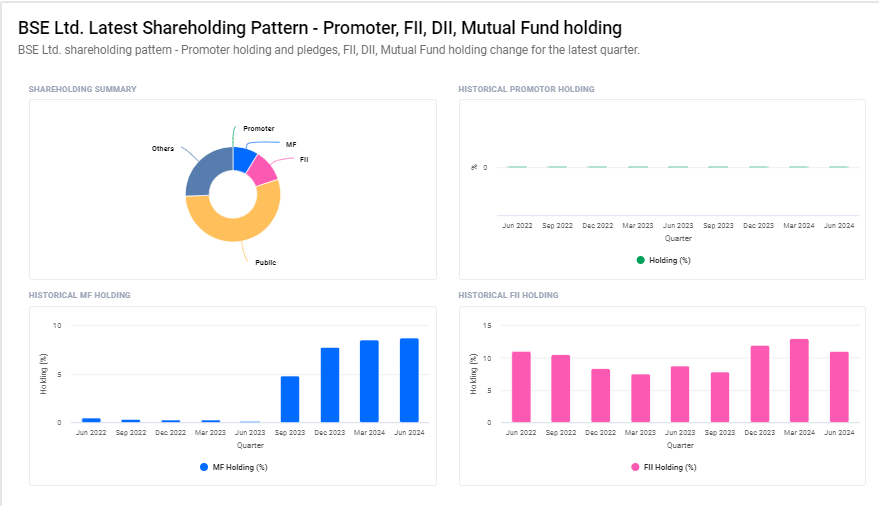

BSE Ltd Shareholding Pattern

- FII: 11.1%

- DII:11.6%

- Public: 54.5%

- Other: 22.8%

Risk and Challenges To BSE Share Price

Here are five risks and challenges that could impact BSE’s share price:

- Market Volatility: BSE’s revenue is closely tied to trading volumes. Significant market volatility or a prolonged downturn can reduce trading activity, impacting the exchange’s earnings and share price.

- Regulatory Changes: The stock exchange industry is heavily regulated. Any changes in financial regulations or compliance requirements could increase operational costs for BSE, potentially affecting its profitability and share price.

- Competition from Other Exchanges: BSE faces stiff competition from other stock exchanges, particularly the NSE. If BSE loses market share or fails to attract new listings and investors, it could negatively impact its share price.

- Technological Disruptions: The financial services sector is rapidly evolving with new technologies. BSE must continually upgrade its infrastructure and services to stay competitive. Any lag in adopting new technology could lead to a loss of business and investor confidence, affecting the share price.

-

Economic Slowdown: A slowdown in the economy can reduce investor participation and corporate listings on the exchange, leading to lower trading volumes and revenues. This, in turn, could negatively impact BSE’s financial performance and share price.

BSE Financials

|

Particulars |

JUN 2022 |

SEP 2022 |

DEC 2022 |

MAR 2023 |

JUN 2023 |

|

Operating Revenue |

141.68 |

147.43 |

154.14 |

156.33 |

156.62 |

|

Other Income |

6.27 |

67.61 |

32.56 |

36.37 |

47.54 |

|

Interest Expended |

0 |

0 |

0 |

0 |

0 |

|

Operating Expenses |

111.61 |

126.54 |

124.35 |

93.31 |

118.35 |

|

Total Provisions |

0 |

0 |

0 |

0 |

504.17 |

|

Depreciation |

8.65 |

9.83 |

14.25 |

16.25 |

16.60 |

|

Profit Before Tax |

27.69 |

78.67 |

48.10 |

83.14 |

-434.96 |

|

Tax |

6.32 |

22.48 |

17.27 |

24.62 |

66.24 |

|

Net Profit |

21.37 |

56.19 |

30.83 |

58.52 |

507.14 |

|

Adjusted EPS (RS) |

1.58 |

4.15 |

2.28 |

4.32 |

37.44 |

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.