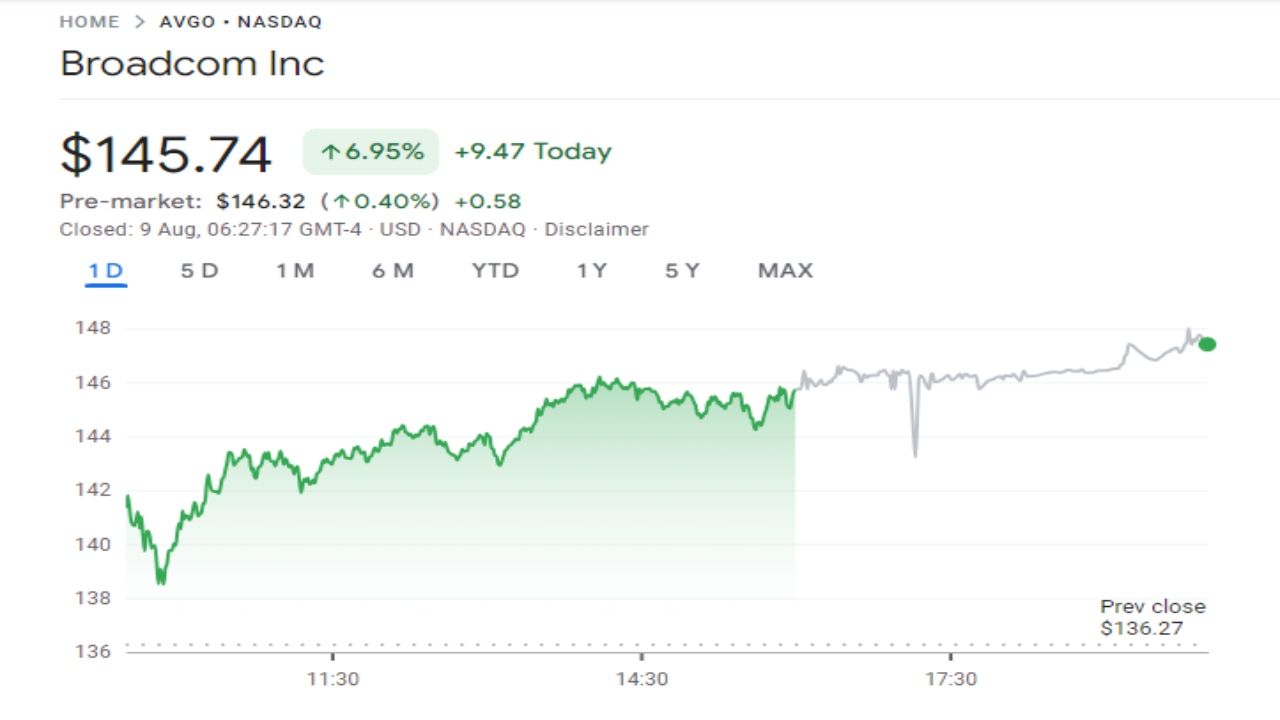

Broadcom Inc. is a leading American multinational company that designs, develops, manufactures, and supplies a diverse array of semiconductor and infrastructure software products on a global scale. Broadcom share price on NSE as of 9 August 2024 is 145.74 USD.

On this page, you will find Broadcom Share Price Target 2024, 2025 to 2030 as well as Broadcom stock split, Broadcom share price target tomorrow, Broadcom stock prediction 2027, Broadcom share price target 2030, Broadcom stock prediction 2040, and more Information.

Broadcom Inc. (AVGO) Details

Broadcom Inc. is a leading global technology company known for designing, developing, and supplying a wide range of semiconductor and infrastructure software solutions. With a focus on innovation, Broadcom plays a crucial role in powering the technologies behind communication, data storage, and networking systems. The company is highly respected in the tech industry for its strong market presence and commitment to advancing connectivity and digital experiences worldwide. Broadcom’s continuous growth and strategic acquisitions have made it a key player in the semiconductor industry.

| Official Website | broadcom.com |

| Formerly Known |

|

| Chairman | Henry Samueli |

| CEO | Hock E. Tan (Mar 2006–) |

| Founded | 1961 |

| Headquarters | San Jose, California, United States |

| Number of employees | ≈ 40,000 (June 2024)) |

| Category | Share Price |

BROADCOM (AVGO) SHARE PRICE RECENT GRAPH

Broadcom Share Price Target Tomorrow

Broadcom Share Price Target Tomorrow

Here are the estimated share prices of Broadcom (AVGO) for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| S. No. | Broadcom Share Price Target YEARS | SHARE PRICE TARGET |

| 1 | Broadcom Share Price Target 2024 | $160.92 |

| 2 | Broadcom Share Price Target 2025 | $199.40 |

| 3 | Broadcom Share Price Target 2026 | $271.38 |

| 4 | Broadcom Share Price Target 2027 | $369.35 |

| 5 | Broadcom Share Price Target 2028 | $502.68 |

| 6 | Broadcom Share Price Target 2029 | $684.15 |

| 7 | Broadcom Share Price Target 2030 | $931.12 |

Overview of Broadcom Share Price Target

- MARKET CAP: ₹67.84KCr

- OPEN: ₹141.20

- HIGH: ₹146.27

- LOW: ₹138.40

- P/E RATIO: 62.70

- DIVIDEND YIELD: 1.44%

- 52 WEEK HIGH: ₹185.16

- 52 WEEK LOW: ₹79.55

Factors Affecting Broadcom Share Price Target

-

Financial Performance

- Revenue Growth: Broadcom’s ability to consistently increase its revenue is a critical factor. Strong revenue growth often leads to higher share price targets as it indicates the company’s products and services are in demand.

- Profit Margins: Healthy profit margins reflect operational efficiency and profitability, which can positively influence the share price target. Investors prefer companies that maximize profits while controlling costs.

- Technology and Innovation

- Product Development: Broadcom is a leader in semiconductor technology. The successful launch of new and innovative products can raise expectations and drive up the share price target.

- R&D Investments: Broadcom’s commitment to research and development (R&D) plays a significant role. High R&D spending can signal future growth, leading analysts to increase their share price targets.

- Market Position

- Competitive Advantage: Broadcom’s position in the market, particularly its dominance in certain technology sectors, affects its share price target. A strong competitive edge can lead to higher valuations.

- Market Share: Increases in market share, especially in growing industries like 5G and cloud computing, can positively influence the company’s share price target.

- Regulatory Environment

- Government Policies: Changes in regulations, particularly in the tech and communications sectors, can affect Broadcom’s operations and, subsequently, its share price target.

- Trade Relations: Broadcom’s global supply chain means that international trade policies and tariffs can significantly impact its costs and revenues, influencing its share price target.

-

Investor Sentiment

- Market Perception: How investors perceive Broadcom’s future prospects, including their confidence in the company’s growth potential, plays a key role in determining share price targets.

- Analyst Ratings: Recommendations and target prices set by financial analysts can heavily influence the market’s perception of Broadcom’s stock and affect its share price target.

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.