Brightcom Group Limited is a global agency of digital advertising and marketing answers that specializes in online marketing and purchaser analytics. It operates for the duration of a couple of geographies and serves a wide variety of customers in several industries.

Over the years, the employer organization has shown wonderful growth, and its stock has received 1.9k crore and a P/E ratio of 0.21; Brightcom offers a compelling investment opportunity. This article will discover the projected Brightcom Share price dream from 2024 to 2030.

Key Financial Metrics

Understanding Bightcom’s modern economics metrics is crucial to evaluating its future percentage price capacity. These metrics provide a notion of the commercial enterprise business’s monetary fitness and offer a basis for destiny prediction.

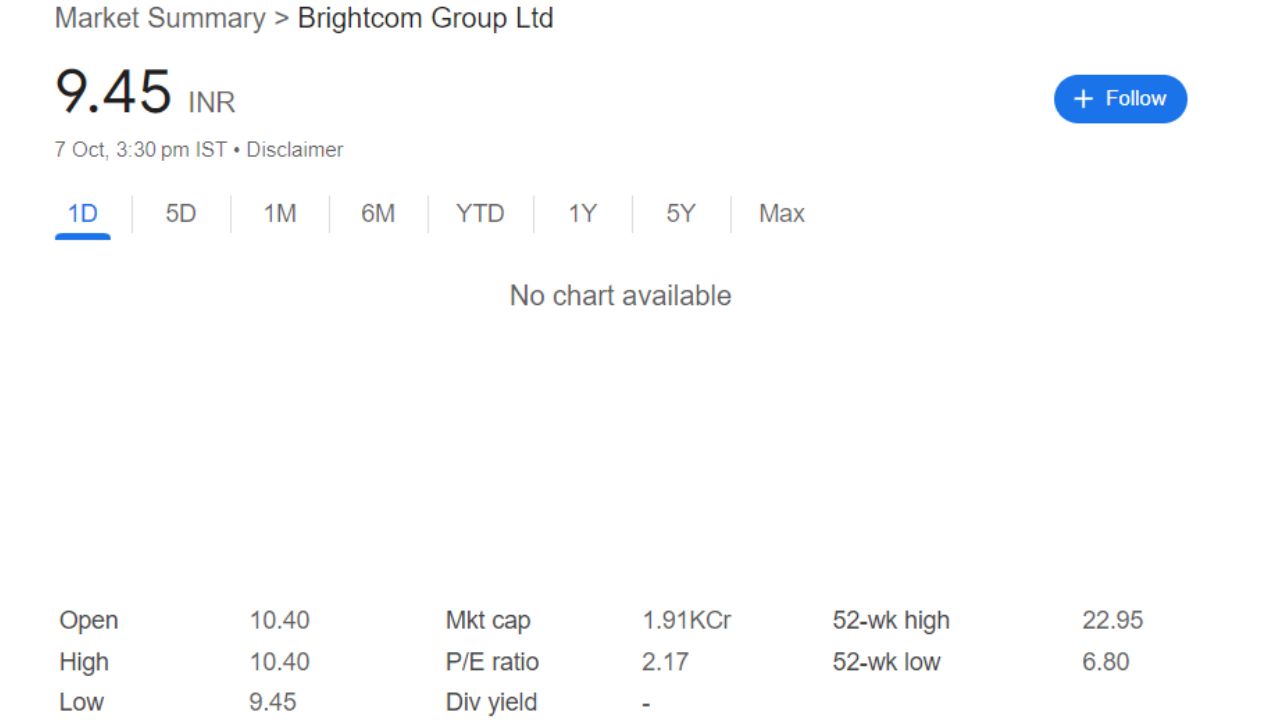

Brightcom Share Price Current Graph

Brightcom Group Ltd: Market Overview

- Open Price: ₹9.61

- High Price: ₹9.61

- Low Price: ₹9.16

- Current Share Price: 9.45

- Previous Close: ₹9.61

- Volume: 4,496,551

- P/E ratio: ₹2.21

- 52-wk high: ₹22.95

- 52-wk low: ₹6.80

- VWAP: ₹9.59

- UC Limit: ₹10.09

- LC Limit: ₹9.12

- Mkt cap: ₹1.94KCr

- Face Value: ₹2

Brightcom share price Target Tomorrow 2024 To 2030

| S. No. | Share Price Target Years | Share Target Value |

|

|

2024 | 15 |

|

|

2025 | 45 |

|

|

2026 | 75 |

|

|

2027 | 98 |

|

|

2028 | 150 |

|

|

2029 | 190 |

|

|

2030 | 240 |

Shareholding Pattern For Brightcom Group Ltd

- Retail and Other: 70.77 %

- Promotors: 18.38 %

- Foreign Institutions: 10.70 %

- Mutual Funds: 0.15 %

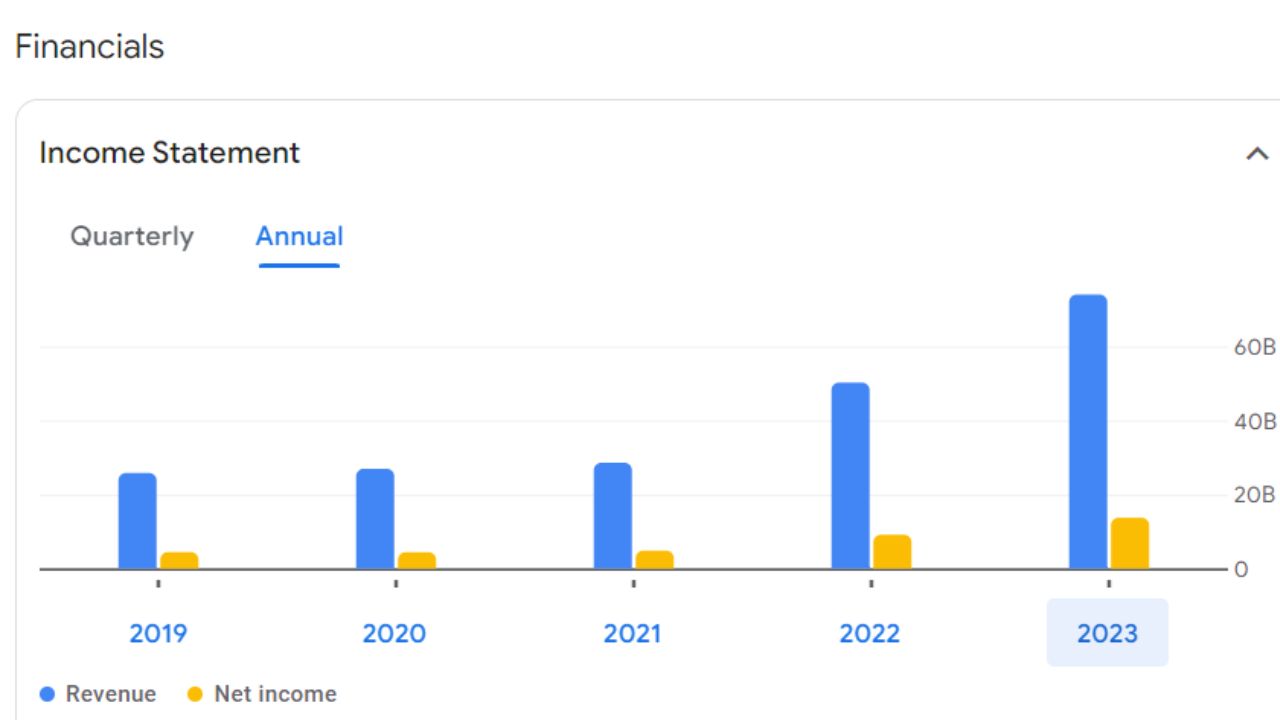

Annual Income Statement Of Brightcom Group Ltd.

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 4.53 B | -84.18 % |

| Operating Expenses | 1.35 B | -44.38 % |

| Net Income | -241.98 M | -104.45% |

| Net Profit Margin | -5.34 | -128.13 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 361.26 M | -95.53 % |

| Effective Tax Rate | 19.97 % | N/A |

Strategies For Brightcom Group Share Price

Brightcom Group’s share price strategy involves focusing on several key factors:

- Digital Advertising Growth: As demand for digital advertising rises, revenue growth can enhance investor confidence, potentially increasing share prices1.

- Technological Innovation: Continuous advancements in digital marketing and AI-driven solutions can attract clients and improve profitability1.

- Global Market Expansion: Entering new international markets can drive growth and positively impact share performance1.

Investors should monitor these elements to gauge potential price movements.