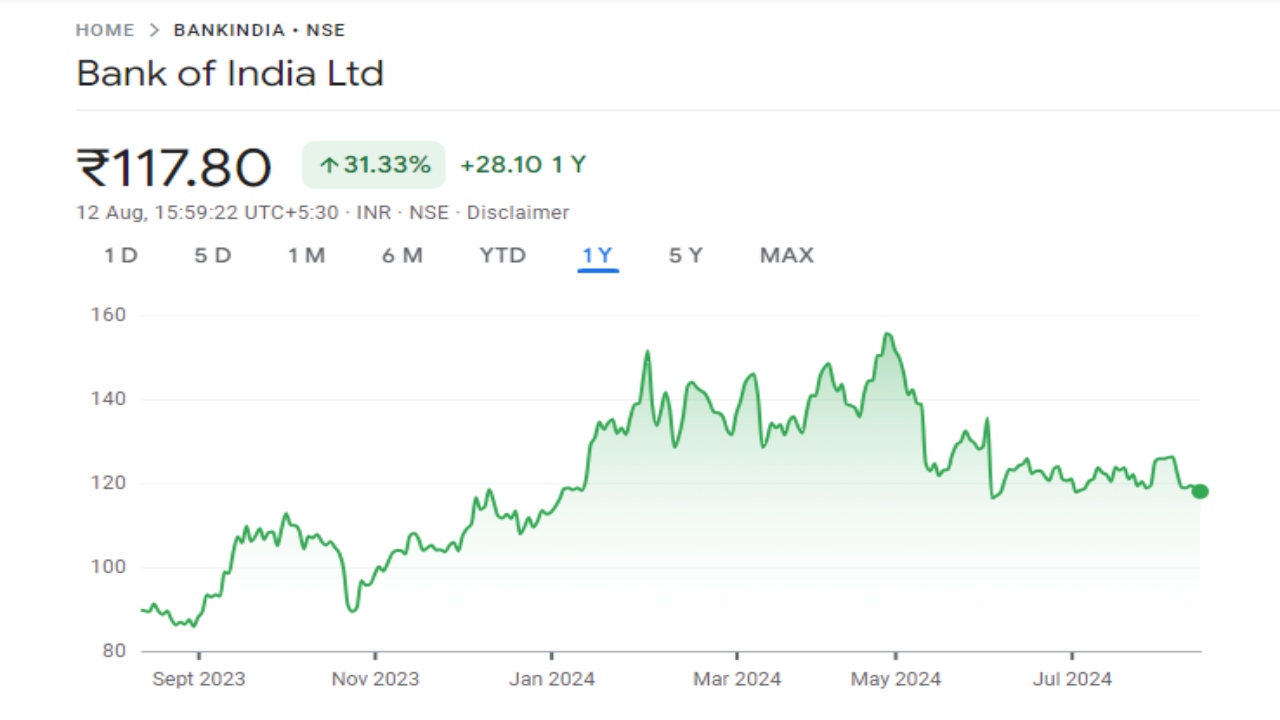

Hello friends, Do you want to know about the future value of BOI share price target? So you have come to the right page. BOI share price on NSE as of 12 August 2024 is 117.80 INR. On this page, you will find BOI Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Boi share price target tomorrow, Why Bank of India share falling today, Bank of India share price 1997, Bank of India Share price target 2040, BOI share price Target 2030, and more Information.

Bank of India Ltd Details

Bank of India is one of India’s oldest and most respected public sector banks, founded in 1906. Headquartered in Mumbai, the bank offers a wide range of financial services, including personal banking, loans, and investment options, to individuals and businesses alike. Known for its strong customer focus and extensive network of branches across India and abroad, Bank of India has played a key role in the country’s economic development. With a commitment to innovation and customer satisfaction, the bank continues to be a trusted name in Indian banking.

| Official Website | bankofindia.co.in |

| CEO | Rajneesh Karnatak (29 Apr 2023–) |

| Founded | 7 September 1906 |

| Headquarters | Mumbai, Maharashtra, India |

| Founder | Ramnarain Ruia |

| Number of employees | 50,944 (2024) |

| Category | Share Price |

Overview of BOI Share Price

- MARKET CAP: ₹53.65KCr

- OPEN: ₹118.79

- HIGH: ₹119.50

- LOW: ₹117.70

- P/E RATIO: 7.47

- DIVIDEND YIELD: 2.38%

- 52 WEEK HIGH: ₹157.95

- 52 WEEK LOW: ₹85.10

BOI Share Price Target Tomorrow

Here are the estimated share prices of BOI for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| BOI Share Price Target Years | SHARE PRICE TARGET |

| BOI Share Price Target 2024 | ₹160.27 |

| BOI Share Price Target 2025 | ₹200.68 |

| BOI Share Price Target 2026 | ₹217.15 |

| BOI Share Price Target 2027 | ₹234.61 |

| BOI Share Price Target 2028 | ₹252.73 |

| BOI Share Price Target 2029 | ₹271.84 |

| BOI Share Price Target 2030 | ₹292.15 |

Read Also:- Bank of Baroda Share Price Target 2024, 2025 to 2030 Prediction

BOI Share Price Recent Graph

BOI Share Price Target 2024

BOI Share Price Target 2024 expected target at the beginning could be ₹138.95, mid of the year could be ₹120.51, and the year-end target could be ₹160.27. BOI share price on NSE as of 12 August 2024 is 117.80 INR.

| S. No. | BOI Share Price Target 2024 (Months) | Target Price |

| 1 | January | ₹138.95 |

| 2 | February | ₹131.45 |

| 3 | March | ₹137.05 |

| 4 | April | ₹155.10 |

| 5 | May | ₹128.70 |

| 6 | June | ₹120.51 |

| 7 | July | ₹125.80 |

| 8 | August | ₹117.80 |

| 9 | September | ₹122.35 |

| 10 | October | ₹132.10 |

| 11 | November | ₹142.20 |

| 12 | December | ₹160.27 |

BOI Share Price Target 2025

BOI Share Price Target 2025 expected target at the beginning could be ₹202.15, mid of the year could be ₹200.65, and the year-end target could be ₹200.68.

| S.No. | BOI Share Price Target 2025 (Months) | Target Price |

| 1 | January | ₹202.15 |

| 2 | February | ₹205.3 |

| 3 | March | ₹202.15 |

| 4 | April | ₹200.59 |

| 5 | May | ₹200.62 |

| 6 | June | ₹200.65 |

| 7 | July | ₹200.66 |

| 8 | August | ₹200.63 |

| 9 | September | ₹200.65 |

| 10 | October | ₹200.66 |

| 11 | November | ₹200.65 |

| 12 | December | ₹200.68 |

Bank of India Share Price Target 2026

BOI Share Price Target 2026 expected target at the beginning could be ₹218.71, mid of the year could be ₹217.12, and the year-end target could be ₹217.15.

| S.No. | BOI Share Price Target 2026 (Months) | Target Price |

| 1 | January | ₹218.71 |

| 2 | February | ₹221.86 |

| 3 | March | ₹218.7 |

| 4 | April | ₹217.1 |

| 5 | May | ₹217.13 |

| 6 | June | ₹217.12 |

| 7 | July | ₹217.13 |

| 8 | August | ₹217.15 |

| 9 | September | ₹217.15 |

| 10 | October | ₹217.14 |

| 11 | November | ₹217.16 |

| 12 | December | ₹217.15 |

Read Also:- Bandhan Bank Share Price Target 2024, 2025 to 2030 and More Details

Bank of India Share Price Target 2027

BOI Share Price Target 2027 expected target at the beginning could be ₹236.13, mid of the year could be ₹234.59, and the year-end target could be ₹234.61.

| S.No. | BOI Share Price Target 2027 (Months) | Target Price |

| 1 | January | ₹236.13 |

| 2 | February | ₹239.3 |

| 3 | March | ₹236.16 |

| 4 | April | ₹234.6 |

| 5 | May | ₹234.62 |

| 6 | June | ₹234.59 |

| 7 | July | ₹234.6 |

| 8 | August | ₹234.6 |

| 9 | September | ₹234.58 |

| 10 | October | ₹234.61 |

| 11 | November | ₹234.59 |

| 12 | December | ₹234.61 |

Bank of India Share Price Target 2028

BOI Share Price Target 2028 expected target at the beginning could be ₹254.4, mid of the year could be ₹252.76, and the year-end target could be ₹252.73.

| S.No. | BOI Share Price Target 2028 (Months) | Target Price |

| 1 | January | ₹254.4 |

| 2 | February | ₹257.56 |

| 3 | March | ₹254.38 |

| 4 | April | ₹252.78 |

| 5 | May | ₹252.48 |

| 6 | June | ₹252.76 |

| 7 | July | ₹252.74 |

| 8 | August | ₹252.73 |

| 9 | September | ₹252.74 |

| 10 | October | ₹252.73 |

| 11 | November | ₹252.73 |

| 12 | December | ₹252.73 |

BOI Share Price Target 2029

BOI Share Price Target 2029 expected target at the beginning could be ₹273.58, mid of the year could be ₹271.95, and the year-end target could be ₹271.84.

| S.No. | BOI Share Price Target 2029 (Months) | Target Price |

| 1 | January | ₹273.58 |

| 2 | February | ₹276.73 |

| 3 | March | ₹273.54 |

| 4 | April | ₹271.93 |

| 5 | May | ₹271.93 |

| 6 | June | ₹271.95 |

| 7 | July | ₹271.95 |

| 8 | August | ₹271.92 |

| 9 | September | ₹271.9 |

| 10 | October | ₹271.9 |

| 11 | November | ₹271.87 |

| 12 | December | ₹271.84 |

Read Also:- Central Bank Share Price Target 2024, 2025 to 2030 and More Details

BOI Share Price Target 2030

BOI Share Price Target 2030 expected target at the beginning could be ₹293.73, mid of the year could be ₹292.16, and the year-end target could be ₹292.15.

| S.No. | BOI Share Price Target 2030 (Months) | Target Price |

| 1 | January | ₹293.73 |

| 2 | February | ₹296.91 |

| 3 | March | ₹293.74 |

| 4 | April | ₹292.14 |

| 5 | May | ₹292.17 |

| 6 | June | ₹292.16 |

| 7 | July | ₹292.17 |

| 8 | August | ₹292.18 |

| 9 | September | ₹292.17 |

| 10 | October | ₹292.19 |

| 11 | November | ₹292.17 |

| 12 | December | ₹292.15 |

Bank of India ltd Finances

| Market Capitalization Value | 59344 crores |

| Total Share Capital | 4104.31 crores |

| Total Deposits | 669585.77 crores |

| Total Borrowings | 67979.02 crores |

| Total Investments | 204397.88 crores |

| Total Assets | 815555.6 crores |

| Total Contingent liabilities | 378970.4 crores |

| Total Income | 54747.61 crores |

| Total Expenditure | 50724.67 crores |

| Cost to income ratio | 58.22 percent |

| Interest coverage ratio | 1.21 percent |

| Debt to equity ratio | 1.08 percent |

| Price to sales ratio | 0.64 percent |

| EPS | 9.80 |

| ROCE | 1.68 percent |

| ROE | 7.72 percent |

| Return on Assets | 0.49 percent |

| Earnings yield ratio | 0.13 percent |

| Equity Dividend rate | 20 percent |

| Capital Adequacy ratio | 16.28 percent |

Bank of India ltd Shareholding Pattern

| Shareholders | Share Percentages |

| Promoters | 73.4 percent |

| Mutual Funds | 4.3 percent |

| Foreign Institutions | 4.3 percent |

| Other Domestic Institutions | 19 percent |

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.