Bharti Airtel Ltd is one of India’s leading telecommunications companies. Bharti Airtel Share Price on NSE as of 23 September 2024 is 1,751.15 INR. On this page, you will find Bharti Airtel Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Bharti Airtel share News today, Bharti Airtel 810 share price, Bharti Airtel News today, Bharti Airtel share price target tomorrow, Bharti Airtel Share Price Target 2030, and more Information.

Bharti Airtel Ltd Company Details

Bharti Airtel Ltd is one of India’s leading telecommunications companies, providing a wide range of services, including mobile and fixed-line voice services, broadband, and digital TV. Founded in 1995, Airtel has grown rapidly and now operates in multiple countries across Asia and Africa. The company is known for its strong network coverage and innovative solutions, such as affordable data plans and digital content services. With a commitment to customer satisfaction, Bharti Airtel continues to play a significant role in connecting people and businesses, making it a key player in the telecommunications industry.

| Official Website | airtel.in |

| Founded | 7 July 1995 |

| Founder | Sunil Mittal |

| Headquarters | Nelson Mandela Road, Vasant Kunj, New Delhi, India |

| MD & CEO | Gopal Vittal |

| Number of employees | 24,137 (2024) |

| Category | Share Price |

Bharti Airtel Share Price Today Chart

Current Market Overview Of Bharti Airtel Share Price

- Open Price: ₹1,719.00

- High Price: ₹1,754.25

- Low Price: ₹1,719.00

- Market Cap: ₹10.48 Lakh Crores

- P/E Ratio: 103.18

- Dividend Yield: 0.46%

- 52-week High: ₹1,754.25

- 52-week Low: ₹895.45

- Current Share Price: ₹1,751.15

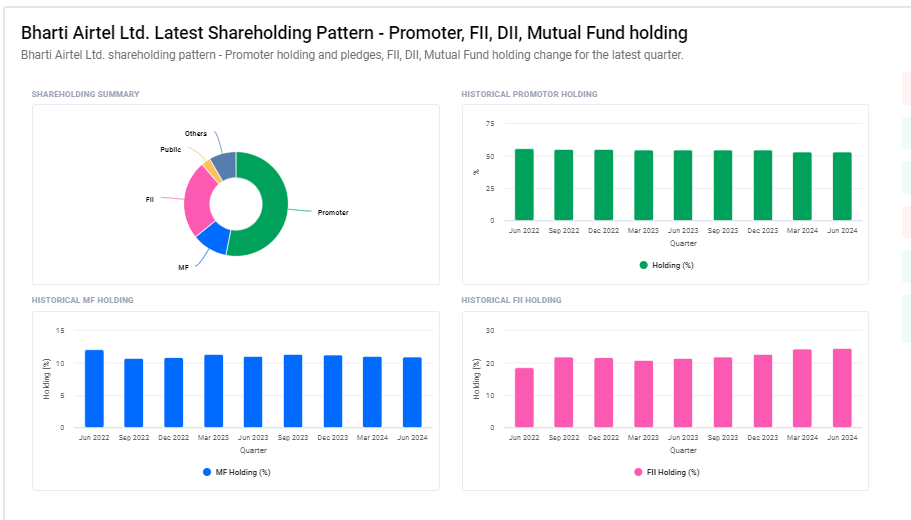

Bharti Airtel Ltd Shareholding Pattern

- Promoters: 53.17%

- Foreign Institutions: 24.62%

- Mutual Funds: eleven.01%

- Other Domestic Institutions: 8.28%

- Retail and Others: 2.90%

Read Also:- Aarti Industries Share Price Target 2024, 2025, 2026 To 2030

Bharti Airtel Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Bharti Airtel for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Bharti Airtel Share Price Target Years | SHARE PRICE TARGET |

| 1 | Bharti Airtel Share Price Target 2024 | ₹1965 |

| 2 | Bharti Airtel Share Price Target 2025 | ₹2682 |

| 3 | Bharti Airtel Share Price Target 2026 | ₹3452 |

| 4 | Bharti Airtel Share Price Target 2027 | ₹4170 |

| 5 | Bharti Airtel Share Price Target 2028 | ₹4929 |

| 6 | Bharti Airtel Share Price Target 2029 | ₹5759 |

| 7 | Bharti Airtel Share Price Target 2030 | ₹6572 |

Bharti Airtel Share Price Target 2024

The share price target for Bharti Airtel Ltd in 2024 is projected at ₹1,965, reflecting a strong outlook for the company’s growth. This target indicates confidence in Airtel’s ability to enhance its services and expand its customer base in the competitive telecom market.

Bharti Airtel Share Price Target 2025

The share price target for Bharti Airtel Ltd in 2025 is set at ₹2,682, reflecting a positive outlook for the company’s future. As Airtel focuses on expanding its digital services and enhancing customer experience, this target suggests that investors can look forward to potential gains.

Risks and Challenges to Bharti Airtel Share Price

Here are five risks and challenges that could impact the share price of Bharti Airtel:

- Intense Competition: The Indian telecom market is highly competitive, with several players vying for market share. This competition can lead to price wars and reduced profit margins, which may negatively affect Airtel’s financial performance and share price.

- Regulatory Changes: Changes in government policies and regulations regarding telecom services can pose risks. New regulations might affect pricing structures, service offerings, or operational costs, potentially impacting Airtel’s profitability.

- Rising Debt Levels: Bharti Airtel has significant debt due to past expansions and investments. High debt levels can limit financial flexibility and increase interest costs, which could pressure the company’s profitability and share price.

- Market Saturation: In some regions, the telecom market may be reaching saturation, leading to slower growth in new customer acquisition. This stagnation could impact revenue growth and ultimately influence the share price.

-

Economic Slowdown: A downturn in the economy can lead to reduced consumer spending on telecom services. If customers cut back on their subscriptions or switch to cheaper plans, Airtel’s revenue may decline, adversely affecting its share price.

Read Also:-

- Saksoft Share Price Target

- Chambal Fertilisers Share Price Target

- Astral Share Price Target

- IRCTC Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.