Bharat Electronics Limited is an Indian public-sector aerospace and defense electronics company. It primarily manufactures advanced electronics products for ground and aerospace applications. BEL is one of the sixteen PSUs under the administration of the Ministry of Defence of India. It has been granted Navratna status by the Government of India.

Bharat Electronics Share Price Current Market Overview

- Today’s Open: 294

- Today’s High: 295

- Today’s Low: 287.65

- Current Share Price: 290.00

- Market Capital: 211873 cr

- P/E: 49.97

- Dividend Yield: 0.76

- 52 Week High: 339.35

- 52 Week Low: 127.65

Bharat Electronics Share Price Current Graph

Bharat Electronics Share Price Target Tomorrow From 2024 To 2030

This analysis for upcoming years is based on market valuation, industrial trends, and expert analysis.

| S. No. | Share Price Target Years | Share Target Value |

|

|

2024 | 298.71 |

|

|

2025 | 345.62 |

|

|

2026 | 463.65 |

|

|

2027 | 582.65 |

|

|

2028 | 603.50 |

|

|

2029 | 724.07 |

|

|

2030 | 846.39 |

Shareholding Pattern For Bharat Electronics Share Price

- Promoters: 51.14%

- Foreign Institutions: 17.43%

- Domestic Institutions: 20.62%

- Public: 10.82%

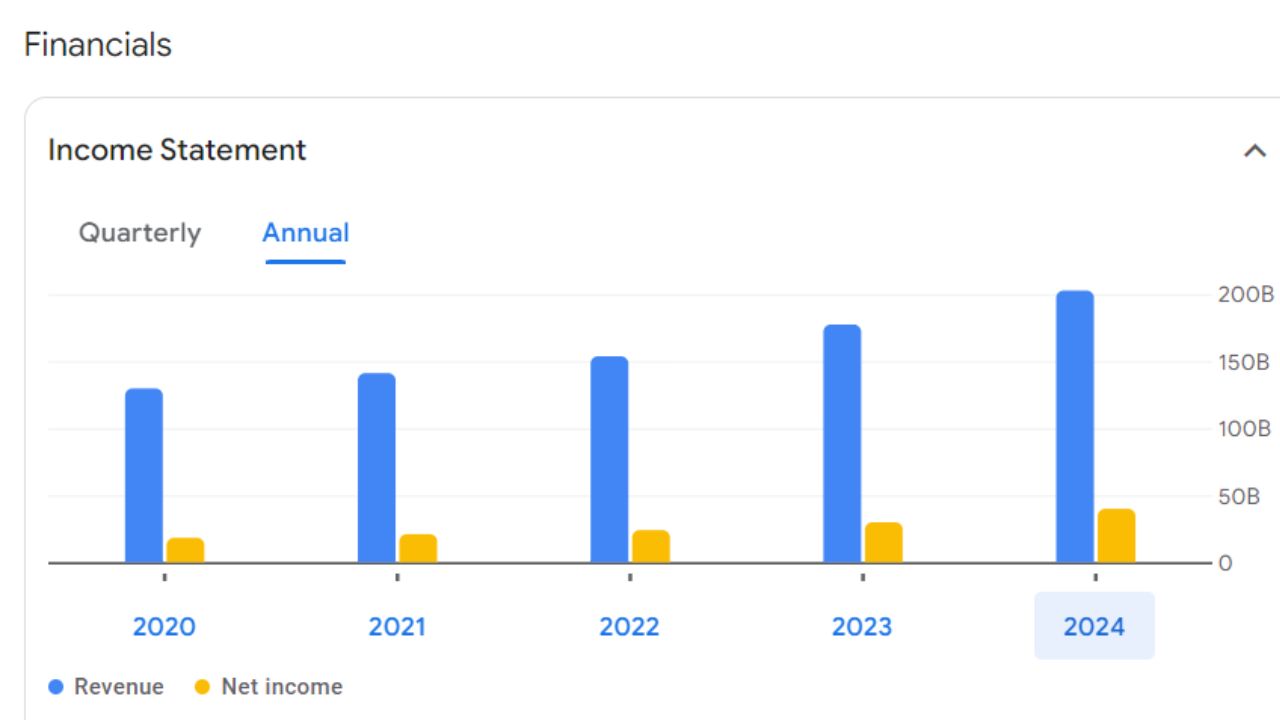

Bharat Electronics Share Price For Annual Income Statement

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 42.44 B | +20.11% |

| Operating Expenses | 10.88 B | +1.11% |

| Net Income | 7.91 B | +46.89% |

| Net Profit Margin | 18.64 | +22.31% |

| Earning Per Share | 1.06 | +43.24% |

| EBITDA | 9.51 B | +41.82% |

| Effective Tax Rate | 24.87% | N/A |

Is BEL Stock Good To Buy?

BEL stock, associated with Bharat Electronics Limited, has shown fluctuating financial performance over recent years. The company reported a net income of $82.85 million in 2018 but faced losses in subsequent years, indicating volatility in profitability. Analysts suggest that while BEL has potential due to its strategic position in the defense sector, investors should be cautious given its inconsistent earnings and market conditions. A thorough analysis of current financials and market trends is recommended before making a purchase decision.