Bengal Steel Industries Ltd is an Indian company primarily involved in the manufacturing and trading of steel products. Bengal Steel Share Price on BSE as of 20 September 2024 is 0.05 INR. On this page, you will find Bengal Steel Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Bengal Steel share price NSE, Bengal Steel share price screener, Bengal Steel Share Price Target 2025 in Hindi, Bengal Steel Share Price target 2030, and more Information.

Bengal Steel Industries Ltd Company

Bengal Steel Industries Ltd is an Indian company primarily involved in the manufacturing and trading of steel products. It plays a key role in the steel industry by producing high-quality steel for various industrial applications. The company delivers durable and reliable steel solutions, serving different sectors like construction, infrastructure, and engineering. With its commitment to quality and growth, Bengal Steel Industries Ltd continues to contribute to the steel industry in India.

Current Market Overview Of Bengal Steel Share Price

- Market Cap: ₹0.02 Cr

- Return on Equity (ROE): 0.76%

- P/E Ratio (TTM): 0.50

- Earnings Per Share (EPS, TTM): ₹0.10

- Price to Book Ratio (P/B): 0.00

- Dividend Yield: 0.00%

- Industry P/E: 50.65

- Book Value: ₹20.07

- Debt to Equity: 0.00

- Face Value: ₹10

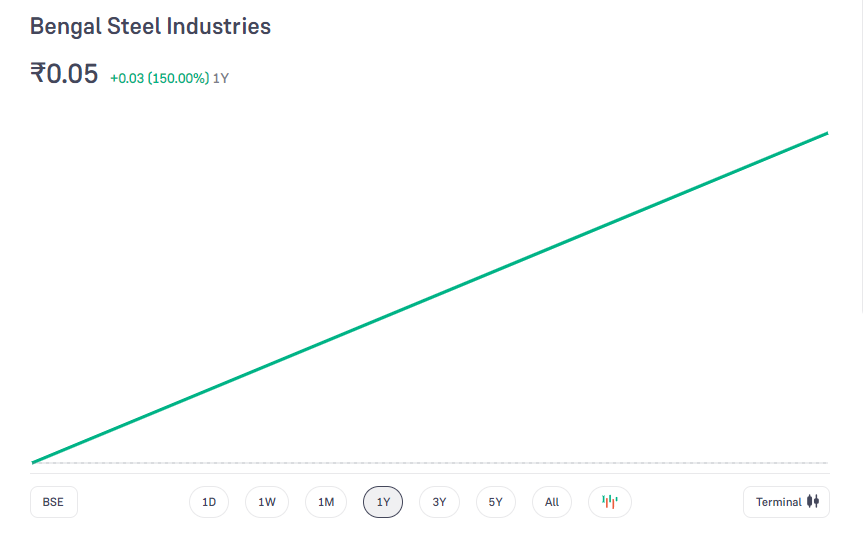

Bengal Steel Share Price Today Chart

Read Also:- Tejas Networks Share Price Target 2024, 2025, 2026 To 2030

Bengal Steel Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Bengal Steel for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Bengal Steel Share Price Target Years | SHARE PRICE TARGET |

| 1 | Bengal Steel Share Price Target 2024 | ₹0.10 |

| 2 | Bengal Steel Share Price Target 2025 | ₹0.16 |

| 3 | Bengal Steel Share Price Target 2026 | ₹0.22 |

| 4 | Bengal Steel Share Price Target 2027 | ₹0.29 |

| 5 | Bengal Steel Share Price Target 2028 | ₹0.35 |

| 6 | Bengal Steel Share Price Target 2029 | ₹0.41 |

| 7 | Bengal Steel Share Price Target 2030 | ₹0.47 |

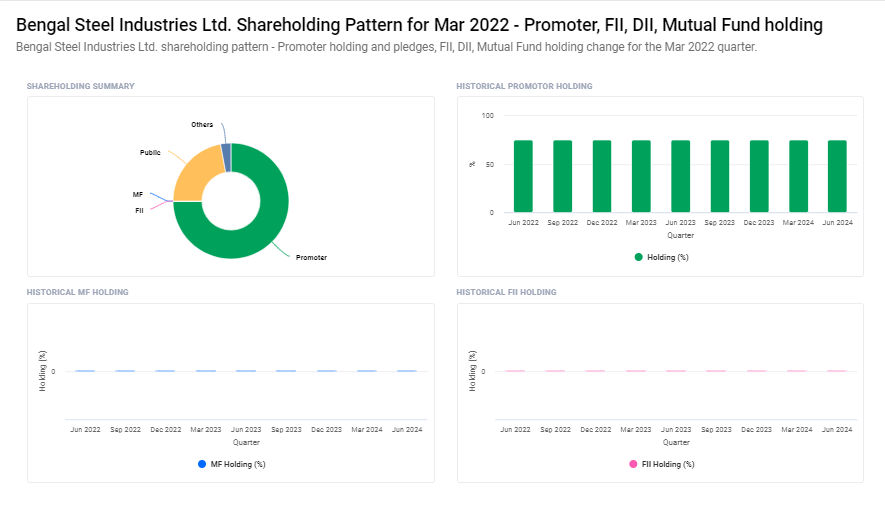

Bengal Steel Industries Ltd Shareholding Pattern

- Promoter: 75%

- DII: 2.9%

- Public: 22.1%

Key Growth Drivers for Bengal Steel Share Price

Here are 6 key growth drivers for Bengal Steel’s share price:

- Demand for Steel Products: Growing demand from sectors like construction, infrastructure, and manufacturing can drive up the company’s sales, which may positively impact its share price.

- Government Projects: Participation in large government infrastructure projects could lead to increased orders, boosting revenues and supporting share price growth.

- Technological Advancements: Adopting new technologies for efficient steel production can enhance the company’s competitiveness, leading to better financial performance and potential stock growth.

- Cost Management: Effective cost control measures, like sourcing raw materials at lower prices or improving operational efficiency, can improve profitability, which investors often respond to positively.

- Expansion Plans: Expansion into new markets or product lines could increase the company’s revenue streams, attracting investor interest and driving share price growth.

-

Global Steel Market Trends: Positive trends in the global steel market, such as rising prices or increasing exports, can improve profitability for steel companies like Bengal Steel, benefiting their stock price.

Read Also:-

- Edelweiss Share Price Target

- EKC Share Price Target

- Allcargo Terminals Share Price Target

- LT Foods Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.