Curious about the future of Bharat Electronics Limited (BEL) shares? You’ve come to the right place! We’ll provide you with the projected share price targets for BEL, helping you make informed investment decisions with ease and confidence. BEL (Bharat Electronics Limited) is an Indian Government-owned aerospace and defense electronics company. BEL Share Price on NSE as of 19 September 2024 is 275.15 INR.

It is renowned for manufacturing advanced electronic products used in ground and aerospace applications. BEL operates under the Ministry of Defence of India and holds the prestigious Navratna status, recognizing its significant contributions to the defense sector. This article will provide more details on BEL Share Price Target 2024, 2025, 2026, 2027 to 2030.

Bharat Electronics Ltd. Full Details

- Category: Share Price

- Official Website: bel-india.in

- Headquarters: Bengaluru

- Founded: 1954, Bengaluru

- Chairman & Managing Director: Manoj Jain

- Number of employees: 8,832 permanent Employees 2626 permanent Workers (FY 2022-23)

- BEL: NSE Financials 2023

- BEL Market Capitalisation: 157,306.44 Crores INR

- BEL 52 Week High-Low: Rs 216.80 – Rs 89.65

| Revenue | 177.34 Billion INR | ⬆ 15.40% YOY |

| Operating expense | 38.69 Billion INR | ⬆ 16.97% YOY |

| Net Income | 29.84 Billion INR | ⬆ 24.41% YOY |

| Net Profit Margin | 16.83 | ⬆ 7.82% YOY |

| Earnings Per Share | 4.11 | ⬆ 27.90% YOY |

| EBITDA | 40.88 Billion INR | ⬆ 23.02% YOY |

| Effective Tax Rate | 24.76% | |

| Total Assets | 377.12 Billion INR | ⬆ 4.66% YOY |

| Total Liabilities | 263.23 Billion INR | ⬆ 0.02% YOY |

| Total Equity | 113.89 Billion INR | |

| Return on assets | 2.32% | |

| Return on Capital | 3.39% | |

| P/E Ratio | 44.09 | |

| Dividend Yield | 0.88% |

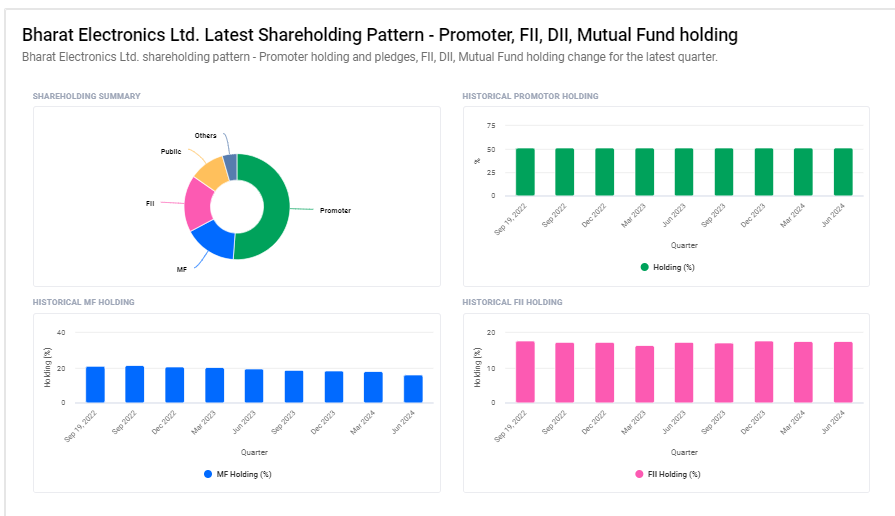

BEL Shareholding Pattern

- Promoter: 51.1%

- FII: 17.4%

- DII: 20.6%

- Public: 10.8%

Read Also:-

- Suzlon Share Price Target

- Jio Finance Share Price Target

- SEL Manufacturing Share Price Target

- IRCON Share Price Target

Current Market Overview Of BEL Share Price

- MARKET CAP: ₹2.01LCr

- OPEN: ₹284.00

- HIGH: ₹284.85

- LOW: ₹274.65

- Current: ₹275.15

- P/E RATIO: 47.49

- DIVIDEND YIELD: 0.80%

- 52 WEEK HIGH: ₹340.50

- 52 WEEK LOW: ₹127.00

BEL Share Price Today Chart

BEL Share Price Target Tomorrow

Are you curious about the future of Bharat Electronics Limited (BEL) shares? Look no further! We’ll provide you with the projected share price targets for BEL, helping you plan your investments with confidence. Here’s a glimpse into the upcoming years:

| S. No. | BEL Share Price Target Years | SHARE PRICE TARGET |

| 1 | BEL Share Price Target 2024 | ₹335 |

| 2 | BEL Share Price Target 2025 | ₹398 |

| 3 | BEL Share Price Target 2026 | ₹468 |

| 4 | BEL Share Price Target 2027 | ₹530 |

| 5 | BEL Share Price Target 2028 | ₹605 |

| 6 | BEL Share Price Target 2029 | ₹690 |

| 7 | BEL Share Price Target 2030 | ₹765 |

Key Factors Affecting BEL Share Price Growth

Here are five key factors that affect the share price growth of BEL (Bharat Electronics Limited) in simple, easy-to-understand language:

- Government Defense Orders: BEL is a key player in India’s defense sector, and its share price is closely linked to government defense contracts. An increase in defense spending and large orders for electronics and equipment can positively boost BEL’s revenue, driving up its share price.

- Expansion into New Technologies: BEL’s focus on developing new and advanced technologies, like radar systems, cybersecurity, and communication solutions, helps it stay competitive. Successful innovations can attract more contracts and investor interest, leading to share price growth.

- Export Opportunities: BEL is expanding its business by exporting defense equipment to other countries. A rise in international orders and successful partnerships with global defense companies can improve its growth prospects, positively impacting the share price.

- Financial Performance: Investors closely monitor BEL’s quarterly financial reports. Strong earnings, revenue growth, and profitability create confidence among investors, potentially pushing the share price higher.

-

Geopolitical and Security Concerns: Regional tensions and global security concerns can lead to increased defense spending. If governments prioritize upgrading defense capabilities, BEL, as a supplier, could benefit from more orders, which may contribute to share price growth.

Read Also:-

- Mazagon Dock Share Price Target

- Maharashtra Bank Share Price Target

- South Indian Bank Share Price Target

- Rail Vikas Nigam Share Price Target

FAQ

Q1. What is the price target of BEL shares?

Ans. The price target for BEL shares is ₹335.

Q1. What is the price target of BEL in 2025?

Ans. The price target for BEL shares in 2025 is expected to be around ₹398.

Q1. What is the price target of BEL in 2030?

Ans. The price target for BEL shares in 2025 is expected to be around ₹765.

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.