Balrampur Chini is an Indian sugar manufacturing company. Balrampur Chini Share Price on NSE as of 27 August 2024 is 568.90 INR. On this page, you will find Asian Paints Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Balrampur Chini latest News, Balrampur Chini share News, Balrampur Chini share price target tomorrow, Why Balrampur Chini going down today, Balrampur chini share price target 2030, and more Information.

Balrampur Chini Mills Ltd Company Details

Balrampur Chini Mills Ltd is one of the largest and most respected sugar manufacturing companies in India. Established in 1975, the company is based in Uttar Pradesh, a region known for its extensive sugarcane farming. Balrampur Chini Mills operates several sugar mills and distilleries, producing not only sugar but also ethanol and other by-products.

The company is recognized for its efficient production processes, commitment to sustainability, and focus on quality. By leveraging modern technology and maintaining strong relationships with farmers, Balrampur Chini Mills continues to play a key role in India’s sugar industry.

| Official Website | chini.com |

| Founded | 1975 |

| Headquarters | India |

| Number of employees | 6,056 (2024) |

| Subsidiary | Khalilabad Sugar Mills (P) Ltd |

| Category | Share Price |

Current Market Overview Of Balrampur Chini Share Price

- Open: 561.00 INR

- High: 574.50 INR

- Low: 555.15 INR

- Market Cap: 11.48K Cr

- P/E Ratio: 21.62

- Dividend Yield: 0.53%

- 52-Week High: 585.40 INR

- 52-Week Low: 343.50 INR

Balrampur Chini Share Price Recent Graph

Read Also:- HUL Share Price Target 2024, 2025, 2026 to 2030 Prediction

Balrampur Chini Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Balrampur Chini for the upcoming years, based solely on market valuation, enterprise trends and professional predictions.

| S. No. | Balrampur Chini Share Price Target Years | SHARE PRICE TARGET |

| 1 | Balrampur Chini Share Price Target 2024 | ₹595 |

| 2 | Balrampur Chini Share Price Target 2025 | ₹680 |

| 3 | Balrampur Chini Share Price Target 2026 | ₹770 |

| 4 | Balrampur Chini Share Price Target 2027 | ₹892 |

| 5 | Balrampur Chini Share Price Target 2028 | ₹1025 |

| 6 | Balrampur Chini Share Price Target 2029 | ₹1155 |

| 7 | Balrampur Chini Share Price Target 2030 | ₹1325 |

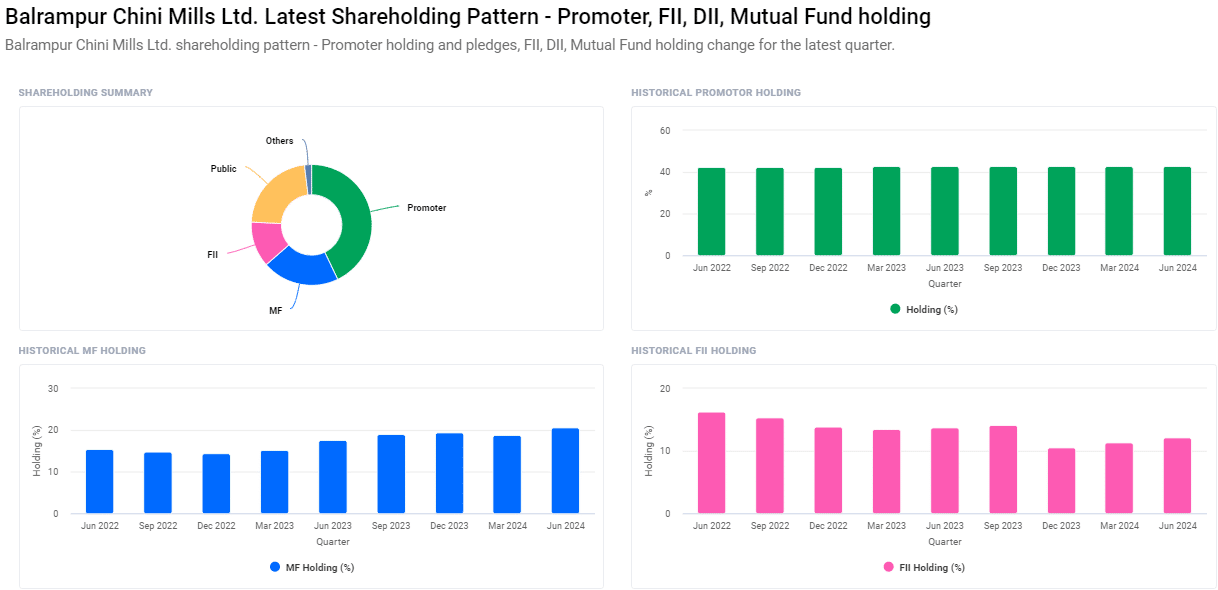

Shareholding Pattern For Balrampur Chini Share Price

- Promoters: 42.90%

- Retail and Others: 22.34%

- Mutual Funds: 20.64%

- Foreign Institutions: 12.19%

- Other Domestic Institutions: 1.94%

Major Factors Affecting Balrampur Chini Share Price Share Price

-

Sugar Prices: The share price of Balrampur Chini Mills is significantly influenced by the market price of sugar. Fluctuations in sugar prices, due to factors like supply-demand dynamics and government policies, can directly impact the company’s profitability and, consequently, its share price.

- Government Policies and Regulations: The sugar industry in India is highly regulated. Government policies related to sugarcane pricing, export quotas, and subsidies can greatly influence Balrampur Chini’s operations and financial performance, thereby affecting its share price.

- Ethanol Production and Pricing: Balrampur Chini Mills also produces ethanol, which is used as a fuel additive. The share price can be influenced by the company’s capacity to produce ethanol and the prevailing ethanol prices, as these contribute to the company’s overall revenue.

- Monsoon and Weather Conditions: As a company dependent on sugarcane, Balrampur Chini’s share price is affected by monsoon patterns and weather conditions. Good rainfall boosts sugarcane harvests, enhancing production and profitability, while poor monsoons can reduce sugarcane yields and negatively impact the share price.

- Global Market Trends: The global demand and supply of sugar can affect the company’s exports and earnings. International sugar prices and trade policies can influence Balrampur Chini’s export revenues, impacting its share price.

-

Operational Efficiency: The company’s ability to maintain cost-effective operations and manage its production efficiently can influence its profitability. Improvements in operational efficiency can lead to better profit margins, positively affecting the share price.

Read Also:-

- KPI Green Share Price Target

- Angel One Share Price Target

- RHFL Share Price Target

- SJVN Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.