Bajaj Hindusthan Sugar is one of India’s largest sugar producers. Bajaj Hindusthan Sugar Share Price on NSE as of 4 September 2024 is 40.23 INR. On this page, you will find Bajaj Hindusthan Sugar Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Is Bajaj Hindusthan Sugar a good buy, Bajaj Hindusthan Sugar News, Bajaj Hindusthan Sugar share price target tomorrow, Bajaj Hindustan sugar share price target 2030, Bajaj Hindustan sugar share price target 2021, and more Information.

Bajaj Hindusthan Sugar Ltd. Company Details

Bajaj Hindusthan Sugar Ltd is one of India’s largest sugar producers. Established in 1931, the company is a pioneer in the sugar industry and plays a significant role in the production of sugar, ethanol, and other by-products. Headquartered in Mumbai, Bajaj Hindusthan operates several sugar mills across Uttar Pradesh. The company also contributes to the energy sector by generating power from bagasse, a by-product of sugarcane. With a strong presence in the Indian market, Bajaj Hindusthan Sugar Ltd continues to be a key player in the country’s agricultural and energy sectors.

| Official Website | bajajhindusthan.com |

| Founded | 23 November 1931 |

| Founder | Jamnalal Bajaj |

| Chairman | Kushagra Bajaj |

| Headquarters |

Mumbai, Maharashtra, India

|

| Number of employees | 7,374 (2024) |

| Category | Share Price |

Current Market Overview Of Bajaj Hindusthan Sugar Share Price

- Open Price: ₹40.93

- High Price: ₹41.98

- Low Price: ₹40.04

- Current Price: ₹40.23

- Market Capitalization: ₹5.12K Crores

- 52-Week High: ₹46.10

- 52-Week Low: ₹22.50

- P/E Ratio: Not Available

- Dividend Yield: Not Available

Bajaj Hindusthan Sugar Share Today Chart

Read Also:- Balrampur Chini Share Price Target 2024, 2025 To 2030 Prediction

Bajaj Hindusthan Sugar Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Bajaj Hindusthan Sugar for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Bajaj Hindusthan Sugar Share Price Target Years | SHARE PRICE TARGET |

| 1 | Bajaj Hindusthan Sugar Share Price Target 2024 | ₹46 |

| 2 | Bajaj Hindusthan Sugar Share Price Target 2025 | ₹65 |

| 3 | Bajaj Hindusthan Sugar Share Price Target 2026 | ₹76 |

| 4 | Bajaj Hindusthan Sugar Share Price Target 2027 | ₹88 |

| 5 | Bajaj Hindusthan Sugar Share Price Target 2028 | ₹100 |

| 6 | Bajaj Hindusthan Sugar Share Price Target 2029 | ₹114 |

| 7 | Bajaj Hindusthan Sugar Share Price Target 2030 | ₹132 |

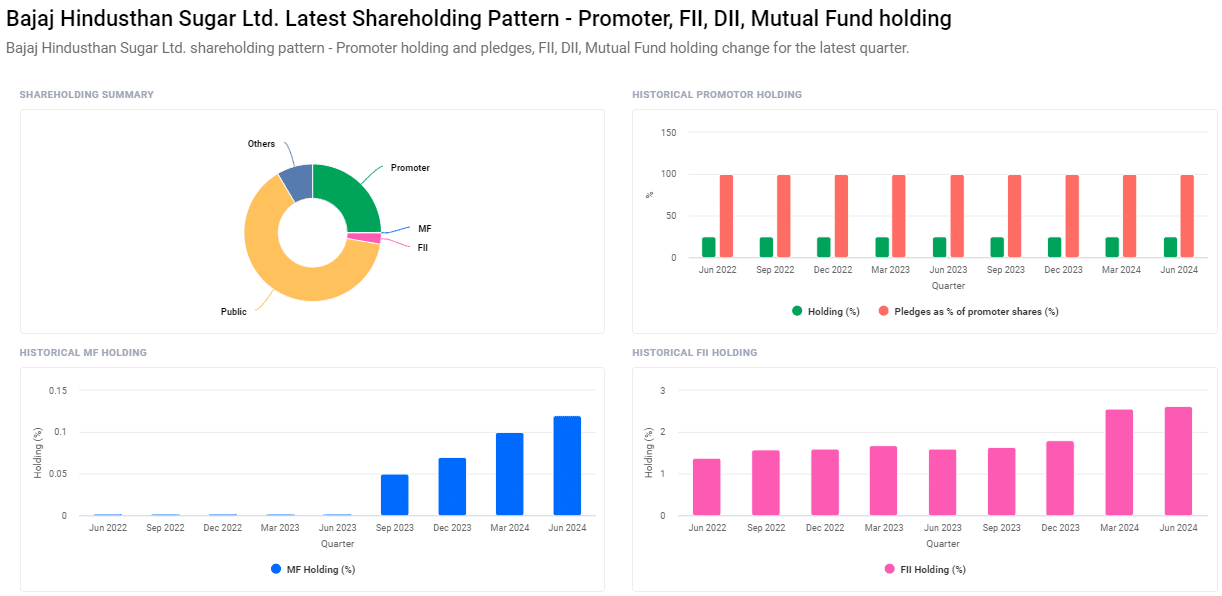

Bajaj Hindusthan Sugar Shareholding Pattern

- Retail and Others: 63.98%

- Promoters: 24.95%

- Other Domestic Institutions: 8.31%

- Foreign Institutional Investors (FII): 2.64%

- Mutual Funds: 0.12%

Bajaj Hindusthan Sugar Ltd Financials 2024

| Revenue | 61.04B INR | ⬆ 3.69% YOY |

| Operating expense | 10.69B INR | ⬆ 13.15% YOY |

| Net Income | -864.10M INR | ⬆ 35.86% YOY |

| Net Profit Margin | -1.42 | ⬆ 33.33% YOY |

| Earnings Per Share |

|

|

| EBITDA | 2.48B INR | ⬇-5.26% YOY |

| Effective Tax Rate | 8.55% |

|

| Total Assets | 159.06B INR | ⬇-0.21% YOY |

| Total Liabilities | 114.21B INR | ⬇-0.73% YOY |

| Total Equity | 44.85B INR |

|

| Return on assets | 0.11% | |

| Return on Capital | 0.20% | |

| P/E Ratio |

|

|

| Dividend Yield |

|

Major Factors Affecting Bajaj Hindusthan Sugar Share Price Share Price

Here are seven major factors that can influence the share price of Bajaj Hindusthan Sugar:

- Sugar Prices: Fluctuations in domestic and international sugar prices can directly impact the company’s profitability, influencing its share price.

- Government Policies: Changes in government regulations, subsidies, and import/export policies related to the sugar industry can have a significant effect on the company’s performance and stock value.

- Monsoon and Weather Conditions: As a sugarcane-dependent company, Bajaj Hindusthan’s production levels are closely tied to monsoon patterns and weather conditions. Poor rainfall or adverse weather can reduce sugarcane yield, affecting the company’s output and share price.

- Ethanol Blending Program: The Indian government’s push for ethanol blending in fuel can benefit Bajaj Hindusthan’s ethanol production. Increased demand for ethanol can boost the company’s revenue and positively impact its share price.

- Global Sugar Market Trends: International sugar demand and supply dynamics, including competition from other sugar-producing countries, can influence the global sugar prices, indirectly affecting Bajaj Hindusthan’s share price.

- Operational Efficiency: The company’s ability to maintain high operational efficiency, control costs, and manage debt levels can influence investor confidence and its stock price.

-

Energy Production: Bajaj Hindusthan’s involvement in energy production from bagasse adds a diversified revenue stream. Any developments in this sector, such as increased energy demand or changes in energy tariffs, can impact the company’s financial performance and share price.

Read Also:-

- Filatex Share Price Target

- Sun TV Share Price Target

- HCC Share Price Target

- Kotak Mahindra Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.