Bajaj Finance is an Indian non-banking financial company. Bajaj Finance Share Price on NSE as of 21 August 2024 is 6,734.00 INR. On this page, you will find Bajaj Finance Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Bajaj Finance share price target tomorrow, Bajaj Finance share price target after 10 years, Bajaj Finance share price target next Week, Bajaj finance share price target 2030, and more Information.

Bajaj Finance Ltd Company Details

Bajaj Finance Ltd is one of India’s leading non-banking financial companies (NBFCs). It offers a wide range of financial services, including consumer finance, small business loans, and commercial lending. Known for its innovative products and customer-centric approach, Bajaj Finance has grown rapidly over the years, establishing a strong presence across the country. The company is part of the Bajaj Group, a well-known Indian conglomerate, and is recognized for its commitment to providing easy and accessible financial solutions to its customers.

| Official Website | bajajfinserv.in |

| CEO | Rajeev Jain (2007–) |

| Founded | 1987 |

| Founder | Rahul Bajaj |

| Headquarters |

Pune, India

|

| Number of employees | 53,782 (2024) |

| Category | Share Price |

Current Market Overview of Bajaj Finance Share Price

- Open: 6,721.95

- High: 6,747.30

- Low: 6,695.00

- Mkt cap: 4.16LCr

- P/E ratio: 27.77

- Div yield: 0.53%

- 52-wk high: 8,192.00

- 52-wk low: 6,187.80

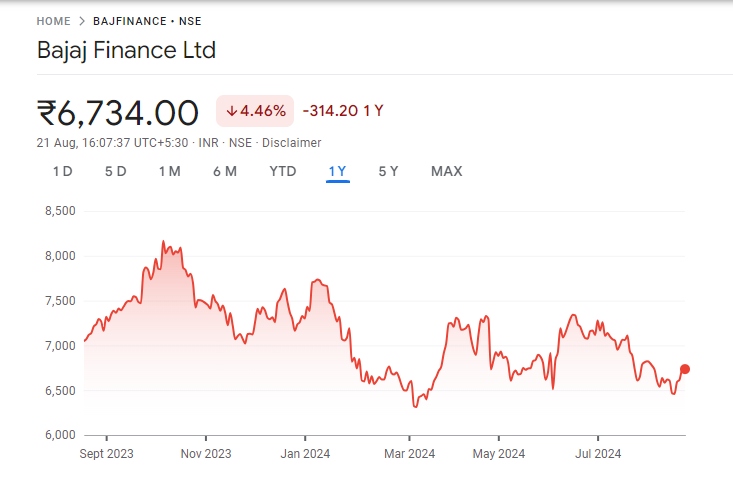

Bajaj Finance Share Price Recent Graph

Read Also:- ICIC Bank Share Price Target 2024, 2025 to 2030 and More Details

Bajaj Finance Share Price Target Tomorrow From 2024 to 2030

| S.No. | Bajaj Finance Share Price Target Years | SHARE PRICE TARGET |

| 1 | Bajaj Finance Share Price Target 2024 | ₹7,447 |

| 2 | Bajaj Finance Share Price Target 2025 | ₹8,371 |

| 3 | Bajaj Finance Share Price Target 2026 | ₹9,311 |

| 4 | Bajaj Finance Share Price Target 2027 | ₹10,236 |

| 5 | Bajaj Finance Share Price Target 2028 | ₹11,165 |

| 6 | Bajaj Finance Share Price Target 2029 | ₹12,064 |

| 7 | Bajaj Finance Share Price Target 2030 | ₹13,654 |

Shareholding Pattern for Bajaj Finance Share Price

- Promoters: 54.70%

- Foreign Institutions: 21.09%

- Retail And Others: 9.91%

- Mutual Funds: 9.15%

- Other Domestic Institutions: 5.16%

Factors Affecting Bajaj Finance Share Price Targets

Here are six key factors that influence Bajaj Finance’s share price targets:

- Interest Rate Changes: Fluctuations in interest rates can significantly impact Bajaj Finance’s profitability. Lower interest rates may lead to higher borrowing, boosting the company’s growth, while higher rates could increase borrowing costs and affect margins.

- Economic Conditions: The overall health of the Indian economy plays a crucial role. During periods of economic growth, demand for loans and financial products typically increases, positively influencing Bajaj Finance’s share price. Conversely, an economic slowdown can reduce demand and increase defaults.

- Loan Growth and Asset Quality: Bajaj Finance’s ability to grow its loan book while maintaining a high-quality portfolio is a key determinant of its share price. A strong growth rate in loans, coupled with low non-performing assets (NPAs), boosts investor confidence and the share price.

- Regulatory Environment: Changes in financial regulations, including those related to NBFCs, can impact Bajaj Finance’s operations. Favorable regulations might provide growth opportunities, while stricter norms could pose challenges, influencing the share price.

- Competition: The level of competition in the financial services sector can affect Bajaj Finance’s market share and profitability. Increased competition may lead to pressure on interest margins and require more aggressive marketing strategies, impacting the share price.

-

Company Performance and Earnings Reports: Quarterly and annual financial results, including revenue, profit margins, and return on equity, are closely watched by investors. Strong financial performance often leads to higher share price targets, while disappointing results may result in downward revisions.

Read Also:-

- Deepak Nitrite Share Price Target

- DCW Share Price Target

- Avantel Share Price Target

- Indigo Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.