Bajaj Auto is an Indian multinational automotive manufacturing company. Bajaj Auto Share Price on NSE as of 28 August 2024 is 10,656.00 INR. On this page, you will find Bajaj Auto Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Bajaj Auto share price in 2010, Why Bajaj Auto share is falling today, Bajaj Auto share price target Tomorrow, Bajaj Auto share News today, and more Information.

Bajaj Auto Ltd. Company Details

Bajaj Auto Ltd is a well-known Indian company that specializes in manufacturing motorcycles, scooters, and three-wheelers. Founded in 1945, it has grown to become one of the largest and most respected two-wheeler and three-wheeler manufacturers in the world. Bajaj Auto is famous for its innovative designs, reliable products, and commitment to quality.

With a strong presence in India and several international markets, the company is a popular choice among customers for its stylish and fuel-efficient vehicles. Bajaj Auto continues to lead the way in the automotive industry with its focus on sustainability and cutting-edge technology.

| Official Website | bajajauto.com |

| CEO | Rajiv Bajaj (Apr 2005–) |

| Founded | 29 November 1945 |

| Founder | Jamnalal Bajaj Rogen Frias |

| Headquarters | Pune, Maharashtra, India |

| Number of employees | 6,192 (2024) |

| Category | Share Price |

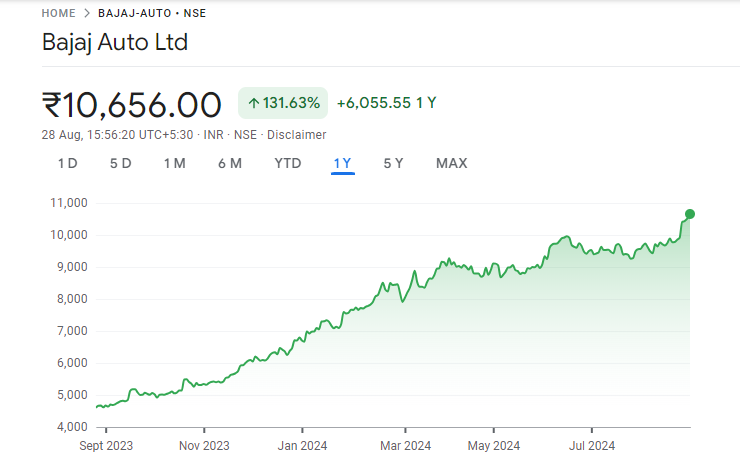

Current Market Overview of Bajaj Auto Share Price

- Open: ₹10,500.00

- High: ₹10,715.00

- Low: ₹10,461.30

- Market Cap: ₹2.98 lakh crore

- P/E Ratio: 37.53

- Dividend Yield: 0.75%

- 52-Week High: ₹10,715.00

- 52-Week Low: ₹4,586.00

- Current Price: ₹10,656.00

Bajaj Auto Share Price Recent Graph

Bajaj Auto Share Price Target From 2024 To 2030

Here are the estimated share prices of Bajaj Auto for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Bajaj Auto Share Price Target Years | SHARE PRICE TARGET |

| 1 | Bajaj Auto Share Price Target 2024 | ₹10,800 |

| 2 | Bajaj Auto Share Price Target 2025 | ₹12,656 |

| 3 | Bajaj Auto Share Price Target 2026 | ₹13,976 |

| 4 | Bajaj Auto Share Price Target 2027 | ₹14,887 |

| 5 | Bajaj Auto Share Price Target 2028 | ₹15,923 |

| 6 | Bajaj Auto Share Price Target 2029 | ₹17,250 |

| 7 | Bajaj Auto Share Price Target 2030 | ₹18,585 |

Read Also:- Delhivery Share Price Target 2024, 2025 To 2030 And More Details

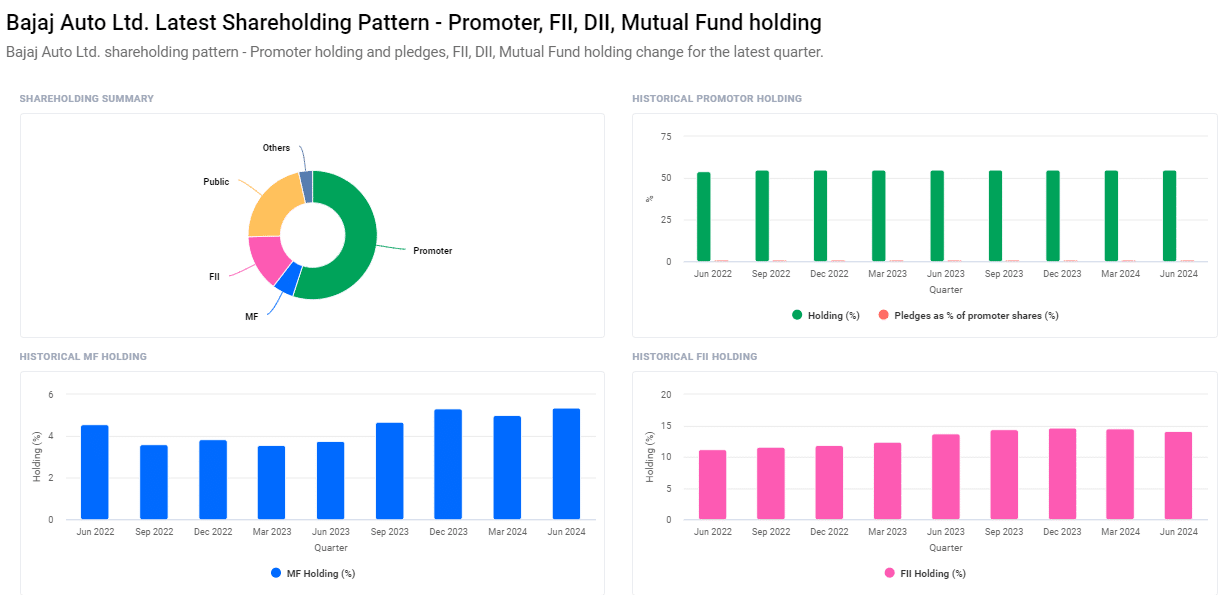

Shareholding Pattern For Bajaj Auto Share Price

- Promoters: 55.06%

- Retail And Others: 21.93%

- Foreign Institutions: 14.20%

- Mutual Funds: 5.37%

- Other Domestic Institutions: 3.45%

Major Factors Affecting Bajaj Auto Share Price Share Price

Here are four major factors that can affect Bajaj Auto’s share price:

- Market Demand: Bajaj Auto’s share price is closely tied to the demand for its motorcycles and three-wheelers, both domestically and internationally. A strong demand for its products can drive sales growth and boost the share price, while a decline in consumer demand can have the opposite effect.

- Competition: The automotive sector is highly competitive, with several major players vying for market share. Intense competition can lead to price wars and reduced profit margins for Bajaj Auto, which might negatively impact its share price if the company struggles to maintain its market position.

- Economic Conditions: Economic factors such as GDP growth, interest rates, and consumer spending power significantly influence the automotive industry. Economic downturns or slow growth can reduce consumer spending on vehicles, leading to lower sales for Bajaj Auto and a potential drop in its share price.

-

Regulatory Environment: Changes in government regulations, including emission standards, safety norms, and taxation policies, can affect Bajaj Auto’s production costs and pricing strategies. Compliance with new regulations may require additional investment, which could impact profitability and, in turn, the share price.

Risks and Challenges For Bajaj Auto Share Price

Here are five key risks and challenges that could impact the share price of Bajaj Auto:

- Market Competition: The automotive industry is highly competitive, with numerous players offering similar products. Intense competition, especially from other major two-wheeler manufacturers, can lead to price wars and affect Bajaj Auto’s market share, potentially impacting its profitability and stock price.

- Fluctuations in Raw Material Costs: The prices of raw materials like steel, aluminum, and rubber can be volatile. Any significant increase in these costs can lead to higher production expenses for Bajaj Auto, which might squeeze profit margins if the company cannot pass these costs onto consumers.

- Regulatory Changes: Changes in government regulations, such as new emission norms or safety standards, can increase the cost of production for Bajaj Auto. Compliance with these regulations might require additional investment in technology, which could affect the company’s financial performance and share price.

- Economic Slowdowns: Bajaj Auto’s performance is closely tied to the overall economic health of the markets it operates in. Economic slowdowns or recessions can reduce consumer spending, leading to lower demand for vehicles. This can directly impact sales and, consequently, the share price.

-

Exchange Rate Fluctuations: Since Bajaj Auto exports a significant portion of its products, fluctuations in currency exchange rates can affect profitability. A stronger Indian rupee compared to other currencies could reduce export earnings, impacting overall revenue and the company’s share price.

Read Also:-

- Bajaj Finance Share Price Target

- RBL Share Price Target

- Angel One Share Price Target

- Igarashi Motors Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.