Astral Ltd is a prominent Indian company specializing in manufacturing and distributing high-quality piping systems. Astral Share Price on NSE as of 23 September 2024 is 1,976.95 INR. On this page, you will find Astral Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Astral Share News, Astral Poly News Today, Astral Share Price Target Tomorrow, Astral Share Price Target 2030, and more Information.

Astral Ltd Company Details

Astral Ltd is a prominent Indian company specializing in manufacturing and distributing high-quality piping systems. Known for its innovation and reliability, Astral offers a wide range of products, including plumbing, drainage, and fire protection systems. The company has established a strong presence in domestic and international markets, earning a reputation for delivering durable and efficient solutions. Astral Ltd continues to be a leader in the piping industry with a focus on quality and customer satisfaction.

| Official Website | astralltd.com |

| Founded | 1996 |

| Headquarters |

Ahmedabad, India

|

| Managing Director | Sandeep Engineer |

| Number of employees | 4,862 (2024) |

| Category | Share Price |

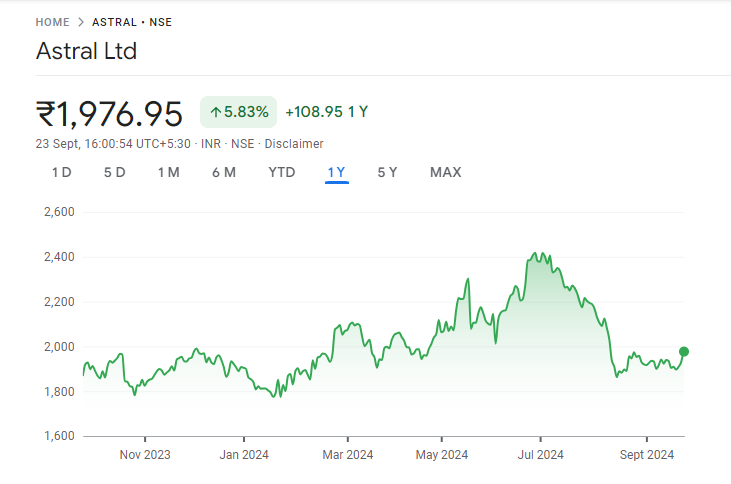

Astral Share Price Today Chart

Current Market Overview Of Astral Share Price

- Open Price: ₹1,947.00

- High Price: ₹1,981.75

- Low Price: ₹1,939.35

- Market Capitalization: ₹52.86KCr crore

- P/E Ratio: 97.19

- Dividend Yield: 0.19%

- 52-Week High: ₹2,454.00

- 52-Week Low: ₹1,740.00

- Current Price: ₹1,976.95

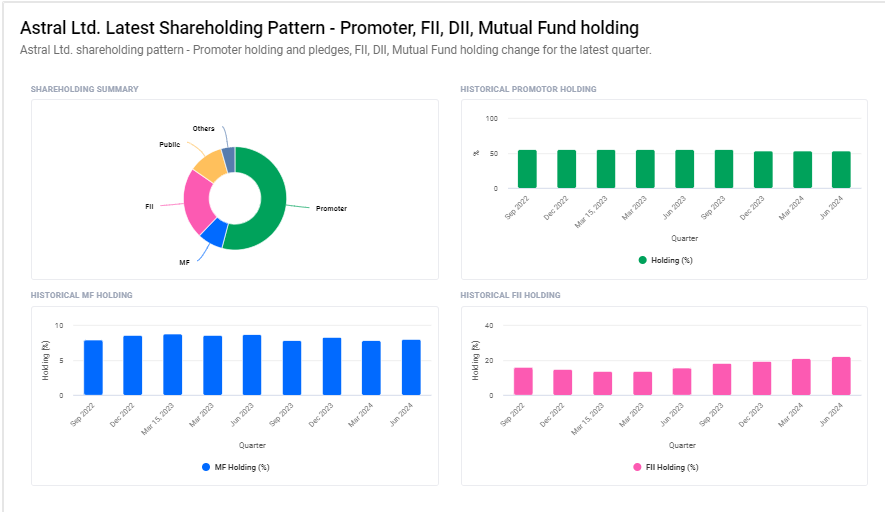

Astral Ltd Shareholding Pattern

- Promoters: 54.10%

- Foreign Institutions: 22.48%

- Retail and Others: 10.97%

- Mutual Funds: 8.03%

- Other Domestic Institutions: 4.42%

Read Also:- RVNL Share Price Target 2024, 2025, 2026 to 2030 and Predictions

Astral Share Price Target Tomorrow From 2024 To 2030

Predicting the exact share price target for Astral tomorrow can be challenging due to the influence of various market factors, such as company news, market trends, and broader economic conditions. Investors often consider technical analysis, market sentiment, and recent performance to estimate potential price movements.

| S. No. | Astral Share Price Target Years | SHARE PRICE TARGET |

| 1 | Astral Share Price Target 2024 | ₹2655 |

| 2 | Astral Share Price Target 2025 | ₹2740 |

| 3 | Astral Share Price Target 2026 | ₹2824 |

| 4 | Astral Share Price Target 2027 | ₹2932 |

| 5 | Astral Share Price Target 2028 | ₹3178 |

| 6 | Astral Share Price Target 2029 | ₹3306 |

| 7 | Astral Share Price Target 2030 | ₹3945 |

Astral Share Price Target 2024

The 2024 share price target for Astral Ltd is projected at ₹2,655, reflecting a positive outlook for the company. This target suggests strong confidence in Astral’s ability to continue its growth trajectory, driven by innovation, market expansion, and consistent financial performance. This target indicates potential for satisfying returns for investors, as Astral remains a leader in the piping industry with a solid reputation for quality and reliability.

Astral Share Price Target 2025

The 2025 share price target for Astral Ltd is set at ₹2,740, highlighting a positive expectation for the company’s future performance. This target reflects confidence in Astral’s continued growth, driven by its commitment to innovation and market leadership in the piping industry. For investors, this target suggests the potential for rewarding returns, as Astral is well-positioned to maintain its strong market presence and deliver consistent value.

Key Factors Affecting Astral Share Price Growth

Here are five key factors that can influence the growth of Astral’s share price:

- Expansion of Product Line: Astral’s ability to introduce new and innovative products can drive growth. Expanding its product line to meet diverse customer needs can increase market share and positively influence the share price.

- Strategic Acquisitions: Acquiring or partnering with other companies can help Astral expand its market presence and capabilities. Successful acquisitions can boost revenue and profitability, contributing to share price growth.

- Infrastructure Development: The growth of construction and infrastructure projects, particularly in key markets, can lead to increased demand for Astral’s piping systems. This demand can drive sales and support a rise in the share price.

- Operational Efficiency: Improving operational processes, such as reducing costs and enhancing supply chain management, can lead to higher profitability. Efficient operations can result in better financial performance and growth in the share price.

-

Brand Reputation: Maintaining a strong brand reputation for quality and reliability is crucial. A positive brand image can attract more customers and investors, leading to increased sales and share price growth.

Read Also:-

- Natco Pharma Share Price Target

- Titagarh Share Price Target

- Ola Electric Share Price Target

- Jio Finance Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.