Arkade Developers Ord Shs is an Indian real estate development company. Arkade Developers Share Price on NSE as of 24 September 2024 is 165.45 INR. On this page, you will find Arkade Developers Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Arkade Developers share price today, Arkade Developers share price today live, Arkade Developers share price nse, Arkade Developers share price in grey market, Arkade share price today live, Arkade developers share price live, and more Information.

Arkade Developers Ord Shs Company

Arkade Developers Ord Shs is an Indian real estate development company that focuses on creating residential and commercial properties. Based in Mumbai, Arkade Developers is known for its commitment to quality construction and innovative design. The company aims to meet the growing demand for housing and commercial spaces in urban areas while providing modern amenities and sustainable living options. With a strong track record of successful projects, Arkade Developers is recognized for its contributions to the real estate sector in India, making it a trusted name among homebuyers and investors alike.

FOR MORE DETAIL FOLLOW THE OFFICIAL WEBSITE: http://arkade.in/

Arkade Developers Share Price Today Chart

Current Market Overview Of Arkade Developers Share Price

- Open Price: ₹175.00

- High Price: ₹190.00

- Low Price: ₹164.80

- Current Price: ₹165.45

- Mkt cap: ₹3,079 Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: ₹190.00

- 52-wk low: ₹164.80

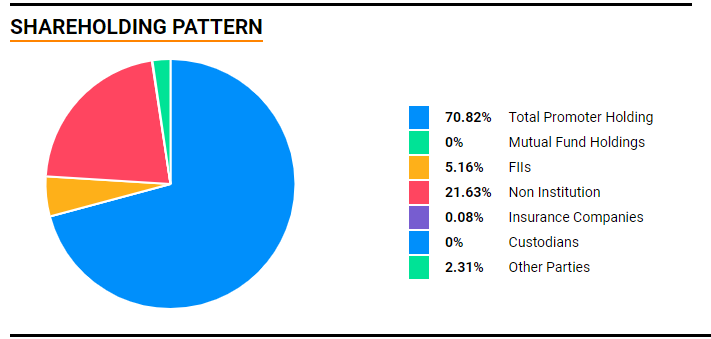

Arkade Developers Shareholding Pattern

- Promoter: 70.82%

- FII: 5.16%

- Non-Institution: 21.63%

- Insurance Companies: 0.08%

- Other Parties: 2.31%

Arkade Developers Share Price Target Tomorrow From 2024 To 2030

| Arkade Developers Share Price Target Years | Expected Share Price Target (₹) |

|---|---|

| Arkade Developers Share Price Target 2024 | ₹180 |

| Arkade Developers Share Price Target 2025 | ₹210 |

| Arkade Developers Share Price Target 2026 | ₹240 |

| Arkade Developers Share Price Target 2027 | ₹270 |

| Arkade Developers Share Price Target 2028 | ₹300 |

| Arkade Developers Share Price Target 2029 | ₹330 |

| Arkade Developers Share Price Target 2030 | ₹360 |

Arkade Developers Share Price Target 2024

| First Target Price | ₹180 |

| Second Target Price | ₹190 |

Arkade Developers Share Price Target 2025

| First Target Price | ₹190 |

| Second Target Price | ₹210 |

Arkade Developers Share Price Target 2030

| First Target Price | ₹320 |

| Second Target Price | ₹360 |

Key Factors Affecting Arkade Developers Share Price Growth

Here are seven key factors that can influence the growth of Arkade Developers’ share price:

- Market Demand for Real Estate: The overall demand for residential and commercial properties in the areas where Arkade Developers operates plays a crucial role. An increase in demand can lead to higher sales and revenue, positively impacting the share price.

- Economic Conditions: The broader economic environment, including GDP growth and employment rates, can affect consumer confidence and spending. A strong economy typically boosts the real estate market, leading to potential growth in Arkade Developers’ share price.

- Regulatory Environment: Changes in government regulations related to real estate, such as zoning laws or tax incentives, can impact the company’s operations. A favorable regulatory environment can lead to increased project approvals and growth opportunities.

- Quality of Projects: The reputation of Arkade Developers is influenced by the quality of its construction and design. Successfully delivering high-quality projects can enhance customer satisfaction and lead to positive word-of-mouth, benefiting share price growth.

- Financial Performance: The company’s financial health, including revenue, profits, and debt levels, directly affects investor perception. Strong financial performance can attract more investors and boost the share price.

- Strategic Partnerships: Collaborations with other developers, contractors, or financial institutions can provide Arkade Developers with additional resources and market reach. Successful partnerships can enhance growth prospects and positively influence share prices.

-

Market Sentiment and Trends: Investor sentiment toward the real estate sector can fluctuate based on trends and news. Positive sentiment can lead to increased demand for shares, while negative news can have the opposite effect. Keeping a pulse on market trends is essential for share price growth.

Read Also:-

- Chambal Fertilisers Share Price Target

- PCBL Share Price Target

- NIIT Ltd Share Price Target

- Astral Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.