Alok Industries Ltd is one of India’s leading textile companies. Alok Industries Share Price on NSE as of 9 September 2024 is 26.55 INR. On this page, you will find Alok Industries Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Expert advice on Alok Industries, Alok Industries News, Alok Industries Share Price Target 2040, Alok Industries share price target tomorrow, and more Information.

Alok Industries Ltd Company Details

Alok Industries Ltd is one of India’s leading textile companies, known for its wide range of products, including cotton and polyester fabrics, garments, and home textiles. Established in 1986, the company has grown into a major player in the global textile industry, with operations in both domestic and international markets.

Alok Industries specializes in the entire textile value chain, from spinning and weaving to processing and garments. It caters to various industries such as fashion, retail, and home furnishings. The company is recognized for its quality products and large production capacity, making it a preferred choice for many businesses worldwide.

| Official Website | alokind.com |

| Founded | 1986 |

| Founder | Surendra Jiwrajka |

| Headquarters | Mumbai, Maharashtra |

| Number of employees | 22,245 (2024) |

| Parent organization | Reliance Industries |

| CEO | Ram Rakesh Gaur |

| Category | Share Price |

Current Market Overview of Alok Industries Share Price

- Open Price: ₹27.18

- High Price: ₹27.25

- Low Price: ₹26.45

- Market Capitalization: ₹13.18K Crores

- P/E Ratio: N/A

- Dividend Yield: N/A

- 52-Week High: ₹39.05

- 52-Week Low: ₹16.10

- Current Price: ₹26.55

Alok Industries Share Price Today Chart

Read Also:- Lotus Chocolate Share Price Target 2024, 2025 to 2030 Prediction

Alok Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Alok Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Alok Industries Share Price Target Years | SHARE PRICE TARGET |

| 1 | Alok Industries Share Price Target 2024 | ₹42 |

| 2 | Alok Industries Share Price Target 2025 | ₹60 |

| 3 | Alok Industries Share Price Target 2026 | ₹71 |

| 4 | Alok Industries Share Price Target 2027 | ₹79 |

| 5 | Alok Industries Share Price Target 2028 | ₹88 |

| 6 | Alok Industries Share Price Target 2029 | ₹99 |

| 7 | Alok Industries Share Price Target 2030 | ₹111 |

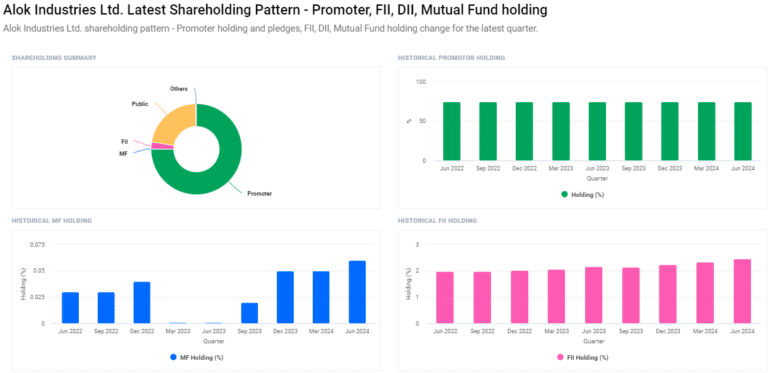

Alok Industries Ltd. Shareholding Pattern

- Promoters: 75.00% (Unchanged from the previous region)

- Retail and Others: 22.15%

- Foreign Institutional Investors (FII/FPI): 2.46% (Increased from 2.34%)

- Mutual Funds: 0.06% (Increased from 0.05%)

- Other Domestic Institutions: 0.32%

Key Factors Affecting Alok Industries Share Price Growth

Here are seven key factors that can affect the share price growth of Alok Industries:

- Demand for Textiles: An increase in demand for textiles, both in India and globally, can lead to higher sales for Alok Industries, positively impacting its share price.

- Export Opportunities: As a global player, Alok Industries benefits from export markets. Growth in international demand for Indian textiles can boost the company’s revenues and stock performance.

- Cost Management: Efficient management of production costs, such as raw materials and labor, can help improve profit margins. Strong profitability often leads to a rise in the share price.

- Government Policies: Supportive government policies, like incentives for the textile industry or favorable trade agreements, can benefit Alok Industries and enhance its growth prospects, reflecting positively on its stock price.

- Expansion Plans: Any new investments or expansion into new markets, product lines, or technologies can drive the company’s future growth, attracting more investor interest and boosting the share price.

- Financial Health: Consistently strong financial performance, including revenue growth, profit, and debt management, can increase investor confidence in Alok Industries and positively affect its share price.

-

Global Economic Conditions: Favorable global economic conditions, such as stable markets and growing demand in key export regions, can help Alok Industries thrive, leading to potential stock price growth.

Read Also:-

- Filatex Share Price Target

- Rattan Power Share Price Target

- RBL Share Price Target

- DMart Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.