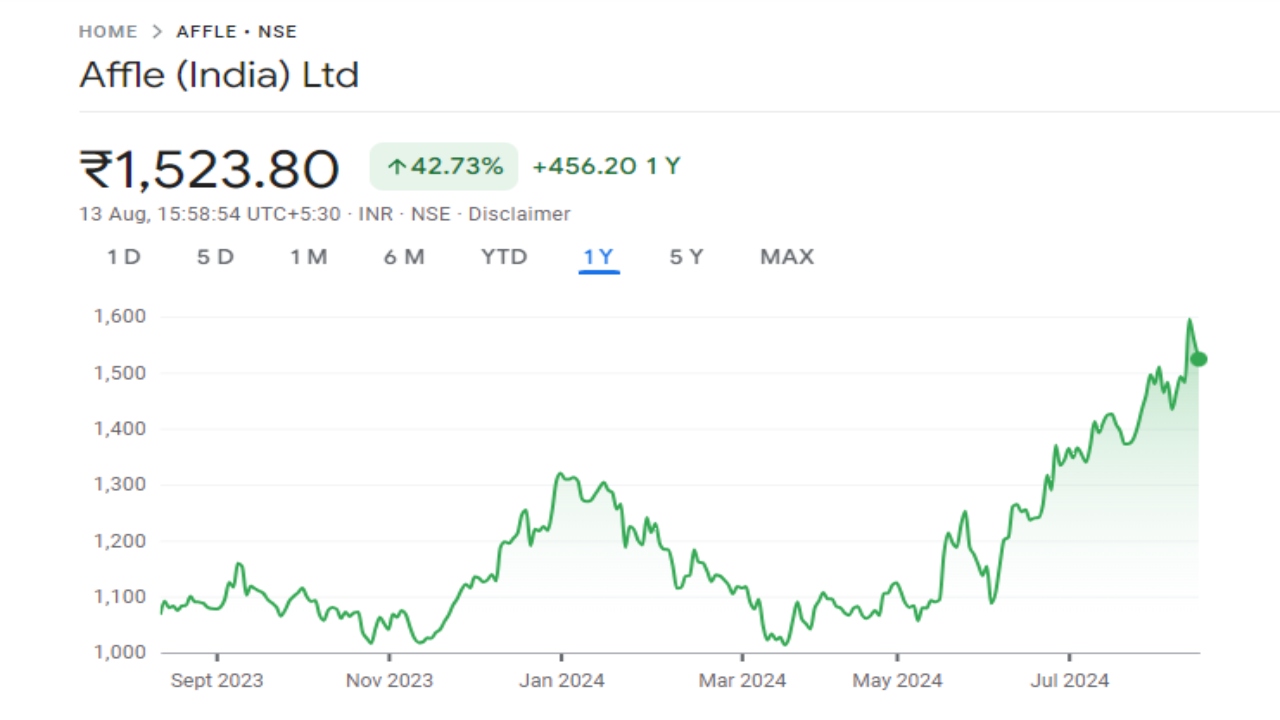

With a focus on emerging markets, AFFLE Ltd has positioned itself as a key player in the digital advertising industry, known for its cutting-edge technology and commitment to transforming how brands connect with consumers. AFFLE Ltd share price on NSE as of 13 August 2024 is 1,523.80 INR. On this page, you will find AFFLE Ltd Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as AFFLE (India) share price target tomorrow, Is AFFLE India a good buy for long term, AFFLE India share price target 2040, AFFLE India share price target Motilal Oswal, and more Information.

AFFLE Ltd. Company Details

AFFLE Ltd is a global technology company based in India, specializing in mobile advertising and digital marketing. The company provides innovative solutions that help businesses reach and engage their target audiences through personalized mobile ads. AFFLE’s platform uses data analytics, AI, and deep learning to deliver effective advertising campaigns, driving higher returns on investment for its clients.

| Official Website | affle.com |

| Founded | 18 August 1994 |

| Headquarters | India |

| Number of employees | 551 (2023) |

| Parent organization | Affle Holdings Private Limited |

| Subsidiary | Affle International Pte. Ltd. |

| Category | Share Price |

Overview of AFFLE India Share Price

- MARKET CAP: ₹21.40KCr

- OPEN: ₹1,569.00

- HIGH: ₹1,569.95

- LOW: ₹1,517.05

- P/E RATIO: 65.26

- DIVIDEND YIELD: N/A

- 52 WEEK HIGH: ₹1634.00

- 52 WEEK LOW: ₹988.15

Read Also:- BSE Ltd. Share Price Target 2024, 2025 to 2030 Prediction and More Details

AFFLE India Share Price Target Tomorrow

| AFFLE India Share Price Target Years | SHARE PRICE TARGET |

| AFFLE India Share Price Target 2024 | ₹1799 |

| AFFLE India Share Price Target 2025 | ₹1864 |

| AFFLE India Share Price Target 2026 | ₹2134 |

| AFFLE India Share Price Target 2027 | ₹2442 |

| AFFLE India Share Price Target 2028 | ₹2795 |

| AFFLE India Share Price Target 2029 | ₹3198 |

| AFFLE India Share Price Target 2030 | ₹3659 |

AFFLE India Share Price Recent Graph

AFFLE India Shareholding Pattern

- Promoters: 55.14%

- Foreign Institutions: 15.30%

- Retail And Others: 13.37%

- Mutual Funds: 12.95%

- Other Domestic Institutions: 3.26%

Factors Affecting AFFLE India Share Price Target

-

Company Performance and Earnings Growth

- AFFLE India’s share price is significantly influenced by its financial performance. Strong earnings growth, driven by increased revenue and profitability, can boost investor confidence, leading to a higher share price target. Conversely, if the company reports weaker-than-expected results, it may negatively impact its stock price.

- Market Demand for Digital Advertising

- As a technology company specializing in mobile advertising, AFFLE India’s growth is closely tied to the overall demand for digital and mobile advertising solutions. An increase in digital ad spending, especially in emerging markets like India, can positively impact the company’s prospects and share price.

- Technological Advancements

- Innovation and the adoption of new technologies in digital advertising can play a key role in AFFLE India’s success. If the company remains at the forefront of technological trends, such as AI and data analytics in advertising, it can maintain a competitive edge, driving up its share price.

- Competitive Landscape

- The level of competition in the digital advertising industry also affects AFFLE India’s share price. If the company manages to outperform its competitors and capture a larger market share, it could lead to a positive outlook on its stock. However, increased competition may pressure its margins and market position.

-

Investor Sentiment and Market Trends

- The overall sentiment in the stock market, including trends in technology stocks, can affect AFFLE India’s share price. Positive investor sentiment towards tech companies and the digital economy can lead to higher valuations, while negative sentiment can result in lower share price targets.

Read Also:-

- Thermax Limited Share Price Target

- JBM Auto Share Price Target

- BOI Share Price Target

- MRPL Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.