Aadhar Housing Finance Ltd is one of India’s leading housing finance companies, focusing on providing affordable home loans. Aadhar Housing Finance Share Price on NSE as of 6 September 2024 is 440.00 INR. On this page, you will find Aadhar Housing Finance Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Aadhar Housing Finance share price target tomorrow, Aadhar Housing Finance share price target 2025 Moneycontrol, Aadhar Housing Finance share price target 2030, and more Information.

Aadhar Housing Finance Ltd Company Details

Aadhar Housing Finance Ltd is one of India’s leading housing finance companies, focusing on providing affordable home loans. The company primarily serves low- and middle-income groups, helping them achieve their dream of homeownership. With a wide network across India, Aadhar Housing Finance aims to make housing accessible by offering easy loan solutions, ensuring financial inclusion, and improving the quality of life for many families.

| Official Website | aadharhousing.com |

| Headquarters | India |

| Number of employees | 3,931 (2024) |

| Parent organization | Bcp Topco VII Pte. Ltd. |

| Category | Share Price |

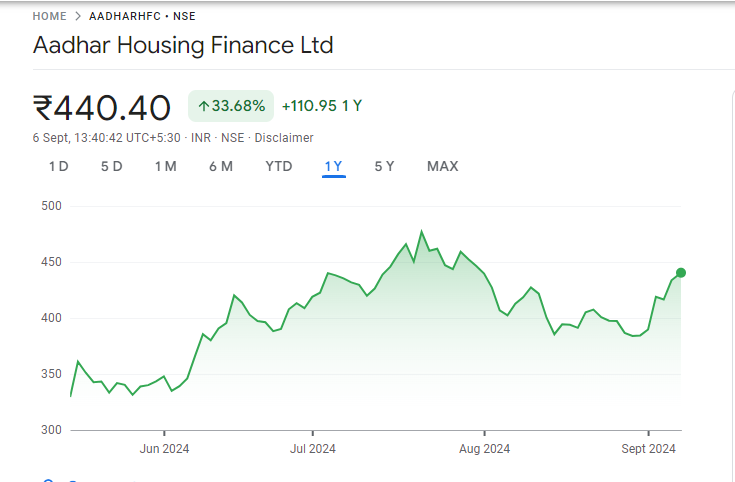

Current Market Overview Of Aadhar Housing Finance Share Price

- Open Price: ₹434.70

- High Price: ₹451.45

- Low Price: ₹434.70

- Current Price: ₹440.35

- Market Capitalization: ₹18.91K Crores

- P/E Ratio: Not Applicable

- Dividend Yield: Not Applicable

- 52-Week High: ₹486.95

- 52-Week Low: ₹292.00

Aadhar Housing Finance Share Price Today Chart

Read Also:- Franklin Industries Share Price Target 2024, 2025 To 2030

Aadhar Housing Finance Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Aadhar Housing Finance for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Aadhar Housing Finance Share Price Target Years | SHARE PRICE TARGET |

| 1 | Aadhar Housing Finance Share Price Target 2024 | ₹496 |

| 2 | Aadhar Housing Finance Share Price Target 2025 | ₹556 |

| 3 | Aadhar Housing Finance Share Price Target 2026 | ₹623 |

| 4 | Aadhar Housing Finance Share Price Target 2027 | ₹697 |

| 5 | Aadhar Housing Finance Share Price Target 2028 | ₹781 |

| 6 | Aadhar Housing Finance Share Price Target 2029 | ₹875 |

| 7 | Aadhar Housing Finance Share Price Target 2030 | ₹1053 |

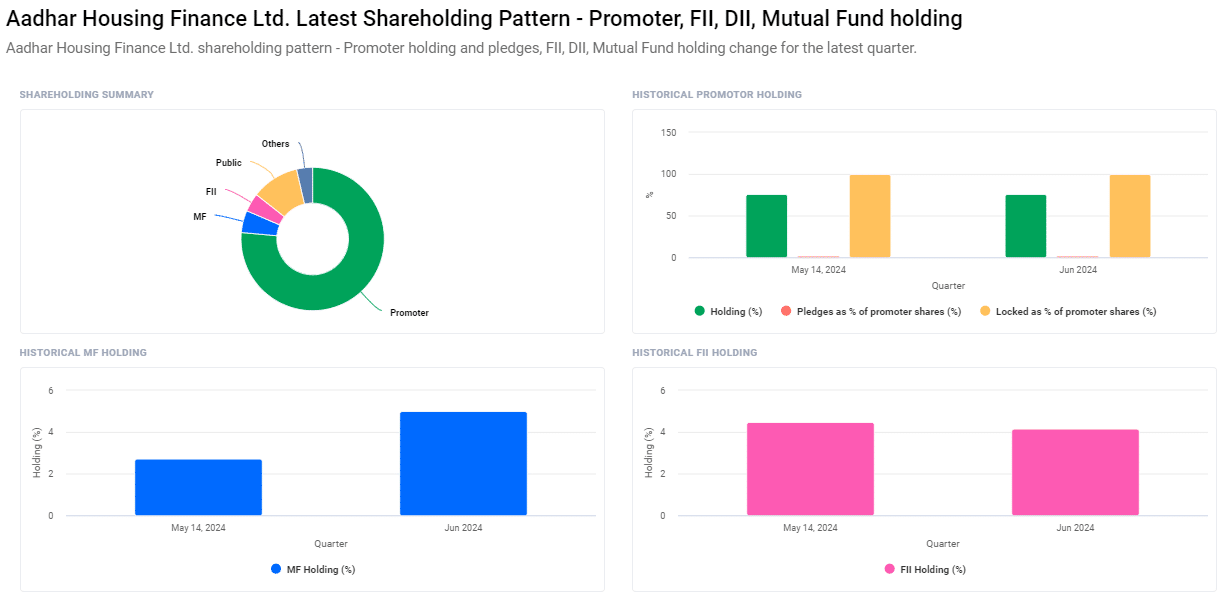

Aadhar Housing Finance Ltd Shareholding Pattern

- Promoters: 76.48%

- Retail and Others: 10.76%

- Mutual Funds: 5.00%

- Foreign Institutional Investors (FII/FPI): 4.17%

- Other Domestic Institutions: 3.60%

Key Factors Affecting Aadhar Housing Finance Share Price Growth

Here are seven key factors that can influence the growth of Aadhar Housing Finance’s share price:

- Demand for Affordable Housing: Aadhar Housing Finance focuses on providing home loans to low- and middle-income groups. Increased demand for affordable housing can drive loan growth, boosting the company’s performance and share price.

- Interest Rate Changes: The company’s profitability is closely tied to interest rates. Lower interest rates can encourage more home loans, increasing revenue, while higher rates might slow demand, potentially affecting share price growth.

- Government Housing Policies: Supportive government initiatives, such as subsidies or schemes for affordable housing, can positively impact Aadhar Housing Finance. These policies could increase demand for home loans, driving share price growth.

- Economic Conditions: A strong economy can boost employment and income levels, leading to higher demand for housing finance. Favorable economic conditions can improve Aadhar’s financial performance, positively affecting the share price.

- Company’s Loan Portfolio Quality: The quality of the loans provided by Aadhar is crucial. If the company maintains a healthy loan portfolio with low default rates, it enhances investor confidence and supports share price growth.

- Expansion of Branch Network: Expanding its branch network and customer outreach can increase loan disbursements. Growth in the company’s presence across different regions can drive revenue and share price upward.

-

Competition in the Market: The housing finance sector is competitive, with several players offering similar products. How well Aadhar Housing Finance competes in terms of interest rates, services, and customer experience can influence its market position and share price growth.

Read Also:-

- Bajaj Hindusthan Sugar Share Price Target

- Nestle India Share Price Target

- Axita Cotton Share Price Target

- Gujarat Gas Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.