Jindal SAW Ltd. Is a first-rate participant in the manufacturing and delivery of iron and metallic pipes in India. The organization operates in the power, water, and infrastructure sectors, providing essential products together with big-diameter pipes and seamless tubes. Over the years, Jindal SAW has maintained a strong marketplace position due to its varied product portfolio and strategic expansions into worldwide markets.

Current Overview Of Jindal Saw Share Price

- Open: ₹372.00

- High: ₹383.85

- Low: ₹366.30

- Market Capitalization: ₹23.46K Cr

- P/E Ratio: 6.36

- Dividend Yield: 1.08%

- 52-Week High: ₹383.85

- 52-Week Low: ₹164.28

- Current Price: ₹331.50

Jindal Saw Share Price Current Graph

Stockholding Patterns For Jindal Saw Share Price

- Promoters: 63.28%

- Retail and Others: 17.78%

- Foreign Institutions (FII/FPI): 15.06%

- Mutual Funds: 3.14%

- Other Domestic Institutions: 0.74%

Jindal Saw Share Price Targets 2024 To 2030

| YEAR | SHARE PRICE TARGET |

| 2024 | 585 |

| 2025 | 798 |

| 2026 | 1023 |

| 2027 | 1243 |

| 2028 | 1456 |

| 2029 | 1664 |

| 2030 | 1887 |

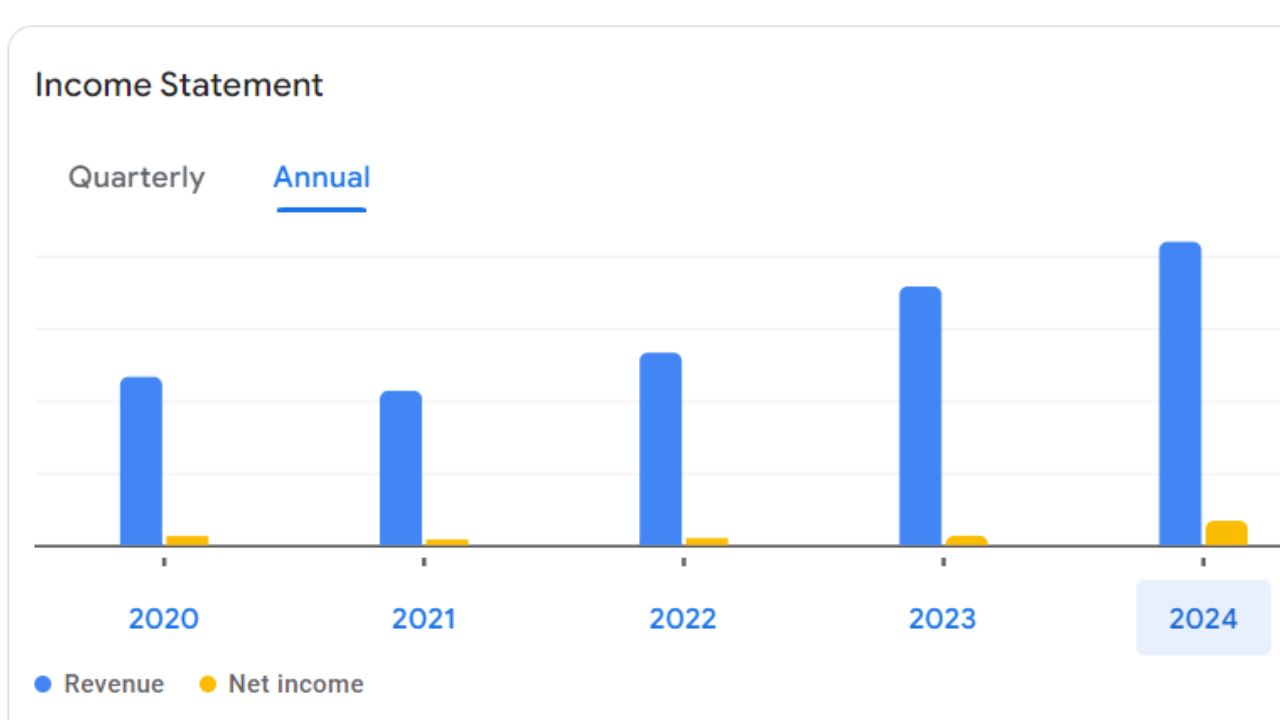

Jindal Saw Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 136.18 B | +8.18 % |

| Operating Expenses | 47.25 B | -9.90 % |

| Net Income | 13.40 B | -20.56 % |

| Net Profit Margin | 9.84 | -26.57 % |

| Earning Per Share | 14.46 | -13.88 % |

| EBITDA | 28.62 B | +6.12 % |

| Effective Tax Rate | 28.03 % | N/A |

Risks And Challenges For Jindal Saw Share Price

While Jindal SAW is poised for growth, investors have to be aware of capability dangers:

1. Raw Material Costs

Fluctuations inside the charges of key raw materials, together with iron ore and metal, can also affect the agency’s earnings margins. While Jindal SAW has controlled charge pressures successfully in the past, those dangers stay customary inside the company.

2. Regulatory and Environmental Challenges

The metallic corporation is challenged by stringent environmental rules, and non-compliance must result in penalties or operational delays. The enterprise will want to put money into purifier generation to live compliant.

3. Global Economic Conditions

The global name for metallic is cautiously tied to financial conditions. Any slowdown in monetary growth or a worldwide recession needs to hose down calls for Jindal SAW’s products.

4. Competition

Jindal SAW faces stiff opposition locally and internationally. The enterprise needs to maintain its competitive aspect to live earlier in the marketplace.