Jyoti Structures Limited is an Indian company that specializes in providing engineering, procurement, and construction (EPC) services for power transmission and distribution projects. Founded in 1974, the company plays a key role in building infrastructure for high-voltage power transmission lines, substations, and distribution networks. Jyoti Structures operates both in India and internationally, delivering projects across Asia, Africa, and the Middle East. Jyoti Structures Share Price on NSE as of 10 October 2024 is 33.60 INR.

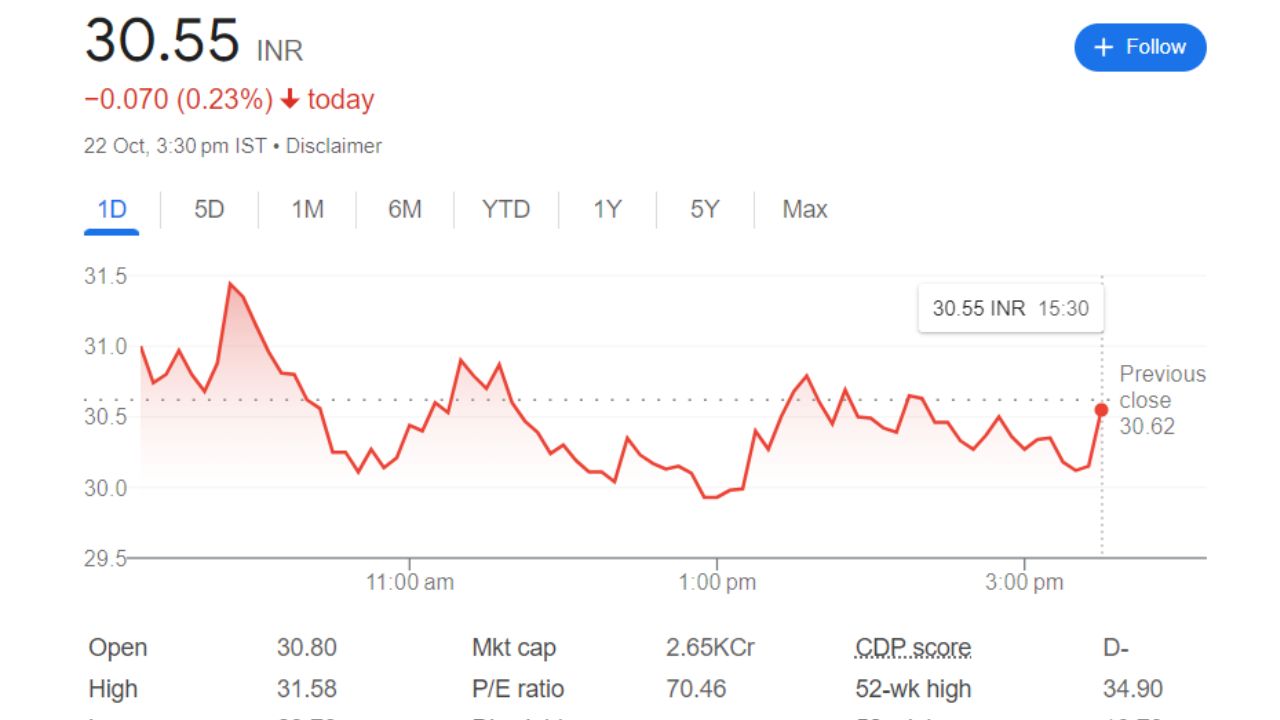

Jyoti Structures Limited: Market Overview

- Open Price: 32.70

- High Price: 34.90

- Low Price: 30.80

- Current Share Price: 30.55

- Previous Close: 32.07

- Volume: 52,333,038

- Value (Lacs): 17,615.30

- VWAP: 32.97

- UC Limit: 35.27

- LC Limit: 28.86

- P/E ratio: 77.49

- Div yield: N/A

- 52-wk high: 34.90

- 52-wk low: 10.70

- Mkt cap: 2.94KCr

- Face Value: 2

Jyoti Structure Share Price Current Graph

Jyoti Structures Limited Competitors

Here are five competitors of Jyoti Structures Limited with their approximate market capital:

- KEC International Ltd

Market Capital: ₹17,000 Crores - Kalpataru Power Transmission Ltd

Market Capital: ₹18,500 Crores - Sterlite Power Transmission Ltd

Market Capital: ₹4,500 Crores - Techno Electric & Engineering Co Ltd

Market Capital: ₹4,300 Crores - Skipper Ltd

Market Capital: ₹1,800 Crores

Jyoti Share Price Targets 2024 To 2030

| YEAR | SHARE PRICE TARGET |

| 2024 | 37 |

| 2025 | 52 |

| 2026 | 60 |

| 2027 | 67 |

| 2028 | 75 |

| 2029 | 82 |

| 2030 | 93 |

Shareholding Pattern For Jyoti Share Price

- Promoters: 0%

- FII: 1.4%

- DII: 1.9%

- Public: 96.8%

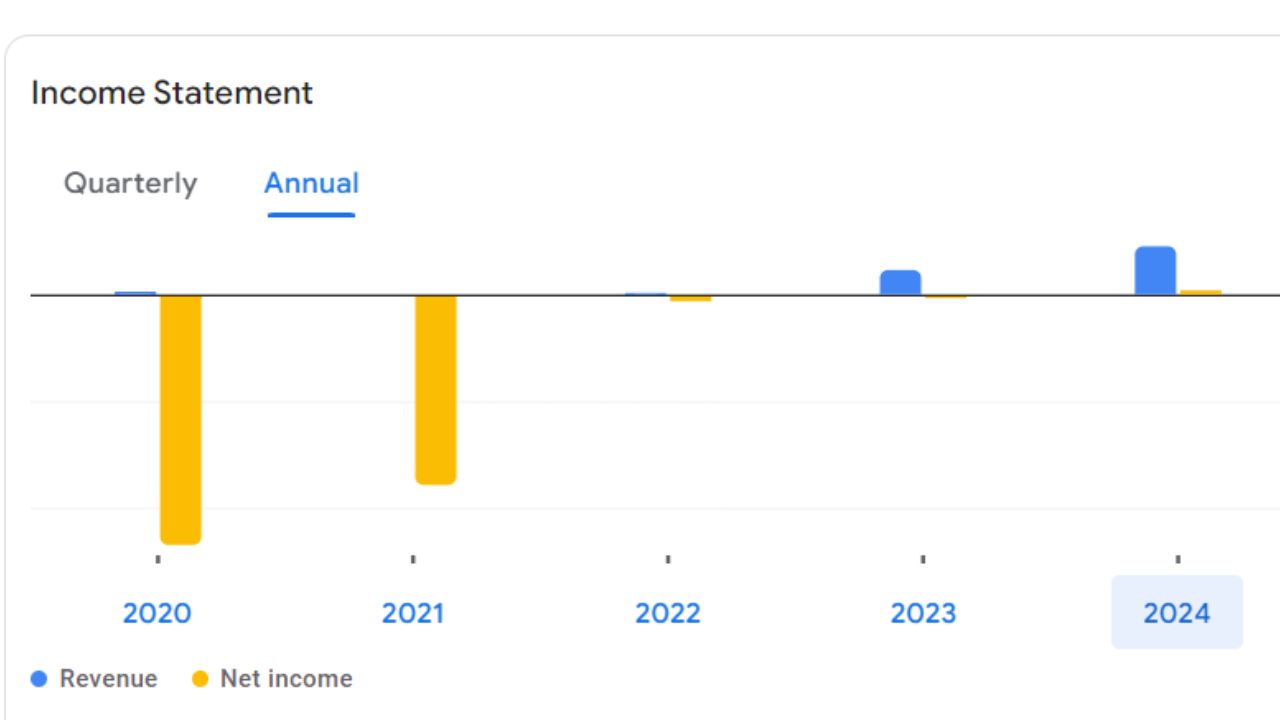

Jyoti Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 882.93 M | -52.32 % |

| Operating Expenses | 245.85 M | +25.00 % |

| Net Income | 50.93 M | +107.20 % |

| Net Profit Margin | 5.77 | +333.83 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 57.92 M | +71.66 % |

| Effective Tax Rate | 1.83 % | N/A |