Investing in shares calls for knowledgeable alternatives based totally on thorough studies and expert evaluation. If you’re considering Tata Chemicals stocks, you are in the proper area. This weblog will offer unique insights into the Tata Chemicals Share Price Target from 2024 to 2030. Our evaluation is based on the organization’s growth, overall performance, and destiny potential, ensuring you’ve got the records you want to make a valid funding selection.

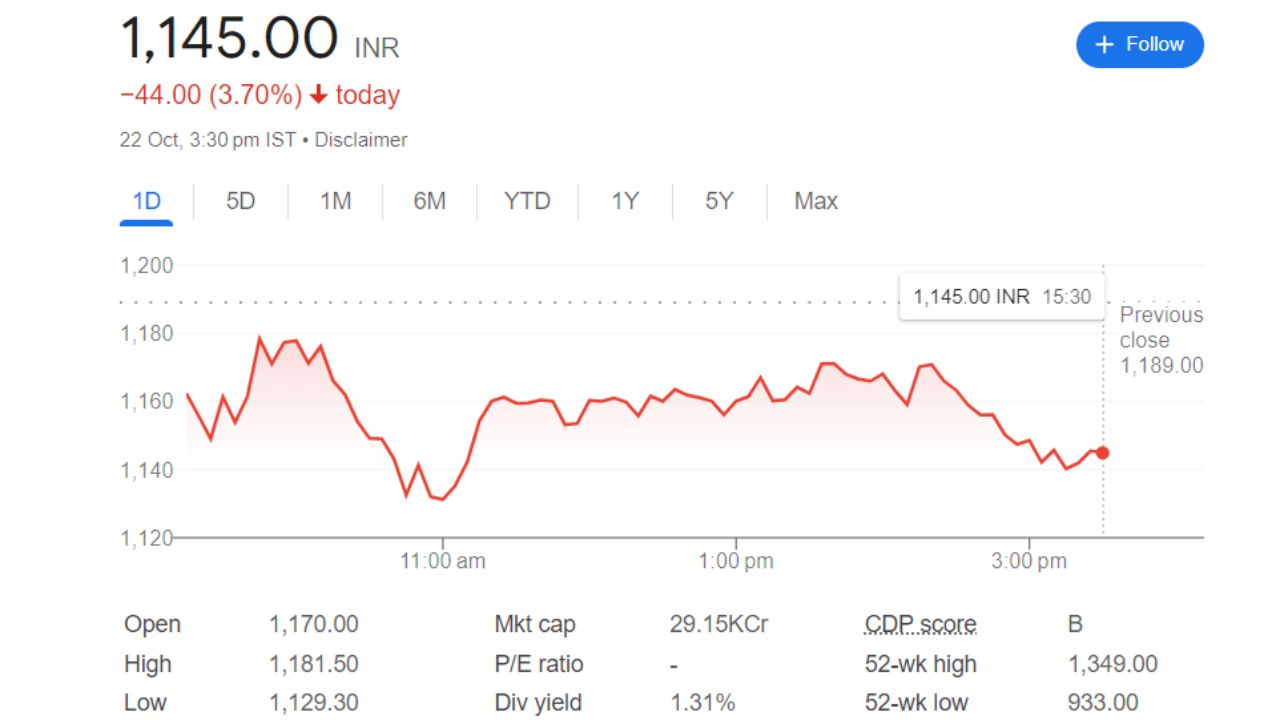

Overview Of Tata Chemical Limited Share Price

- Market Cap: ₹26.94kcr

- Open: ₹1063.70

- High: ₹1065.85

- Low: ₹1056.10

- Current Share Price: 1145.00

- P/E Ratio: 94.77

- Dividend Yield: 1.42%

- 52 Week High: ₹1349.00

- 52 Week Low: ₹933

Tata Chemical Share Price Current Graph

Tata Chemical Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 1320.20 |

| 2025 | 1528 |

| 2026 | 1750 |

| 2027 | 2003 |

| 2028 | 2293 |

| 2029 | 2623 |

| 2030 | 3003 |

Shareholding Pattern For Tata Chemical Share Price

- Retail and Other: 28.08 %

- Other Domestic Institutions:12.03 %

- Foreign Institution: 13.56

- Promotors:37.98 %

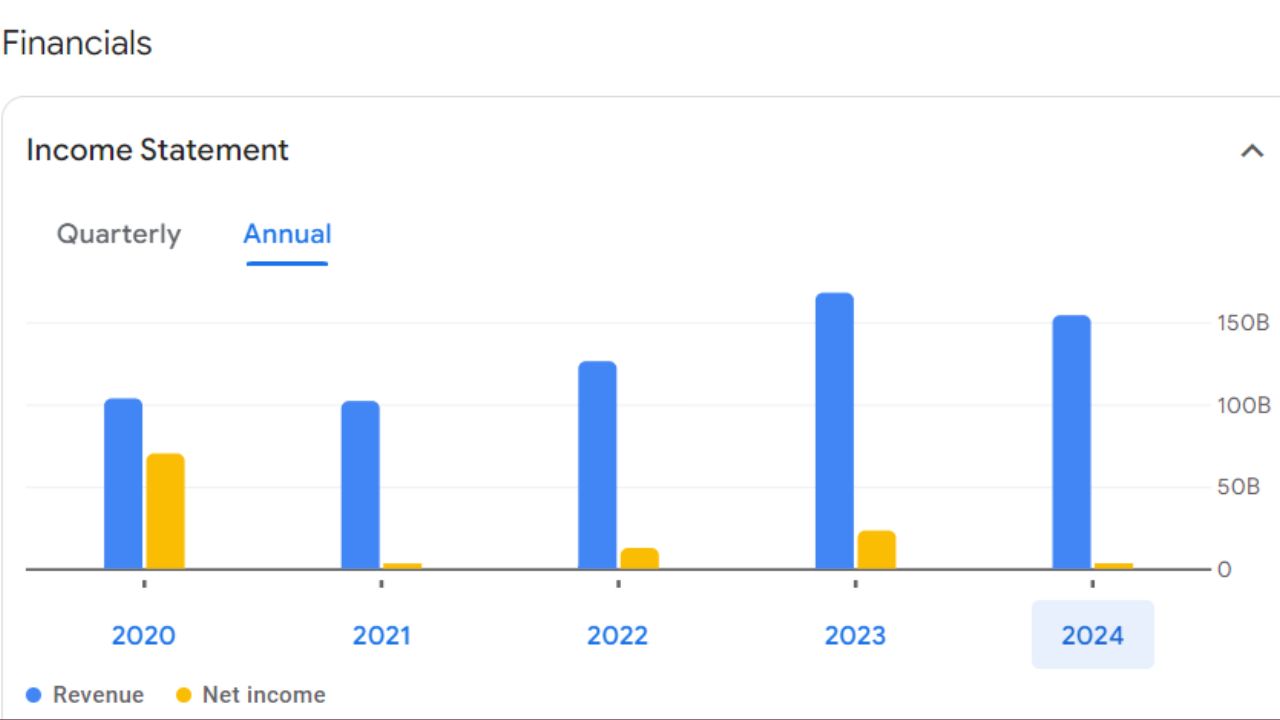

Tata Chemical Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 39.99 B | +0.03 % |

| Operating Expenses | 22.10 B | +13.80 % |

| Net Income | 1.94 B | -54.67 % |

| Net Profit Margin | 4.85 | -54.72 % |

| Earning Per Share | 7.61 | -43.25 % |

| EBITDA | 6.16 B | -43.25 % |

| Effective Tax Rate | 23.28 % | N/A |

Advantages And Disadvantages Of Tata Chemical Share Price

Advantage

- Strong worldwide presence with a numerous patron base.

- Consistent sales increase and profitability.

Disadvantage

- Exposure to international financial volatility.

- Intense opposition in the IT services area.

Factors Contributing To Tata Chemical Share Price Development

- Robust Order Book: ITD Cementation constantly keeps a strong order e-book, securing big-scale tasks at some stage. This not simplest guarantees sales visibility but moreover offers not difficult increase trajectory for the corporation.

- Government Initiatives: India’s infrastructure development is at the coronary heart of the government’s economic growth method. Steps such as the National Infrastructure Pipeline, Smart Cities Mission, and Gati Shakti plan are anticipated to enhance calls for infrastructure organizations like ITD Cementation.

- Diversification: The employer’s projects span multiple sectors, including marine, highways, roads, airports, and metros. This diversification reduces risk and complements opportunities for regular revenue technology across the one-of-a-type economic cycle.