Pfizer India, a subsidiary of the worldwide pharmaceutical giant Pfizer Inc., has made itself a key player in the Indian pharmaceutical marketplace. With a wealthy legacy of imparting modern-day healthcare answers, Pfizer India has experienced superb increases over time, making it a very famous preference for every prolonged-term and brief-time period trader.

In this article, we offer an in-depth analysis of Pfizer India’s Share Price targets from 2024 to 2030, including insights into its present-day market’s usual normal overall performance, destiny boom chances, and elements affecting its inventory performance.

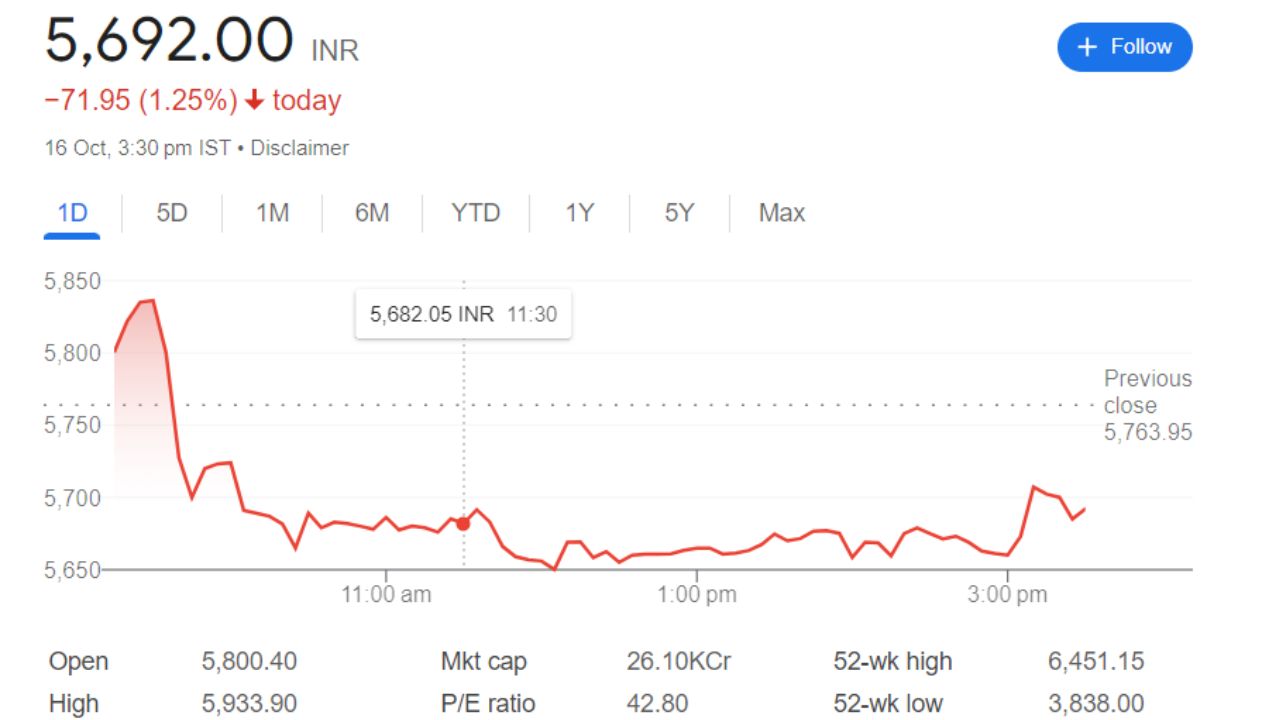

Pfizer Share Price Current Market Overview

As of the present day to be had statistics, Pfizer India Share Price is priced at ₹5,614.05, reflecting a top-notch 43.34% benefit over the past year. Here’s a breakdown of the vital components of financial statistics:

- Current Price: ₹5,692.00

- Change: +1,697.45

- Open: ₹5,570.00

- High: ₹5,766.00

- Low: ₹5,560.00

- Market Capitalization: ₹25,680 Cr

- P/E Ratio: 42.21 compared to income)

- Dividend Yield: 0.60%

- 52-Week High: ₹6,451.15

- 52-Week Low: ₹3,838.00

Pfizer India Share Price Current Graph

Pfizer Share Price Target Tomorrow From 2024 To 2030

This analysis for upcoming years is based on market valuation, industrial trends, and expert analysis.

| S. No. | Share Price Target Years | Share Target Value |

|

|

2024 | 6700 |

|

|

2025 | 7200 |

|

|

2026 | 8347 |

|

|

2027 | 9552 |

|

|

2028 | 10931 |

|

|

2029 | 12509 |

|

|

2030 | 14316 |

Shareholding Pattern For Pfizer India Share Price

- Promoters: 63.90%

- Foreign Institutions: 3.22 %

- Domestic Institutions: 7.52 %

- Mutual Funds: 8.32%

- Retail and Other: 17.06 %

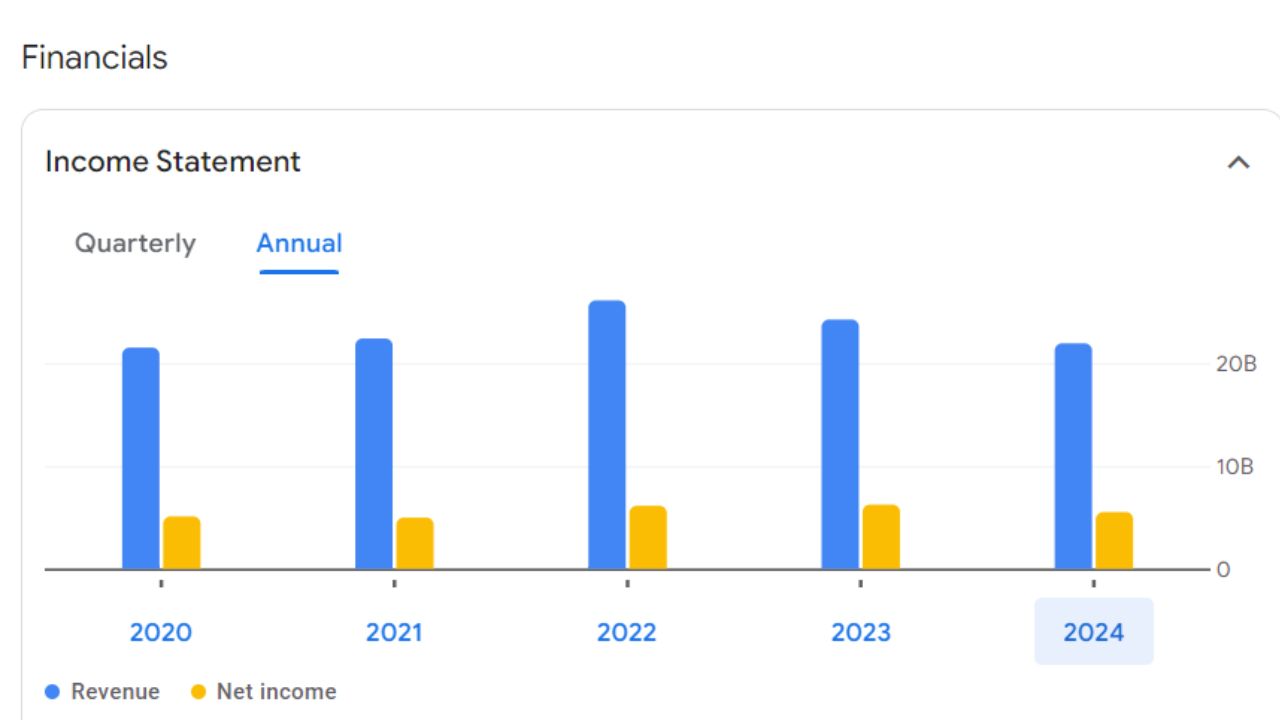

Pfizer India Share For Annual Income Statement

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 5.63 M | +5.93 % |

| Operating Expenses | 1.99 B | + -9.54 % |

| Net Income | 1.51 B | +61.14 % |

| Net Profit Margin | 26.78 | 52.16 % |

| Earning Per Share | 32.94 | N/A |

| EBITDA | 1.78 B | +59.88 % |

| Effective Tax Rate | 26.62 % | N/A |

Challenges For PFIZER India Share Price

- Regulatory Risks: Political risks This is a risk that emanates from shifting government policies and regulations that might affect the firm’s revenues and operations.

- Interest Rate Fluctuations: High inflation leads to increased interest rates, and this makes the cost of borrowing high, which causes the profitability margin to shrink.

- Operational Risks: Any disruptions or indicators of a decline in the execution of the project will have a potential impact on revenues.

- Market Competition: Rising competitive industry pressures might ensue, as well as lower margins in the power transmission space.