Mishtann Foods Limited, a major Indian enterprise in the food processing quarter, is generally regarded for its top-class excellent basmati rice and different agricultural products. Over the years, Mishtann has expanded its product variety, which now consists of pulses, wheat, salt, and several spices. The agency has garnered interest from investors due to its consistent growth and marketplace ability in a rural area wherein the call for food staples continues to boom.

Current Financial Metrics For Mishtann Foods Share Price

Before delving into the future proportion charge goals, permit’s first take a look at the current financial photograph of Mishtann Foods:

- Market Capital: 1.56K crore

- Open: 14.50

- High: 14.56

- Low: 14.12

- Current Share Price: 14.45

- P / E Ratio: 4.33

- Dividend Yield: 0.0069 %

- 52 Week High: 25.36

- 52 Week Low: 11.93

Mishtann Foods Share Price Current Graph

Mishtann Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 25 |

| 2025 | 56 |

| 2026 | 78 |

| 2027 | 90 |

| 2028 | 112 |

| 2029 | 233 |

| 2030 | 335 |

Shareholding Pattern For Mishtann Share Price

- Retail and Other: 50.34 %

- Promotors: 46.87 %

- Foreign Institution: 2.79%

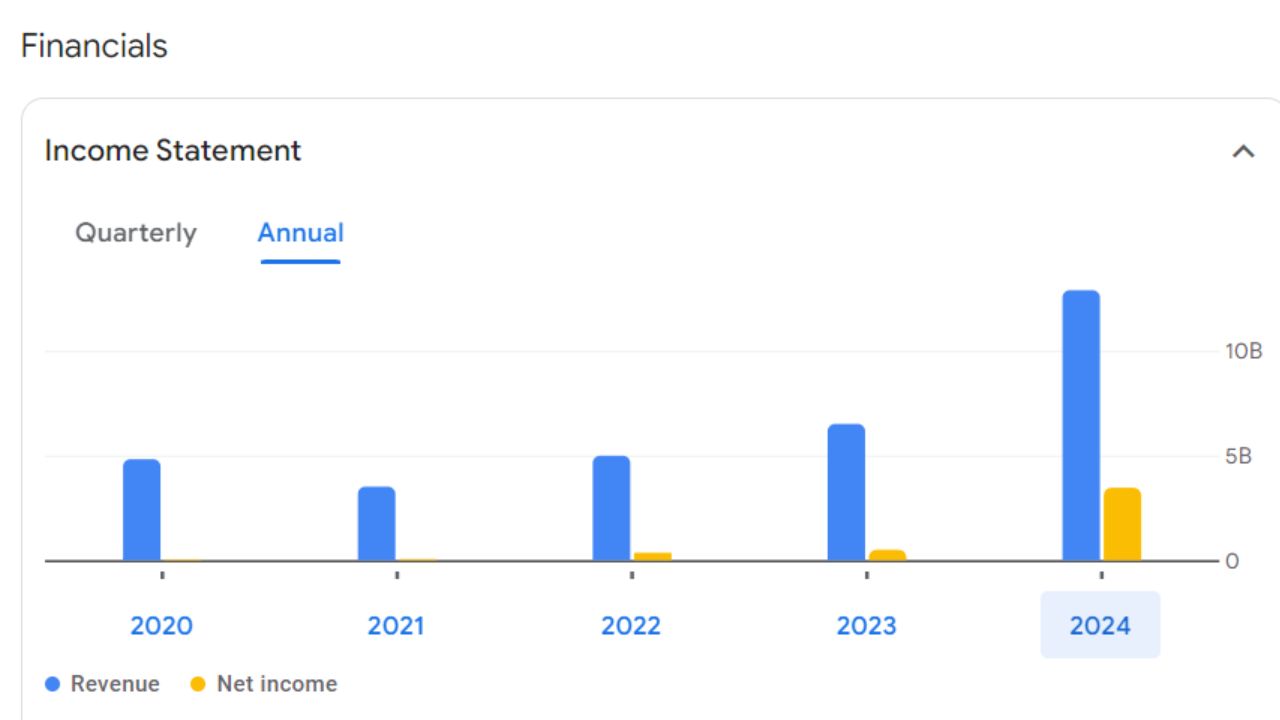

Mishtann Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 3.83 B | +30.18 % |

| Operating Expenses | 458.27 M | +16.36 % |

| Net Income | 713.03 M | +3.47 % |

| Net Profit Margin | 18.63 | -20.52 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 727.01 M | -0.11 % |

| Effective Tax Rate | 0.94 % | N/A |

Pros

- The company has reduced debt.

- The company is almost debt-free.

- The company’s median sales growth is 98.1% for the last 10 years

Cons

- Promoter holding has decreased over the last quarter: -1.51%

- The tax rate seems low

- The company has high debtors of 168 days.