Delta Corp Limited, India’s major participant in the gaming and hospitality sectors, has established a dominant presence inside the online casino and online gaming markets. As the company operates and leverages new possibilities in the evolving gaming corporation, customers were eager to sign its monetary normal ordinary overall performance and future capability.

This article delves into Delta Corp’s Share Price trajectory, projecting fee goals from 2024 to 2030.

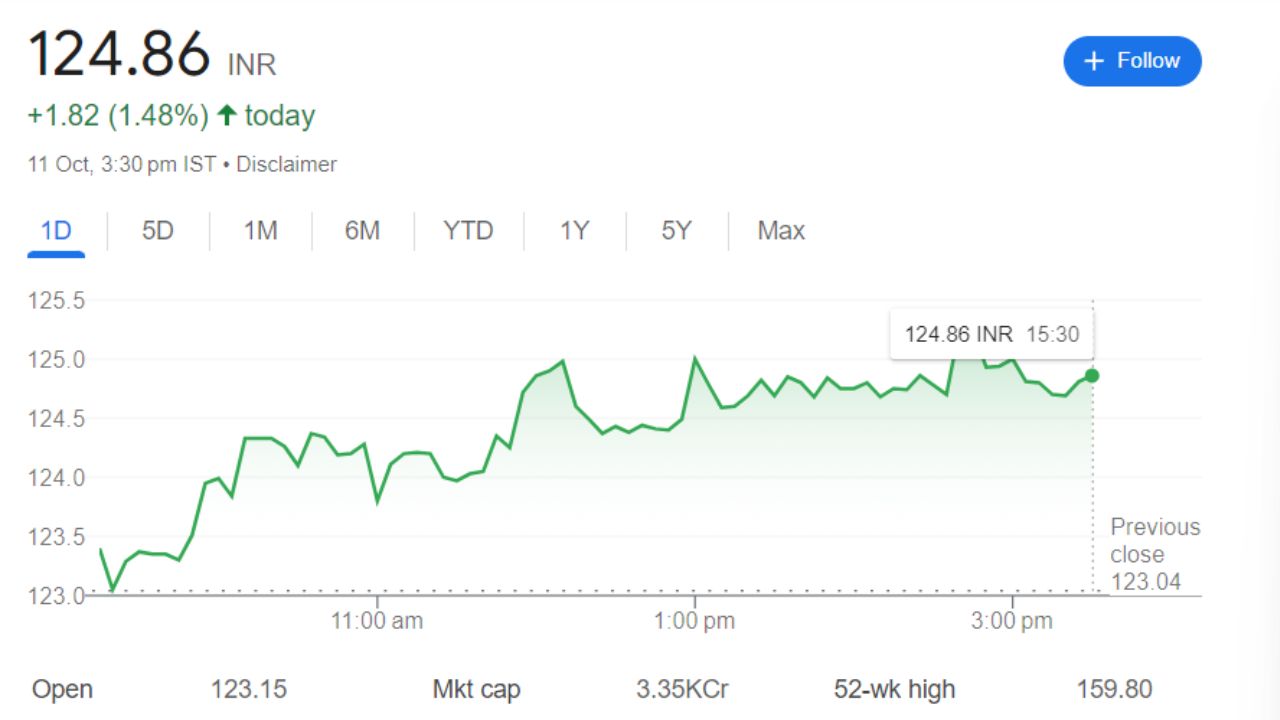

Delta Corp Share Price Key Financial Metrics

Understanding Delta Corp’s present-day financial ordinary overall performance is critical for predicting destiny inventory rate moves. Here are the important detailed economics metrics that provide belief into the organization’s fee

- Market Capital: 3.50 k cr

- Open: 128.48

- High: 126.33

- Low: 130.00

- Current Share Price: 124.86

- P / E Ratio: 17.66

- Dividend Yield: .96 %

- 52 Week High: 159.80

- 52 Week Low: 104.45

Delta Corp Share Price Current Graph

Delta Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 190 |

| 2025 | 310 |

| 2026 | 356 |

| 2027 | 407 |

| 2028 | 466 |

| 2029 | 533 |

| 2030 | 612 |

Shareholding Pattern For Delta Corps Share Price

- Retail and Other: 0 %

- Public: 56.59 %

- Foreign Institution: 1.45 %

- Mutual Funds: 8.80 %

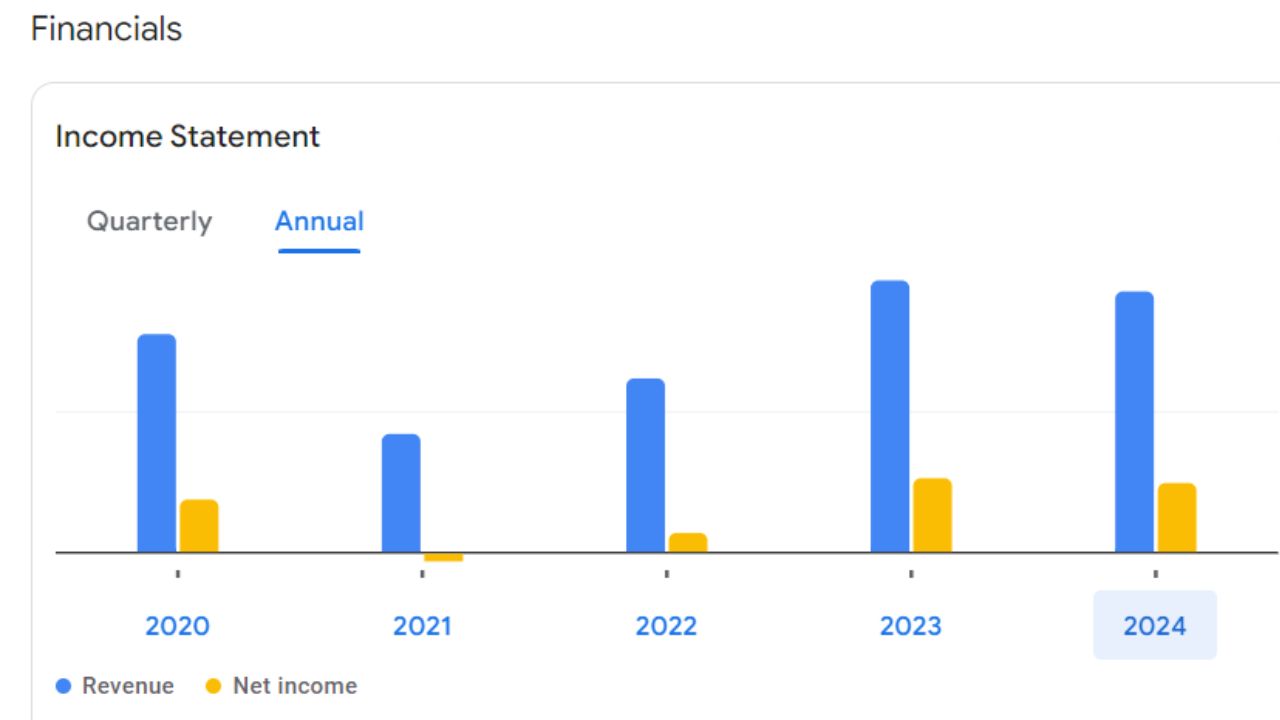

Delta Corps Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 1.81 B | -33.78 % |

| Operating Expenses | 755.40 M | -23.54 % |

| Net Income | 216.80 M | -68.08 % |

| Net Profit Margin | 12 | -51.79 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 328.85 M | -62.98 % |

| Effective Tax Rate | 32.50 % | N/A |

Should I Buy Delta Corps Stocks?

So, we have discussed all the factors by which investment depends on an individual. The company makes a profit every year, but as we have told you, the GST tax is huge, which impacts this company, and that is the reason why the share is going down day by day. So, for now, you should skip this stock.