Easy Trip is one of India’s foremost online adventure groups, offering a massive form of adventure-associated services, along with flight tickets, hotel bookings, excursion programs, bus and rail tickets, and ancillary journey services. Founded in 2008 by the Pitti brothers, Easy Trip has grown considerably in the mainly aggressive Indian Excursion market.

Unlike a variety of its opposition, the enterprise has managed to reap profitability early on with the useful resource of manners that specialize in a lean operational model and minimize advertising and marketing and marketing costs.

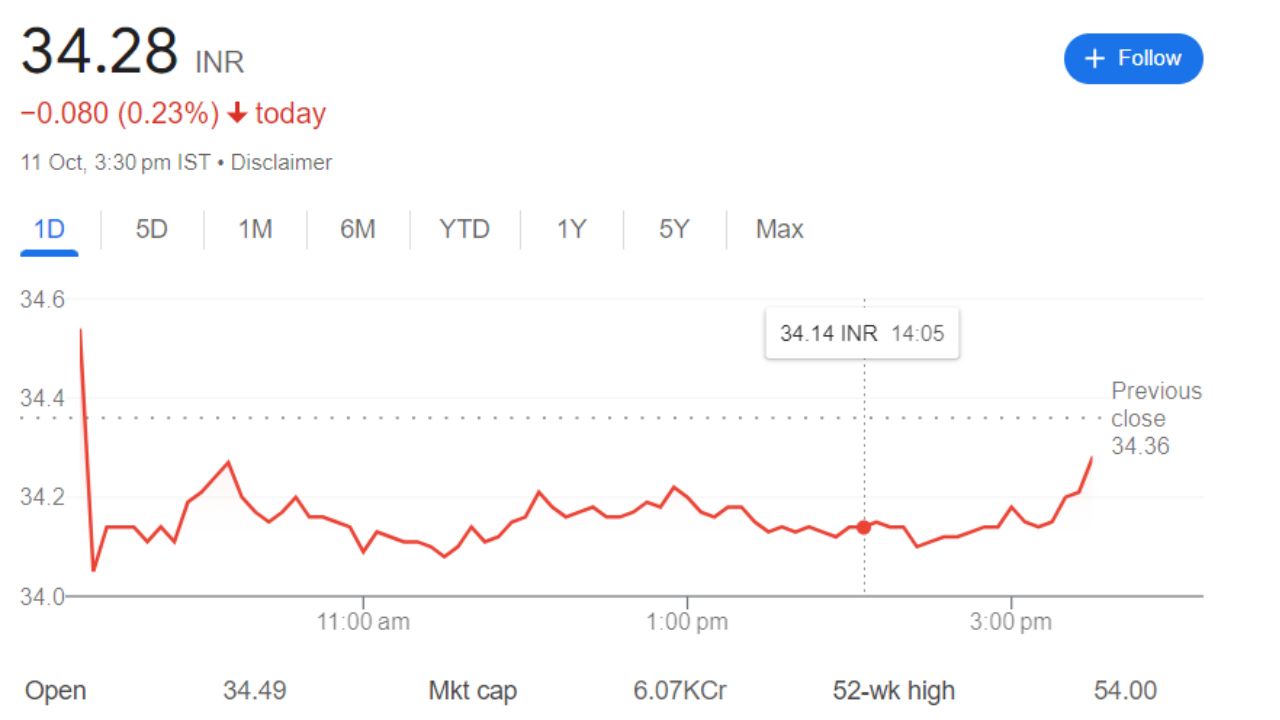

Current Market Position For Easy Trip Share Price

To recognize the destiny capability of EaseMyTrip, it’s miles essential to keep in mind its modern-day marketplace status and key financial metrics:

- Market Capital: 7430 crore

- Open: 43.20

- High: 43.90

- Low: 41.70

- Current Share Price: 34.28

- P / E Ratio: 66.49

- Dividend Yield: 0.24 %

- 52 Week High: 54.00

- 52 Week Low: 37.00

Easy Trip Share Price Current Graph

Easy Trip Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 54 |

| 2025 | 60 |

| 2026 | 69 |

| 2027 | 79 |

| 2028 | 91 |

| 2029 | 103 |

| 2030 | 116 |

Shareholding Pattern For Easy Trip Share Price

- Retail and Other: 64.30 %

- Other Domestic Institutions: 30.54 %

- Foreign Institution: 2.56 %

- Mutual Funds: 0.08 %

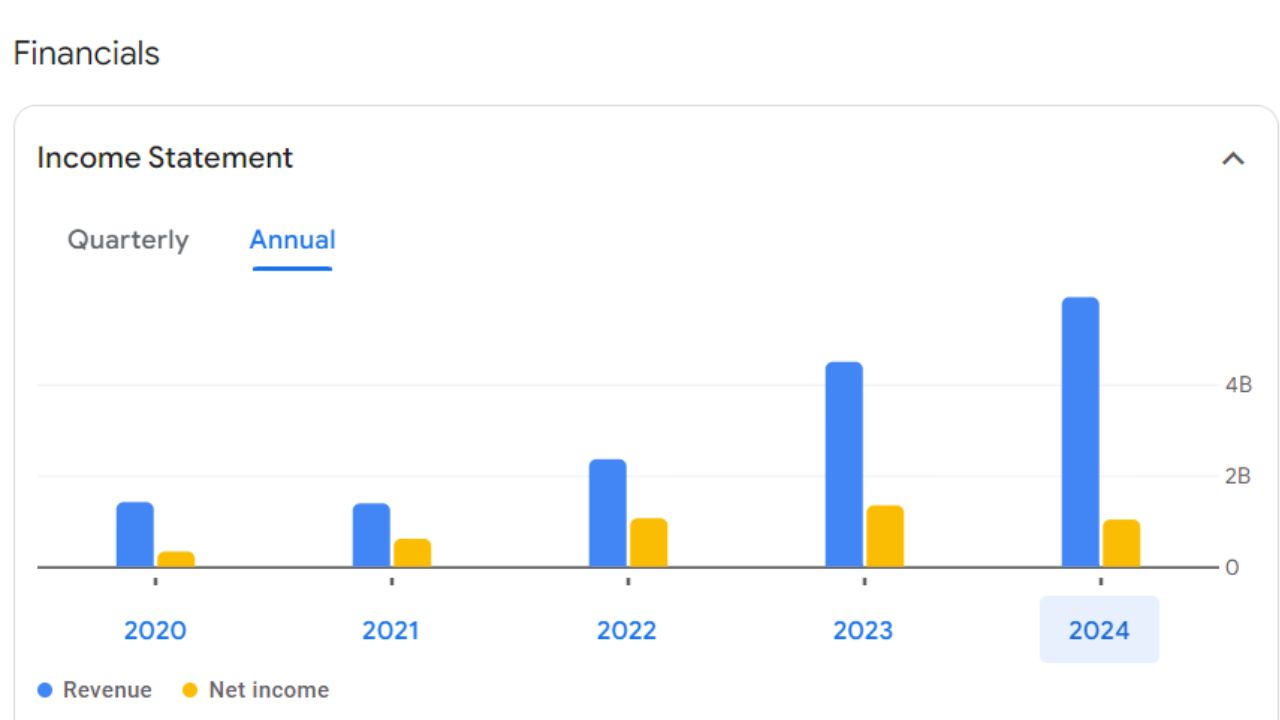

Easy Trip Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 1.53 B | +23.01 % |

| Operating Expenses | 480.42 M | -1.95 % |

| Net Income | 324.84 M | 24.83 % |

| Net Profit Margin | 21.29 | 1.48 % |

| Earning Per Share | N/A | N/A |

| EBITDA | 622.64 M | +23.42 % |

| Effective Tax Rate | 28.09 % | N/A |

Should I Spend Money On Easy Trip Share Price Now?

Considering its strong marketplace characteristics and increased capacity, Easy Trip stocks can be promising funding for the long term. However, investors must keep in mind the ongoing financial losses and competitive panorama.