Investing in shares requires informed options based on thorough studies and expert assessment. If you are considering Maruti Shares, you are in the right place. This blog will offer fantastic insights into the Maruti Share Price target from 2024 to 2030. Our experts have analyzed the data for the next 6 years.

What Is Maruti Suzuki India Limited?

Maruti Suzuki India Limited, typically referred to as Maruti, is considered one of India’s biggest car manufacturers. Established in 1981 as a joint mission among the government of India and Suzuki Motor Corporation of Japan, Maruti has grown to become the market leader in the passenger car segment in India.

Overview Of The Maruti Suzuki Share Price

Maruti Suzuki India Limited operates throughout various segments, serving loads of clients with its huge variety of automobiles, together with hatchbacks, sedans, SUVs and MPVs. The enterprise has a strong distribution network and a huge presence in every city and rural market.

- Market Capital: 3.89 LCR

- Open: 12373

- High: 12525

- Low: 12350

- Current Share Price: 13148.00

- P / E Ratio: 26.48

- Dividend Yield: 1.01 %

- 52 Week High: 13680

- 52 Week Low: 9254

Maruti Suzuki Share Price Current Graph

Maruti Suzuki Share Price Targets 2024 To 2030

| Year | Share Price Target |

| 2024 | 13385 |

| 2025 | 14318 |

| 2026 | 15529 |

| 2027 | 16061 |

| 2028 | 17957 |

| 2029 | 18272 |

| 2030 | 19066 |

Shareholding Pattern For Maruti Suzuki Share Price

- Promotors: 58.19 %

- Foreign Institutional: 18.98 %

- Mutual Funds: 13.26 %

- Other Domestic Institutions: 6.24 %

- Retail and other: 3.33 %

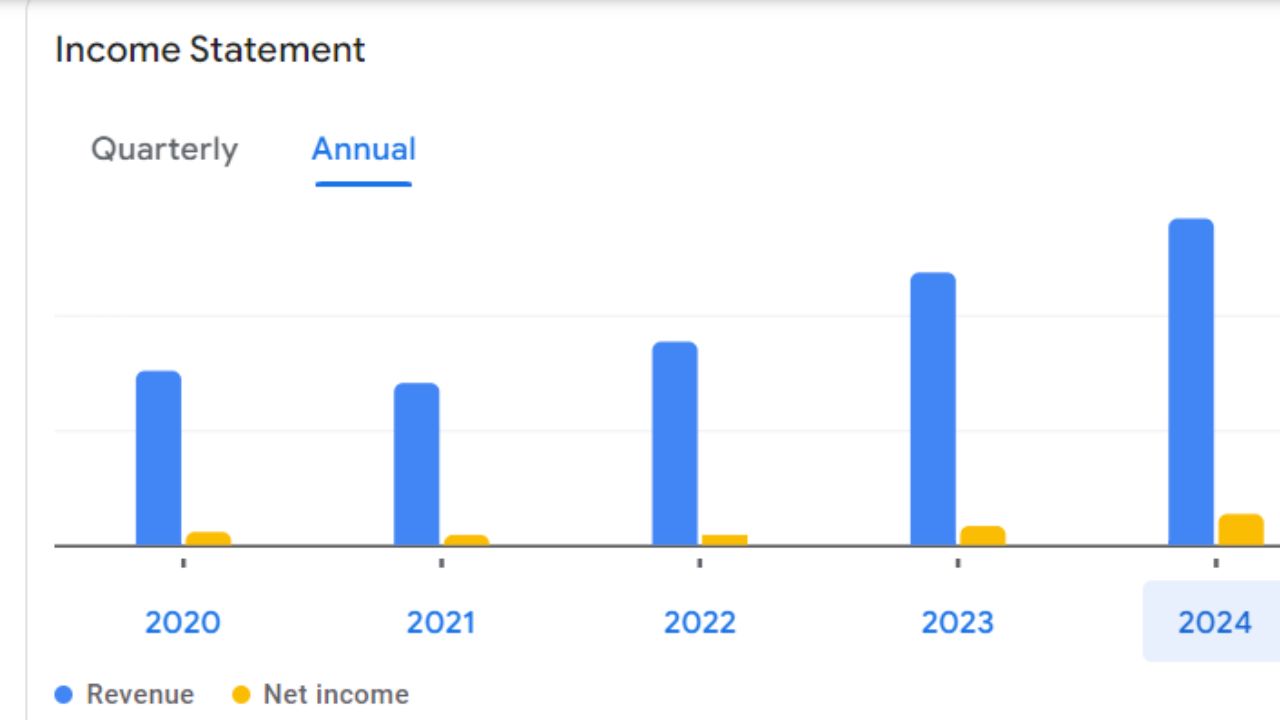

Maruti Suzuki Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 357.79 B | +10.64 % |

| Operating Expenses | 74.12 B | +12.11 % |

| Net Income | 37.60 B | +48.89 % |

| Net Profit Margin | 10.51 | +34.57 % |

| Earning Per Share | 116.09 | +41.11 % |

| EBITDA | 50.89 B | +72.87 % |

| Effective Tax Rate | 22.25 % | N/A |

Factors Influencing Maruti Suzuki Share Price

- Technological Advancements: Broadcom’s reputation for innovation and its potential to increase modern-day semiconductor answers play a splendid role in the usage of its percentage charge.

- Strategic Acquisitions: Broadcom’s strategic acquisition facts have bolstered its product portfolio and market presence, contributing to an increase in sales.

- Market Demand: Demand for semiconductors in prevent markets, which consist of factories, facilities, networking, and wireless conversation, appreciably affects Broadcom’s economics and well-known regular generic general overall performance.

- Global Economics Conditions: Economics health, alongside element factors which incorporate GDP boom, interest expenses, and client spending, need to have an effect on Broadcom’s fashionable not unusual performance.

- Competition: The semiconductor organization is pretty competitive, with several key gamers vying for marketplace per cent. Broadcom’s aggressive positioning and capacity to innovate are vital.