South Indian Bank is one of India’s oldest private bank banks, with a robust presence inside the southern vicinity of the USA. The financial organization has been focusing on growing its footprint, improving its digital abilities, and improving its financial regulator’s universal performance. This complete assignment explores the projected percentage price goals for South Indian Bank from 2024 to 2030.

Overview of South Indian Bank Share Price

Founded in 1929, South Indian Bank has a rich record of serving the Indian banking quarter. It offers a wide range of financial services, including retail banking, employer banking, and treasury operations. The economics organization has a large presence in Kerala, Tamil Nadu, Karnataka, and Andhra Pradesh.

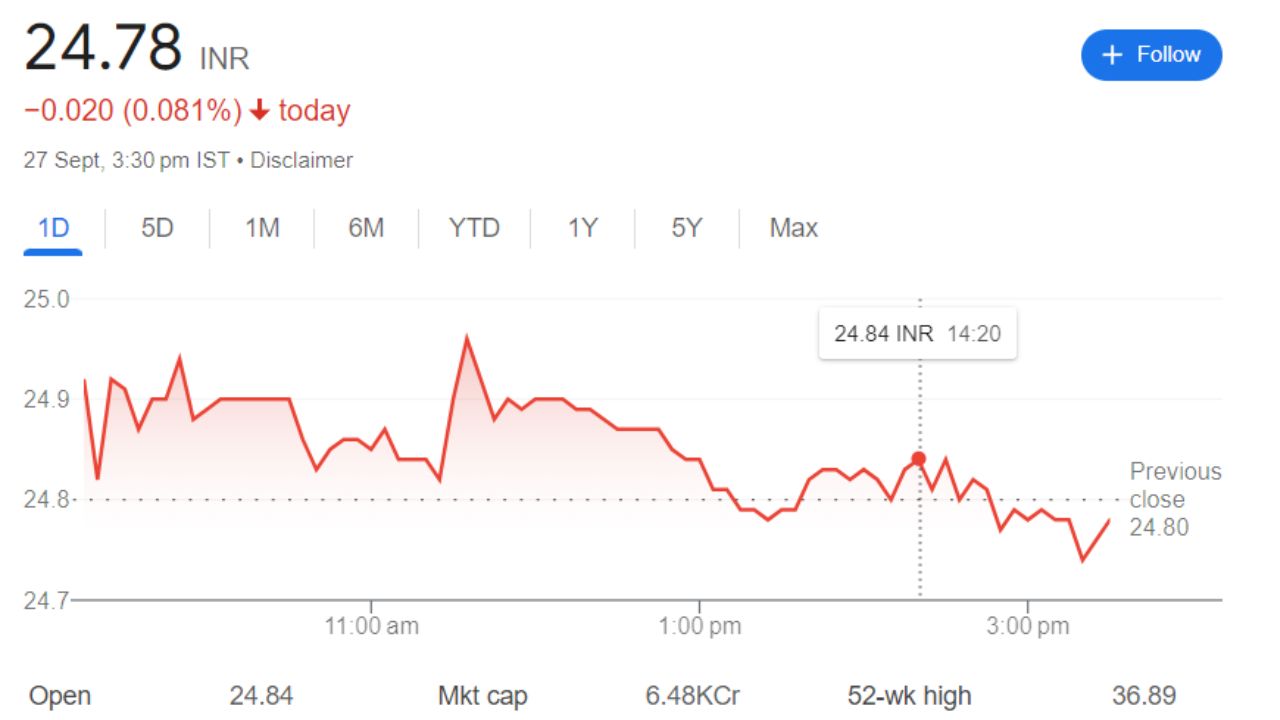

- Market Capital: 6.60 cr

- Open: 24.65

- High: 24.65

- Low: 24.01

- Current Share Price: 24.78

- P / E Ratio: 4.80

- Dividend Yield: 1.24%

- 52 Week High: 36.89

- 52 Week Low: 18.60

South Indian Bank Share Price Current Graph

South Indian Bank Share Price Targets 2024 To 2030

| YEAR | SHARE PRICE TARGET |

| 2024 | 35 |

| 2025 | 45 |

| 2026 | 55 |

| 2027 | 70 |

| 2028 | 100 |

| 2029 | 125 |

| 2030 | 150 |

Shareholding Pattern For South Indian Bank Share Price

- Retail and Other: 81.45 %

- Other Domestic Institutions: 2.91 %

- Foreign Institution: 13.44 %

- Mutual Funds: 2.19 %

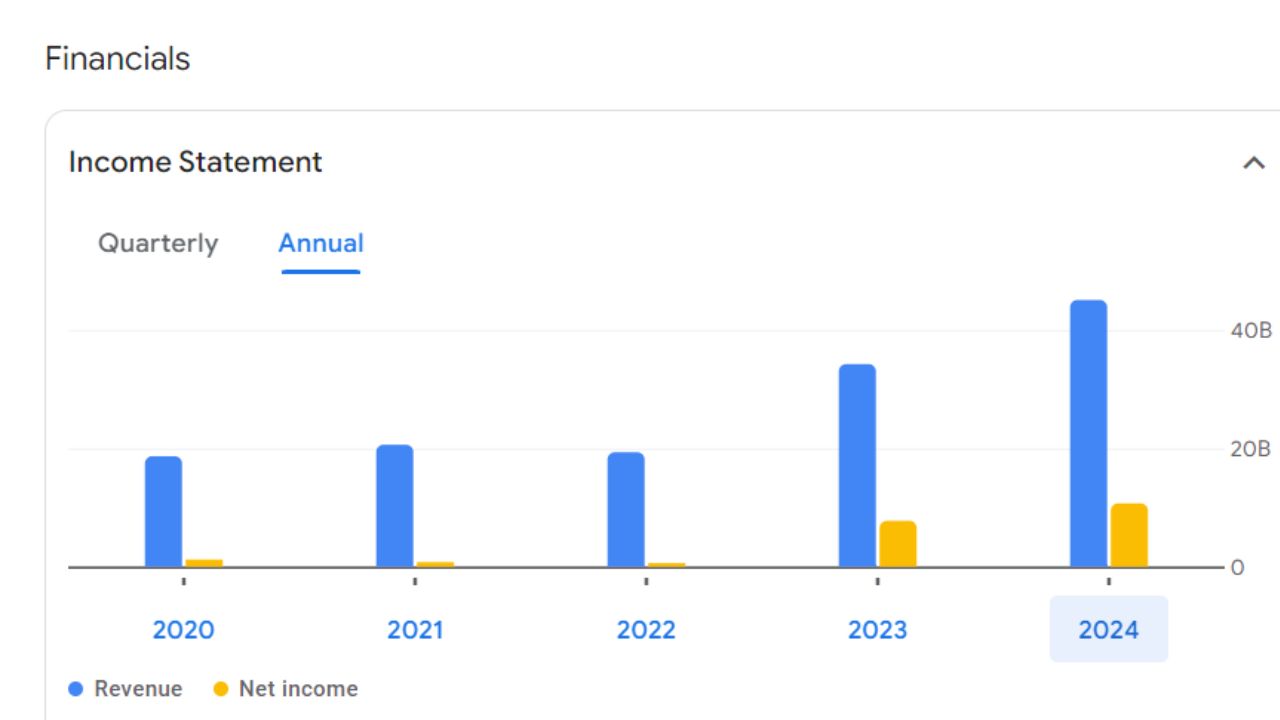

South Indian Bank Share Price For Annual Income Statement

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 11.74 B | +21.03% |

| Operating Expenses | 7.80 B | +14.98% |

| Net Income | 2.94 B | +45.08% |

| Net Profit Margin | 25.03 | +19.88 % |

| Earning Per Share | 1.12 | N/A |

| EBITDA | N/A | N/A |

| Effective Tax Rate | 25.50 % | N/A |

Market Dynamics and Growth Drivers For South Indian Bank Share Price

The Indian banking sector is poised for growth, driven by useful aid of factors which include digital transformation, financial inclusion obligations, and transformation, financial inclusion obligations, and economics restoration publish – covid – 19. SIB, with its huge community and several product portfolios, is properly – located to capitalize on one’s tendencies. The bank’s focus on enhancing assets great, improving digital abilities, and developing its consumer base can be key drivers of its growth in the coming years.