Trident is a progressive, diversified group of sector-leading businesses engaged in creating a buoyant economic climate. Headquartered in Ludhiana, Punjab, the group is focused on growing sustainably with the community and the environment. Leveraging business from an expanding product portfolio, Trident Limited, the flagship company of the groupies, is one of the top 5 global terry towel giants of the world and a global player in home textiles, yarn, chemicals, and paper.

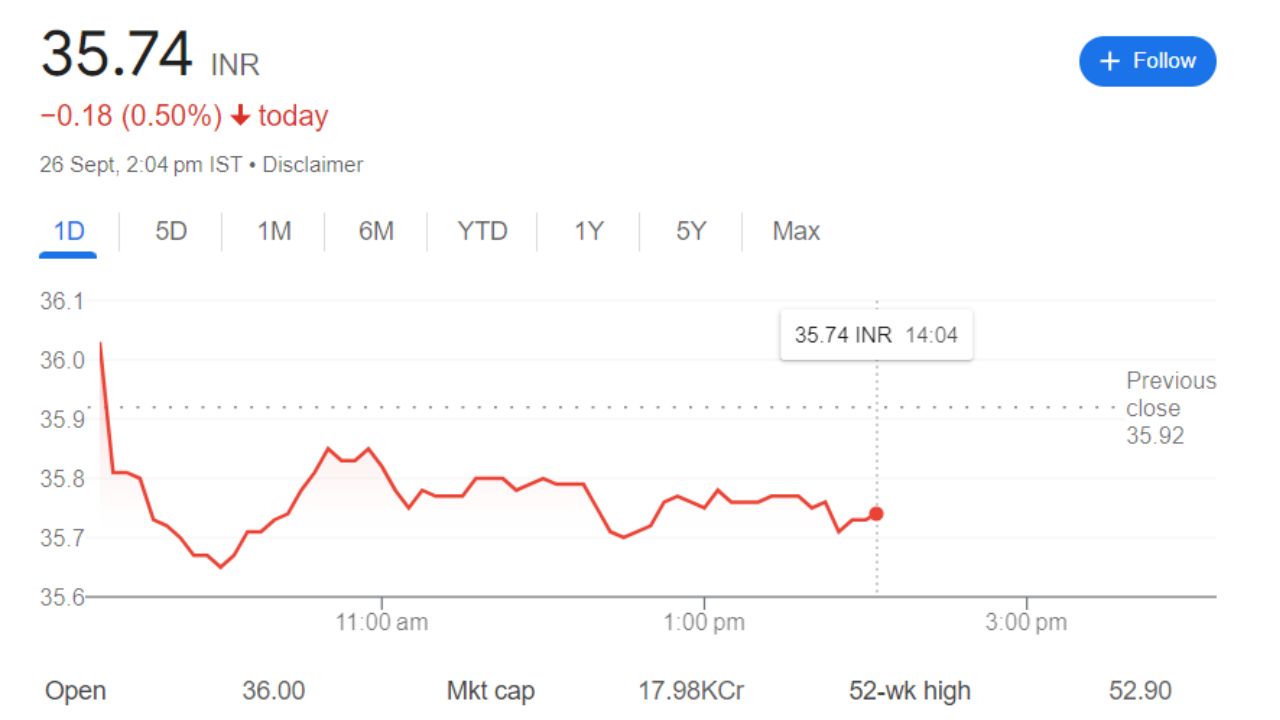

Trident Share Price Current Market Overview

-

- Market Cap: ₹18.61kcr

- Open: ₹37.22

- High: ₹37.30

- Low: ₹36.92

- Current Share Price: 35.74

- P/E Ratio: 55.71

- Dividend Yield: 1.46%

- 52 Week High: ₹52.90

- 52 Week Low: ₹32.90

Trident Share Price Current Graph

Trident Share Price Target Tomorrow From 2025 To 2030

This analysis for upcoming years is based on market valuation, industrial trends, and expert analysis.

| Year | Share Price Target |

| 2025 | ₹56.15 |

| 2026 | ₹70.55 |

| 2027 | ₹88.30 |

| 2028 | ₹94.64 |

| 2029 | ₹107.40 |

| 2030 | ₹118.20 |

Shareholding Pattern For Trident Share Price

- Promoters: 73.19%

- Foreign Institutions: 2.63%

- Domestic Institutions: 0.06%

- Public: 22.87%

- Other: 1.25%

Trident Share Price For Annual Income Statement

For detailed information regarding the annual income statement, refer to the given data.

| Particulars | Info 2024 | Y/Y Change |

| Revenue | 17.43 B | +16.67% |

| Operating Expenses | 7.11 B | +14.18% |

| Net Income | 737.30 M | -31.06% |

| Net Profit Margin | 4.23 | -32.32% |

| Earning Per Share | N/A | N/A |

| EBITDA | 2.14 B | +0.94% |

| Effective Tax Rate | 27.55% | N/A |

Trident Share Price Strategic Initiatives

Current Share Price: ₹35.74, with a slight increase of 0.03% from the previous close.

Strategic Focus

- Operational Efficiency: Initiatives aimed at improving productivity and reducing costs.

- Cost Management: Employee costs represented 12.88% of operating revenues in FY 2024.

Performance Overview

- Three-Year Return: 43.18%, which is lower than the Nifty Midcap 100’s return of 100.87%.

Market Sentiment

- Analysts recommend a “Strong Buy” rating.

- Target prices are projected between ₹38 and ₹40, indicating a positive outlook for the stock.