Good Luck Ltd is an Indian company specializing in manufacturing and supplying various engineering products. Good Luck Share Price on NSE as of 24 September 2024 is 1,181.10 INR. On this page, you will find Good Luck Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Good Luck Share News, Goodluck Defence share price, Good Luck India News, Good luck share price target tomorrow, Good Luck share price target 2030, and more Information.

Good Luck Ltd Company Details

Good Luck Ltd is an Indian company specializing in manufacturing and supplying various engineering products, including steel structures, pipes, tubes, and forgings. Established with a focus on quality and innovation, the company serves infrastructure, automotive, and agriculture industries. Good Luck Ltd has built a strong reputation for delivering reliable products domestically and internationally. Its commitment to excellence and continuous improvement has made it a trusted name in the steel and engineering sectors.

| Official Website | goodluckinternational.com |

| Headquarters | India |

| Number of employees | 2,647 (2024) |

| Subsidiary | Masterji Metalloys Private Limited |

| Category | Share Price |

Good Luck Share Price Today Chart

Current Market Overview Of Good Luck Share Price

- Open Price: ₹1,233.00

- High: ₹1,233.00

- Low: ₹1,176.10

- Market Capitalization: ₹3.87K Crore

- Price to Earnings (P/E) Ratio: 25.03

- Dividend Yield: 0.51%

- 52-Week High: ₹1,330.00

- 52-Week Low: ₹578.50

- Current Price: ₹1,181.10

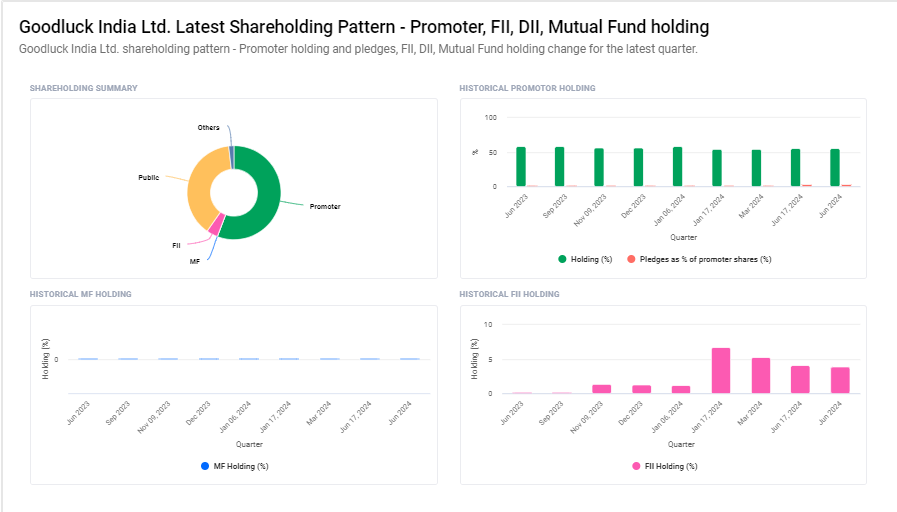

Good Luck Ltd Shareholding Pattern

- Promoters: 55.78%

- Retail and Others: 38.47%

- Foreign Institutions: 3.94%

- Other Domestic Institutions: 1.81%

Read Also:- Spicejet Share Price Target 2024, 2025, To 2030 and More Details

Good Luck Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Good Luck for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Good Luck Share Price Target Years | SHARE PRICE TARGET |

| 1 | Good Luck Share Price Target 2024 | ₹1586 |

| 2 | Good Luck Share Price Target 2025 | ₹1725 |

| 3 | Good Luck Share Price Target 2026 | ₹1972 |

| 4 | Good Luck Share Price Target 2027 | ₹2266 |

| 5 | Good Luck Share Price Target 2028 | ₹2598 |

| 6 | Good Luck Share Price Target 2029 | ₹2965 |

| 7 | Good Luck Share Price Target 2030 | ₹3393 |

Good Luck Share Price Target 2024

The share price target for Good Luck Ltd in 2024 is set at ₹1,586, reflecting a positive outlook for the company’s growth. With its strong presence in the steel and engineering sectors, investors can feel optimistic about its future potential.

Good Luck Share Price Target 2025

The share price target for Good Luck Ltd in 2025 is projected at ₹1,725, indicating strong confidence in the company’s future performance. With its commitment to delivering high-quality products and expanding its presence in key industries, investors can feel assured of steady growth.

Key Factors Affecting Good Luck Share Price Growth

Here are four key factors that can influence the growth of Good Luck Ltd’s share price:

- Demand for Steel Products: As a major supplier of steel pipes, tubes, and structures, rising demand in industries like construction, automotive, and infrastructure can boost Good Luck’s revenues, supporting share price growth.

- Expansion into New Markets: Entering new geographical regions or industries can open up additional revenue opportunities. Successful expansion efforts can lead to stronger growth potential, positively impacting the share price.

- Government Infrastructure Spending: Increased government focus on infrastructure development can benefit Good Luck by creating more opportunities for contracts and projects, driving company growth, and boosting its stock value.

-

Operational Efficiency: Good Luck’s ability to control costs, streamline operations, and maintain high production standards will be crucial. Efficient management can enhance profitability, directly supporting share price growth.

Risks and Challenges to Good Luck Share Price

Here are four risks and challenges that could impact Good Luck Ltd’s share price:

- Volatility in Raw Material Prices: Fluctuations in the cost of raw materials like steel can affect production costs. If prices rise and the company can’t pass these costs to customers, profit margins may shrink, negatively affecting the share price.

- Economic Slowdowns: A downturn in the economy can lead to reduced demand for steel products, particularly in sectors like construction and automotive. Lower demand could impact revenues and hinder share price growth.

- Competitive Pressure: The steel and engineering sectors are highly competitive. Increased competition could lead to price cuts or reduced market share, which could negatively influence the company’s profitability and stock value.

-

Regulatory and Compliance Risks: Changes in government regulations or trade policies, such as tariffs or environmental standards, can increase operational costs or restrict market access, potentially impacting Good Luck Ltd’s financial performance and share price.

Read Also:-

- Sri Adhikari Brothers Share Price Target

- Capacite Share Price Target

- Bharti Airtel Share Price Target

- Tolins Tyres Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.