Capacite Infraprojects Ltd is an Indian construction and infrastructure development company. Capacite Share Price on NSE as of 23 September 2024 is 394.60 INR. On this page, you will find Capacite Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as CAPACITE Infraprojects Ltd share price screener, Capacite Infra News, Capacite share price target tomorrow, Capacite share price target 2030, and more Information.

Capacite Infraprojects Ltd Company Details

Capacite Infraprojects Ltd is an Indian construction and infrastructure development company that focuses on delivering high-quality projects across various sectors. Established in 2012, the company specializes in building roads, bridges, and other essential infrastructure, playing a crucial role in India’s growth and development. With a strong emphasis on innovation and sustainability, Capacite Infraprojects aims to provide efficient solutions that meet the needs of its clients while contributing to the nation’s infrastructure. The company is known for its commitment to quality and safety, making it a trusted partner in the construction industry.

| Official Website | capacite.in |

| CEO | Saroj Pati (Oct 2017–) |

| Headquarters | India |

| Number of employees | 912 (2024) |

| Category | Share Price |

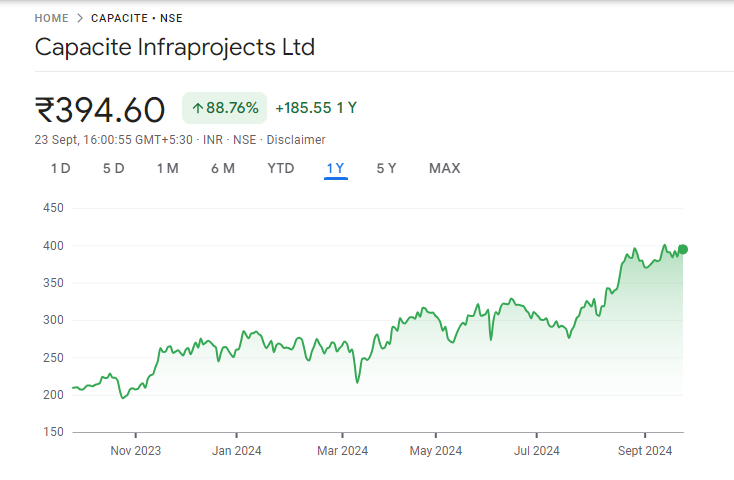

Capacite Share Price Today Chart

Current Market Overview Of Capacite Share Price

- Open Price: ₹402.60

- High Price: ₹407.90

- Low Price: ₹392.10

- Market Capitalization: ₹3.34K Crore

- P/E Ratio: 19.92

- Dividend Yield: Not available

- 52-week High: ₹411.80

- 52-week Low: ₹187.30

- Current Price: ₹394.60

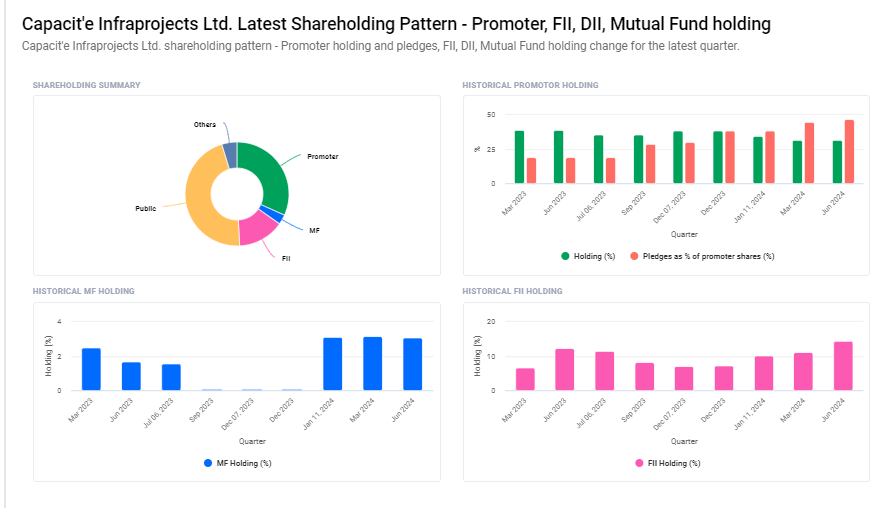

Capacite Infraprojects Ltd Shareholding Pattern

- Retail and Others: 46.11%

- Promoters: 31.69%

- Foreign Institutions: 14.43%

- Other Domestic Institutions: 4.69%

- Mutual Funds: 3.07%

Read Also:- GE T&D Share Price Target 2024, 2025, 2026 To 2030 Prediction

Capacite Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Capacite for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Capacite Share Price Target Years | SHARE PRICE TARGET |

| 1 | Capacite Share Price Target 2024 | ₹560 |

| 2 | Capacite Share Price Target 2025 | ₹637 |

| 3 | Capacite Share Price Target 2026 | ₹742 |

| 4 | Capacite Share Price Target 2027 | ₹825 |

| 5 | Capacite Share Price Target 2028 | ₹954 |

| 6 | Capacite Share Price Target 2029 | ₹1085 |

| 7 | Capacite Share Price Target 2030 | ₹1242 |

Key Factors Affecting Capacite Share Price Growth

Here are five key factors that can influence the growth of Capacite Infraprojects’ share price:

- Strong Order Book: A robust order book filled with large, high-value projects can drive consistent revenue growth. Securing more contracts, especially from government or high-profile clients, can boost investor confidence and positively impact the share price.

- Operational Efficiency: Capacite’s ability to complete projects on time and within budget is crucial. Efficient project execution without delays or cost overruns enhances profitability, which can lead to share price growth.

- Expansion into New Markets: Expanding into new geographic regions or sectors within the construction industry can open up additional revenue streams. Successful expansion efforts can drive growth and positively influence the share price.

- Government Infrastructure Initiatives: Increased government focus on infrastructure development, such as new policies or funding programs, can provide more opportunities for companies like Capacite. Benefiting from these initiatives can lead to higher revenues and share price growth.

-

Strategic Partnerships: Forming alliances or partnerships with other companies can help Capacite secure larger projects and access new technologies or resources. Strong partnerships can enhance the company’s competitive position and support share price growth.

Risks and Challenges to Capacite Share Price

Here are five risks and challenges that could impact Capacite Infraprojects’ share price:

- Project Delays: Delays in completing projects can lead to increased costs, reduced profitability, and potential penalties. Such setbacks can harm the company’s reputation and negatively impact its share price.

- Economic Downturn: A slowdown in the economy can reduce the number of new infrastructure projects, leading to lower revenues for Capacite. Economic challenges can also affect the company’s ability to secure funding, putting pressure on its share price.

- Rising Raw Material Costs: Increases in the prices of construction materials like cement, steel, and labor can erode profit margins. If Capacite cannot pass these costs onto clients, it may face reduced profitability, which could negatively affect its share price.

- Competitive Pressure: The construction industry is highly competitive, with many companies vying for the same contracts. Intense competition can lead to lower bid prices and tighter margins, which may challenge the company’s profitability and share price.

-

Regulatory and Compliance Risks: Changes in government regulations, environmental laws, or compliance requirements can increase operational costs or delay projects. These regulatory risks can impact the company’s financial performance and share price stability.

Read Also:-

- Bharti Airtel Share Price Target

- Tolins Tyres Share Price Target

- Spicejet Share Price Target

- Torrent Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.