GE T&D India Ltd is a leading company in the power transmission and distribution sector in India. GE T&D India Share Price on NSE as of 20 September 2024 is 1,585.00 INR. On this page, you will find GE T&D India Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as GE T&D India Ltd share price screener, GE T&D India Ltd products, GE T&D India Ltd Latest News, GE T&D India Ltd share price target tomorrow, Ge t&d India Ltd share price target 2030, and more Information.

Ge T&D India Ltd Company Details

GE T&D India Ltd is a leading company in the power transmission and distribution sector in India. The company specializes in providing advanced technology solutions for power grids, including the design, engineering, and manufacturing of equipment. With a strong presence in the Indian market, GE T&D India plays a crucial role in supporting the country’s energy infrastructure, helping to ensure reliable and efficient power supply across various regions.

| Official Website | ge.com |

| CEO | Pitamber Shivnani (1 Jul 2020–) |

| Founded | 1957 |

| Headquarters | Henderson, Nevada, United States |

| Number of employees | 1,697 (2024) |

| Parent organization | Grid Equipments Private Limited |

| Category | Share Price |

GE T&D India Share Price Today Chart

Current Market Overview Of GE T&D India Share Price

- Open Price: ₹1,526.50

- High Price: ₹1,629.90

- Low Price: ₹1,526.50

- Market Capitalization: ₹40.58K Crore

- P/E Ratio: 141.23

- Dividend Yield: 0.13%

- 52-Week High: ₹1,889.90

- 52-Week Low: ₹349.00

- Current Price: ₹1,585.00

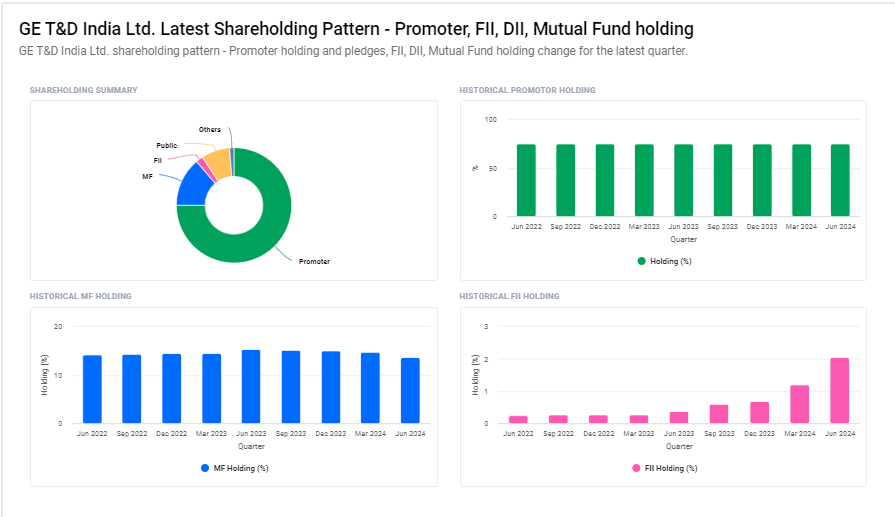

Ge T&D India Ltd Shareholding Pattern

- Promoters: 75.00%

- Mutual Funds: 13.70%

- Retail and Others: 7.99%

- Foreign Institutions: 2.04%

- Other Domestic Institutions: 1.25%

Read Also:- CDSL Share Price Target 2024, 2025 To 2030 and More Details

GE T&D India Share Price Target Tomorrow From 2024 To 2030

Predicting the exact share price target for GE T&D India tomorrow can be challenging due to the influence of various market factors, such as company news, market trends, and broader economic conditions. Investors often consider technical analysis, market sentiment, and recent performance to estimate potential price movements.

| S. No. | GE T&D India Share Price Target Years | SHARE PRICE TARGET |

| 1 | GE T&D India Share Price Target 2024 | ₹1925 |

| 2 | GE T&D India Share Price Target 2025 | ₹3040 |

| 3 | GE T&D India Share Price Target 2026 | ₹4172 |

| 4 | GE T&D India Share Price Target 2027 | ₹5249 |

| 5 | GE T&D India Share Price Target 2028 | ₹6380 |

| 6 | GE T&D India Share Price Target 2029 | ₹7460 |

| 7 | GE T&D India Share Price Target 2030 | ₹8781 |

Key Factors Affecting GE T&D India Ltd Share Price Growth

Here are five key factors that can influence the growth of GE T&D India Ltd’s share price:

- Infrastructure Development: Increased investment in India’s power infrastructure can boost demand for GE T&D India’s products and services. Government projects aimed at upgrading the power grid can positively impact the company’s revenue and share price.

- Adoption of Advanced Technology: GE T&D India’s focus on providing cutting-edge technology for power transmission and distribution can give it a competitive edge. Continued innovation and successful implementation of new technologies can attract investors and support share price growth.

- Economic Conditions: The overall health of the economy influences industrial and commercial power needs. A strong economy can drive higher demand for power transmission solutions, benefiting GE T&D India and potentially leading to a rise in share price.

- Regulatory Policies: Government policies related to the energy sector, including regulations promoting clean energy and smart grids, can create new opportunities for GE T&D India. Favorable policies can encourage growth and positively affect the share price.

-

Global Market Trends: As part of a global company, GE T&D India is influenced by international market trends and trade relations. Positive developments in global markets, such as increased demand for energy solutions in emerging economies, can contribute to share price growth.

Risks and Challenges to GE T&D India Ltd Share Price

Here are five risks and challenges that could impact GE T&D India Ltd’s share price:

- Regulatory Changes: Sudden changes in government policies or regulations, especially those related to the energy sector, could increase compliance costs or limit business operations, potentially impacting the company’s profitability and share price.

- Fluctuations in Raw Material Costs: The cost of raw materials, such as metals used in manufacturing equipment, can be volatile. Rising raw material prices can increase production costs, squeezing margins and possibly leading to a decline in the share price.

- Economic Slowdowns: A slowdown in the economy can reduce investment in infrastructure projects, leading to lower demand for GE T&D India’s products and services. This could negatively affect the company’s revenue and share price.

- Competitive Pressure: The power transmission and distribution sector is highly competitive, with both domestic and international players. If GE T&D India loses market share to competitors, it could impact its growth prospects and share price.

-

Global Economic Conditions: As part of a global company, GE T&D India is exposed to international market risks. Economic downturns, trade tensions, or currency fluctuations in key global markets could negatively affect the company’s financial performance and share price.

Read Also:-

- Orient Green Power Share Price Target

- IndusInd Bank Share Price Target

- Syncom Formulations Share Price Target

- Genus Power Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.