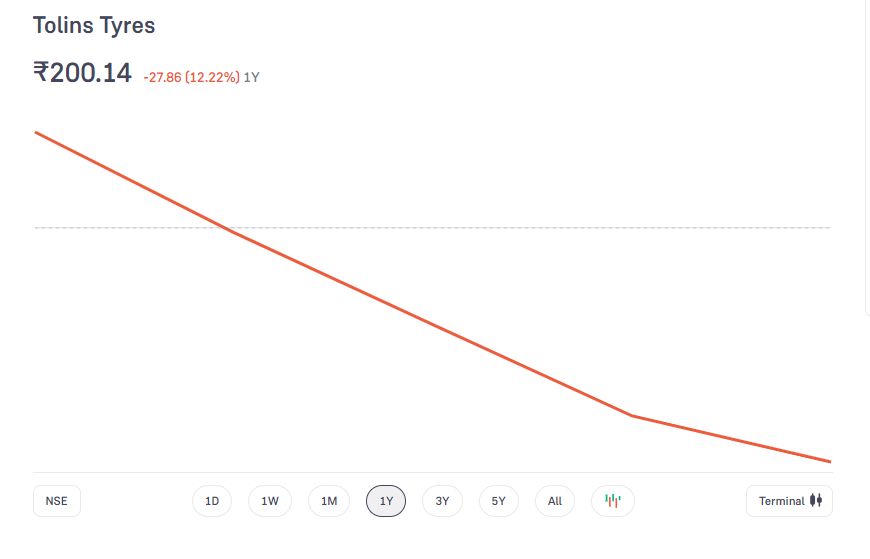

Tolins Tyres Ltd is an Indian company that specializes in manufacturing and distributing a wide range of tires. Tolins Tyres Share Price on NSE as of 20 September 2024 is 200.14 INR. On this page, you will find Tolins Tyres Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Tolins Tyres IPO share Price, Tolins Tyres share price screener, Tolins Tyres Price list, Tolins Tyres share price nse, Tolins Tyres share price target 2030, and more Information.

Tolins Tyres Ltd Company

Tolins Tyres Ltd is an Indian company that specializes in manufacturing and distributing a wide range of tires. Known for producing durable and reliable tires for various vehicles, including trucks, buses, and two-wheelers, Tolins Tyres has built a strong reputation in the industry. The company focuses on quality and innovation, offering products that meet the diverse needs of its customers across India and beyond.

Tolins Tyres Share Price Today Chart

Current Market Overview Of Tolins Tyres Share Price

- Open: 197.00

- Prev. Close: 200.14

- Volume: 4,45,161

- Total traded value: 8.91 Cr

- Upper Circuit: 210.14

- Lower Circuit: 190.13

- Market Cap: ₹792Cr

- ROE: 25.87%

- P/E Ratio(TTM): 30.48

- EPS(TTM): 6.58

- P/B Ratio: 2.64

- Dividend Yield: 0.00%

- Industry P/E: 25.03

- Book Value: 76.07

- Debt to Equity: 0.78

- Face Value: 5

Tolins Tyres Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Tolins Tyres for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Tolins Tyres Share Price Target Years | SHARE PRICE TARGET |

| 1 | Tolins Tyres Share Price Target 2024 | ₹245 |

| 2 | Tolins Tyres Share Price Target 2025 | ₹306 |

| 3 | Tolins Tyres Share Price Target 2026 | ₹330 |

| 4 | Tolins Tyres Share Price Target 2027 | ₹382 |

| 5 | Tolins Tyres Share Price Target 2028 | ₹430 |

| 6 | Tolins Tyres Share Price Target 2029 | ₹490 |

| 7 | Tolins Tyres Share Price Target 2030 | ₹533 |

Read Also:- JSW Infra Share Price Target 2024, 2025 to 2030 and More Information

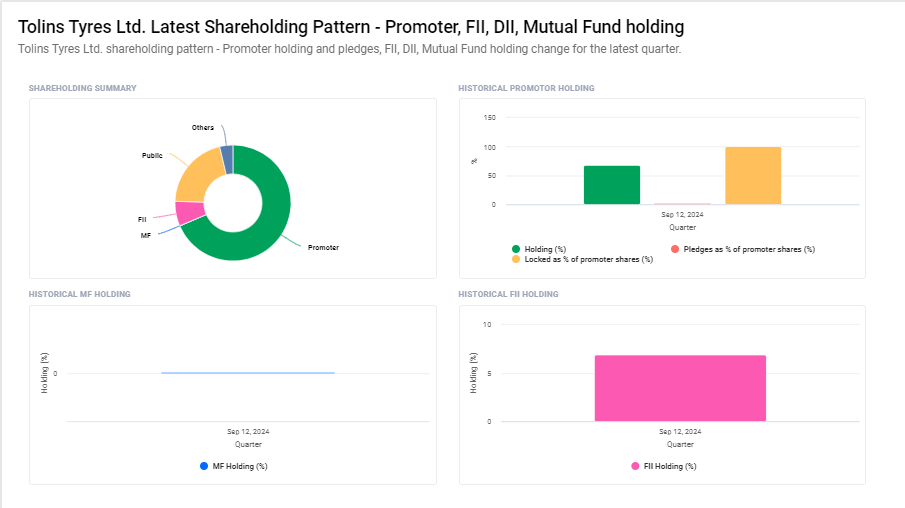

Tolins Tyres Ltd Shareholding Pattern

- Promoters: 68.53%

- Retail and Others: 23.29%

- Foreign Institutions: 6.92%

- Other Domestic Institutions: 1.26%

Key Factors Affecting Tolins Tyres Share Price Growth

Here are six key factors that can influence the growth of Tolins Tyres’ share price:

- Demand for Tires: The overall demand for tires, driven by the automotive industry, plays a crucial role in Tolins Tyres’ revenue. Growth in vehicle sales, particularly in commercial and two-wheeler segments, can boost the company’s sales and positively impact its share price.

- Raw Material Costs: The cost of raw materials like rubber significantly affects the company’s production costs. Fluctuations in these costs can impact profit margins, influencing investor sentiment and share price.

- Technological Advancements: Tolins Tyres’ ability to innovate and produce high-quality, durable tires can enhance its market reputation. Staying ahead in technology and product development can attract more customers and investors, driving share price growth.

- Expansion into New Markets: Expanding the company’s presence into new geographic markets, both domestically and internationally, can increase sales opportunities. Successful market expansion can lead to higher revenues and support share price growth.

- Economic Conditions: The overall economic environment affects consumer spending on vehicles and related products like tires. A strong economy can boost demand for tires, while an economic downturn might reduce sales, impacting the share price.

-

Competition in the Tire Industry: The tire market is competitive, with many established brands. Tolins Tyres’ ability to maintain a competitive edge through pricing, quality, and customer service will influence its market share and, consequently, its share price.

Risks and Challenges to Tolins Tyres Share Price

Here are four risks and challenges that could impact Tolins Tyres’ share price:

- Rising Raw Material Costs: Increases in the cost of essential raw materials, like rubber, can squeeze profit margins. If Tolins Tyres faces higher production costs without being able to pass them on to customers, it could negatively affect profitability and the share price.

- Intense Industry Competition: The tire industry is highly competitive, with many established brands vying for market share. If Tolins Tyres struggles to differentiate itself or loses market share to competitors, it could lead to a decline in revenue and a drop in share price.

- Economic Downturns: Economic slowdowns or recessions can reduce consumer spending on vehicles, directly impacting the demand for tires. Lower sales during tough economic times could hurt Tolins Tyres’ financial performance and result in a decline in its share price.

-

Regulatory Changes: Changes in government regulations, such as environmental standards or import/export policies, could increase operational costs or limit market access. These regulatory challenges might negatively impact the company’s profitability and share price.

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.