Aarti Industries Ltd is a leading Indian chemical company. Aarti Industries Share Price on NSE as of 19 September 2024 is 568.00 INR. On this page, you will find Aarti Industries Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Aarti Industries News, Aarti share price chart, Aarti share price NSE, Why Aarti Industries share falling today, Aarti Industries share price target tomorrow, Aarti Industries share price target 2030, and more Information.

Aarti Industries Ltd Company Details

Aarti Industries Ltd is a leading Indian chemical company that specializes in manufacturing a wide range of chemicals, including specialty chemicals, pharmaceuticals, and intermediates. The company serves various industries such as agrochemicals, polymers, dyes, and pharmaceuticals, both in India and globally. Known for its strong focus on research and development, Aarti Industries continues to expand its production capabilities and deliver innovative chemical solutions. Its well-established market presence and diversified product portfolio make it a key player in the chemical sector.

| Official Website | aarti-industries.com |

| Founded | 1984 |

| Headquarters | Maharashtra |

| Number of employees | 6,100 (2024) |

| Subsidiaries | Anushakti Chemicals And Drugs Ltd., Aarti Usa Inc., and More |

| Category | Share Price |

Current Market Overview Of Aarti Industries Share Price

- Current: ₹568.00

- Open: ₹561.65

- High: ₹570.60

- Low: ₹559.00

- Market Cap: ₹20.59K crore

- P/E Ratio: 42.57

- Dividend Yield: 0.18%

- 52-week High: ₹769.25

- 52-week Low: ₹438.00

Aarti Industries Share Price Today Chart

Aarti Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Aarti Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Aarti Industries Share Price Target Years | SHARE PRICE TARGET |

| 1 | Aarti Industries Share Price Target 2024 | ₹820 |

| 2 | Aarti Industries Share Price Target 2025 | ₹1095 |

| 3 | Aarti Industries Share Price Target 2026 | ₹1243 |

| 4 | Aarti Industries Share Price Target 2027 | ₹1430 |

| 5 | Aarti Industries Share Price Target 2028 | ₹1632 |

| 6 | Aarti Industries Share Price Target 2029 | ₹1870 |

| 7 | Aarti Industries Share Price Target 2030 | ₹2138 |

Read Also:- EKC Share Price Target 2024, 2025, 2026 To 2030 Prediction

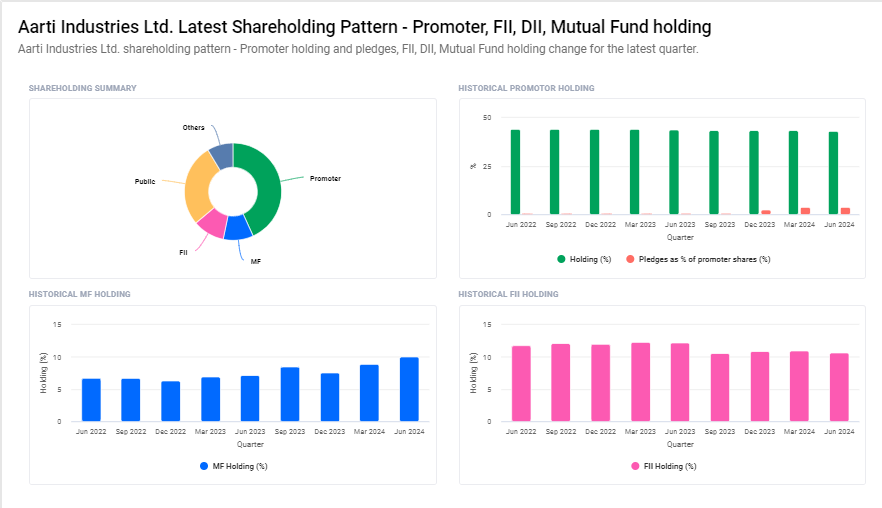

Aarti Industries Ltd Shareholding Pattern

- Promoters: 43.24%

- Retail and Others: 27.58%

- Foreign Institutions: 10.61%

- Mutual Funds: 10.03%

- Other Domestic Institutions: 8.54%

Key Factors Affecting Aarti Industries Share Price Growth

-

Strong Demand for Chemicals: Aarti Industries operates in sectors with consistent demand, such as pharmaceuticals and agrochemicals. As global and domestic markets grow, increased demand for chemical products can drive revenue and profits, positively influencing the share price.

- Innovation and R&D Investments: The company’s commitment to research and development allows it to create innovative products and improve existing ones. Successful new product launches can enhance market competitiveness and attract more customers, which may lead to higher sales and a boost in share price.

- Strategic Partnerships and Expansions: Collaborations with other companies and strategic expansions into new markets can strengthen Aarti Industries’ market position. Successful partnerships can open up new revenue streams, while expansion efforts can help capture a larger market share, both of which can positively impact the stock price.

-

Favorable Regulatory Environment: A supportive regulatory framework can greatly benefit Aarti Industries. If the government implements policies that promote the chemical sector, such as tax incentives or easier compliance processes, it can enhance the company’s profitability, encouraging investor confidence and leading to share price growth.

Risks and Challenges to Aarti Industries Share Price

-

Fluctuations in Raw Material Prices: Aarti Industries relies on various raw materials for its chemical production. Sudden increases in the prices of these materials can raise production costs, impacting profit margins. If the company is unable to pass these costs on to customers, it may hurt profitability and, in turn, the share price.

- Regulatory Changes: The chemical industry is subject to strict regulations regarding safety, environmental impact, and manufacturing practices. Any changes in regulations can require significant adjustments in operations, which may involve additional costs. Non-compliance could also lead to fines or operational disruptions, affecting investor confidence and share value.

- Intense Competition: Aarti Industries faces strong competition from both domestic and international players in the chemical sector. Competitors may offer similar products at lower prices or develop innovative alternatives. This intense competition can lead to price wars, reduced market share, and lower profitability, all of which can negatively impact the company’s stock price.

-

Economic Slowdowns: Economic downturns can affect demand for chemical products across various industries. If key sectors, such as pharmaceuticals or agrochemicals, experience a slowdown, it can lead to reduced sales for Aarti Industries. Lower demand may result in declining revenues and profits, putting downward pressure on the share price.

Read Also:-

- PNG Jewellers Share Price Target

- Gail Share Price Target

- Bengal Steel Share Price Target

- Edelweiss Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.