P N Gadgil Jewellers Ltd is an Indian well-known jewellery company. P N Gadgil Jewellers Share Price on NSE as of 19 September 2024 is 699.05 INR. On this page, you will find P N Gadgil Jewellers Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Pn Gadgil Jewellers share price today, Png Jewellers share price screener, Png Jewellers share Price BSE, Png Jewellers share price target tomorrow, Png Jewellers share price target 2030, and more Information.

P N Gadgil Jewellers Ltd Company Details

P N Gadgil Jewellers Ltd is a well-known jewellery company in India, with a rich heritage that dates back over 185 years. The company specializes in crafting a wide range of gold, silver, and diamond jewelry, offering both traditional and modern designs. Known for its quality and trust, P N Gadgil Jewellers has a strong presence in retail, serving customers with a blend of artistic craftsmanship and innovation. The brand is recognized for its commitment to purity and customer satisfaction, making it a popular choice for jewelry lovers.

| Official Website | pngjewellers.com |

| Founded | 29 November 1832, Sangli |

| Founder | Ganesh Gadgil |

| Headquarters | India |

| Number of employees | 1,228 (2024) |

| Category | Share Price |

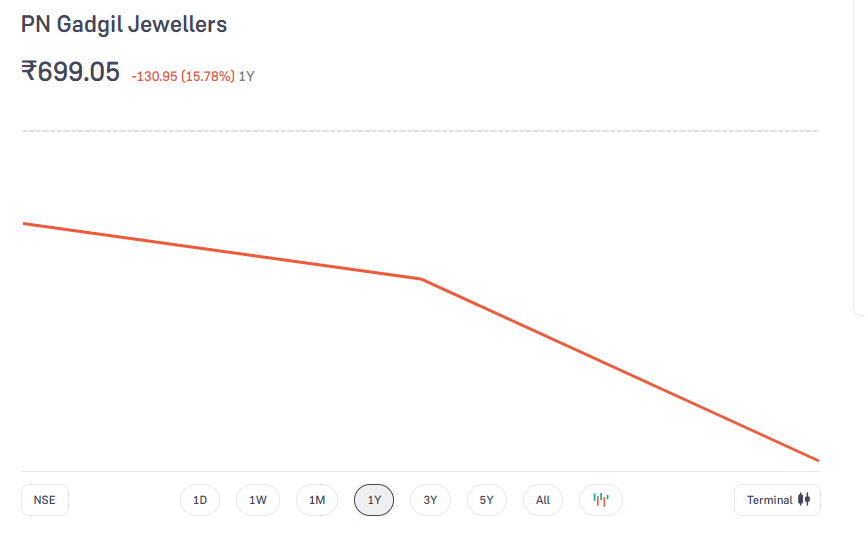

Current Market Overview Of PNG Jewellers Share Price

- Current Price: ₹699.05

- Open: ₹830

- High: ₹848

- Low: ₹781.5

- Issue price: ₹480

- Traded volume (Lakhs): 212.51

- Traded value (Crore): ₹1,729.26

- Total market capitalization (Crore): ₹10,993

- 52 Week Low – ₹782.00

- 52-Week High – ₹843.80

PNG Jewellers Share Price Today Chart

PNG Jewellers Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of PNG Jewellers for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | PNG Jewellers Share Price Target Years | SHARE PRICE TARGET |

| 1 | PNG Jewellers Share Price Target 2024 | ₹887 |

| 2 | PNG Jewellers Share Price Target 2025 | ₹981 |

| 3 | PNG Jewellers Share Price Target 2026 | ₹1245 |

| 4 | PNG Jewellers Share Price Target 2027 | ₹1544 |

| 5 | PNG Jewellers Share Price Target 2028 | ₹1895 |

| 6 | PNG Jewellers Share Price Target 2029 | ₹2286 |

| 7 | PNG Jewellers Share Price Target 2030 | ₹2679 |

Read Also:- NHPC Share Price Target 2025 to 2030 and Full Details

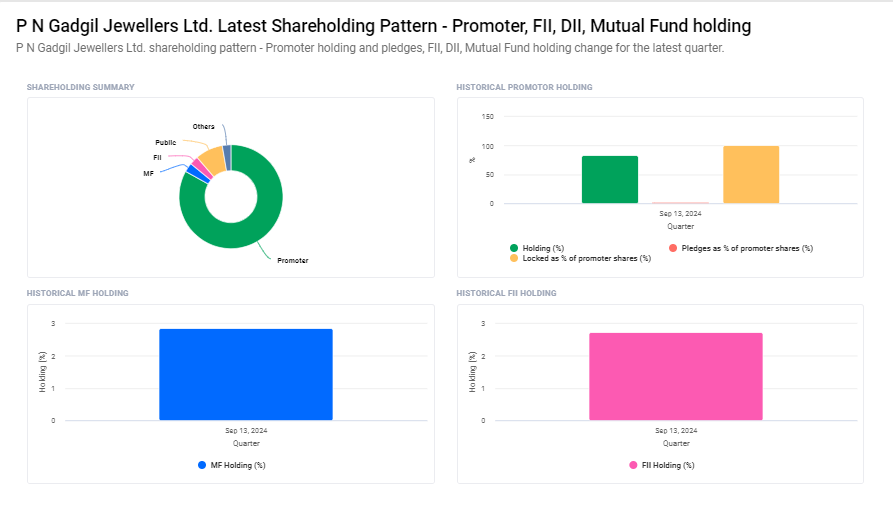

P N Gadgil Jewellers Ltd Shareholding Pattern

- Promoter: 83.1%

- FII: 2.7%

- DII: 5.5%

- Public: 8.6%

Key Factors Affecting PNG Jewellers Share Price Growth

-

Gold Price Fluctuations: The price of gold has a direct impact on PNG Jewellers’ sales and profitability. Since gold is a key material in their products, rising gold prices may reduce consumer demand for jewellery, affecting the company’s revenue and share price. Conversely, falling gold prices can boost demand and positively impact the stock.

- Consumer Demand for Jewellery: Consumer preferences for jewellery, particularly during festivals and wedding seasons in India, play a major role in driving PNG Jewellers’ sales. Any changes in consumer spending habits, driven by economic conditions or cultural shifts, can influence the company’s performance and its share price.

- Expansion and Store Network: PNG Jewellers’ strategy of expanding its store network across new cities and regions can contribute to its growth. If the company successfully opens new stores and taps into untapped markets, it can enhance its revenue streams, leading to a positive impact on the share price.

-

Brand Reputation and Customer Trust: PNG Jewellers’ long-standing reputation for trust and quality is a key strength. Any positive or negative developments regarding customer satisfaction, service quality, or brand image can affect customer loyalty. Maintaining a strong reputation helps sustain the company’s profitability, which in turn supports share price growth.

Risks and Challenges to PNG Jewellers Share Price

-

Volatility in Gold Prices: PNG Jewellers is highly sensitive to fluctuations in gold prices, as gold is the primary material used in jewellery. Significant price hikes can reduce consumer demand, as customers may delay or reduce purchases. Conversely, a sharp decline in gold prices can impact the company’s inventory value, leading to potential losses, thus negatively affecting the share price.

- Changing Consumer Preferences: Shifts in consumer preferences, particularly towards alternative luxury items or lower-cost fashion jewellery, could pose a threat to PNG Jewellers’ business. If customers opt for more affordable options or move away from traditional jewellery, the company’s revenues may decline, creating downward pressure on its stock price.

- Competition in the Jewellery Market: The jewellery industry is highly competitive, with both local and international players vying for market share. PNG Jewellers faces the risk of losing customers to competitors offering better pricing, designs, or marketing. Increased competition can erode market share and profit margins, impacting the company’s financial performance and stock value.

-

Economic Slowdowns and Consumer Spending: Jewellery is often considered a luxury product, and during periods of economic downturn, consumer spending on non-essential items tends to decrease. A recession or weak economic growth can lead to lower jewellery sales, affecting PNG Jewellers’ profitability. Such economic challenges could lead to a decline in the company’s share price as investors anticipate reduced revenues.

Read Also:-

- Tejas Networks Share Price Target

- Infibeam Avenues Share Price Target

- Infosys Share Price Target

- Urja Global Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.