GAIL (India) Ltd is a leading natural gas company in India. GAIL Share Price on NSE as of 19 September 2024 is 211.40 INR. On this page, you will find GAIL Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as GAIL latest News today, GAIL share price target tomorrow, Gail share price target Motilal Oswal, GAIL share price target 2030, GAIL Share Price Target 2040, and more Information.

Gail (India) Ltd Company Details

GAIL (India) Ltd is a leading natural gas company in India, involved in the production, transmission, and distribution of natural gas. It plays a key role in the country’s energy sector by supplying gas for industries, households, and power generation. GAIL is also involved in petrochemicals, liquid hydrocarbons, and renewable energy initiatives, contributing to India’s clean energy goals. The company’s operations help ensure reliable energy supply, making it a crucial player in India’s economic development.

| Official Website | gailonline.com |

| Founded | 1984 |

| Headquarters | 16, Bhikaji Cama Place, R.K. Puram, New Delhi, Delhi, India |

| Chairman & MD | Sandeep Kumar Gupta |

| Number of employees | 5,038 (2024) |

| Category | Share Price |

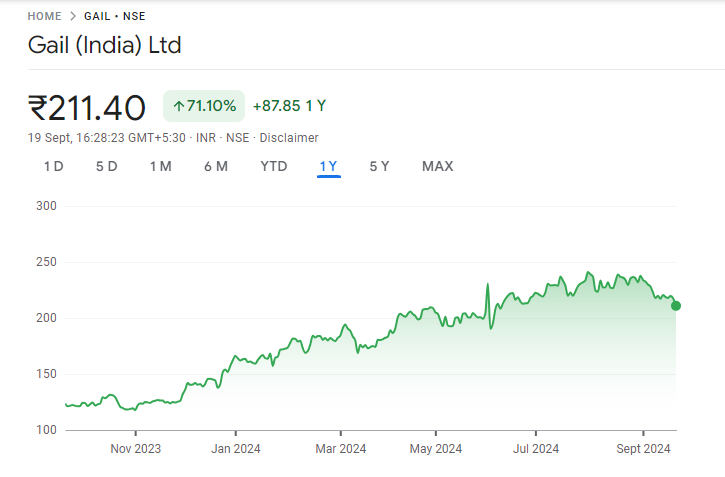

Current Market Overview Of Gail Share Price

- Open: ₹219.00

- High: ₹219.45

- Low: ₹208.62

- Current: ₹211.40

- Market Cap: ₹1.39L crore

- P/E Ratio: 12.31

- Dividend Yield: 2.60%

- 52-Week High: ₹246.30

- 52-Week Low: ₹116.15

Gail Share Price Today Chart

Gail Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of GAIL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | GAIL Share Price Target Years | SHARE PRICE TARGET |

| 1 | GAIL Share Price Target 2024 | ₹270 |

| 2 | GAIL Share Price Target 2025 | ₹385 |

| 3 | GAIL Share Price Target 2026 | ₹447 |

| 4 | GAIL Share Price Target 2027 | ₹506 |

| 5 | GAIL Share Price Target 2028 | ₹584 |

| 6 | GAIL Share Price Target 2029 | ₹667 |

| 7 | GAIL Share Price Target 2030 | ₹763 |

Read Also:- SAIL Share Price Target 2024, 2025 To 2030 and More Details

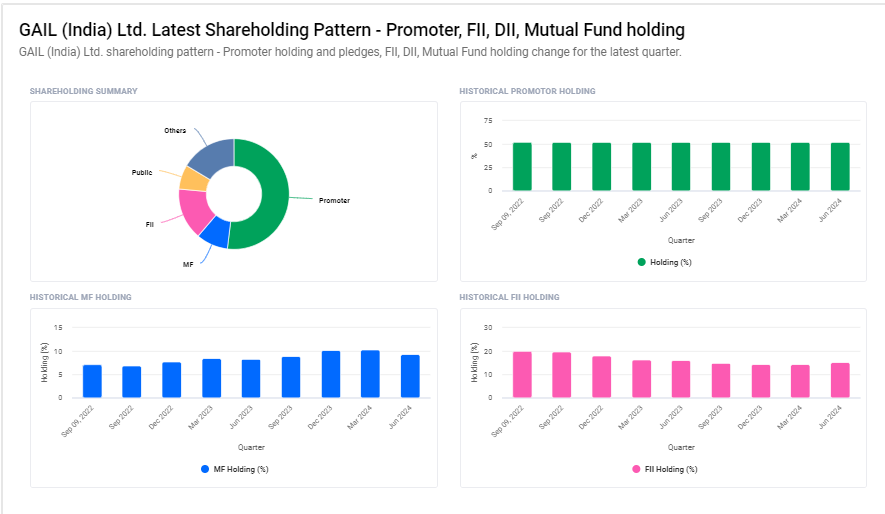

Gail Ltd Shareholding Pattern

- Promoters: 51.90%

- Foreign Institutions: 15.19%

- Retail and Others: 14.64%

- Mutual Funds: 9.33%

- Other Domestic Institutions: 8.90%

Key Factors Affecting GAIL Share Price Growth

-

Global Natural Gas Prices: GAIL is deeply influenced by fluctuations in natural gas prices worldwide. Since the company imports and distributes natural gas, any rise in global prices can increase its costs, reducing profit margins. Conversely, when gas prices are lower, GAIL benefits from reduced costs, leading to improved profitability, which can push its share price higher.

- Government Regulations and Policies: GAIL operates in a heavily regulated industry, where government policies on energy, pricing, and environmental norms play a crucial role. Favorable policies, such as incentives for clean energy projects, pipeline expansion, or deregulation of gas pricing, can encourage business growth. On the other hand, strict regulations or unfavorable policy shifts could restrict GAIL’s operations, impacting its share price negatively.

- Infrastructure Expansion: GAIL’s ongoing investment in expanding its gas pipeline infrastructure is key to its growth potential. As the demand for natural gas rises in various regions, a wider pipeline network helps GAIL reach more customers. Successful infrastructure projects lead to increased market share and revenue, positively influencing the share price.

-

Renewable Energy Initiatives: GAIL is increasingly investing in green energy projects, such as hydrogen production and renewables. As the global shift towards sustainable energy intensifies, GAIL’s ability to adapt and invest in these areas could be a key driver for its future growth. Companies leading in green energy often see enhanced investor interest, which can support long-term share price growth.

Risks and Challenges to GAIL Share Price

-

Volatility in Global Gas Prices: GAIL’s business is heavily influenced by global natural gas prices. Any sudden increase in gas prices can raise the company’s import costs, leading to reduced profitability. Conversely, a sharp decline in gas prices may affect the company’s revenue from its gas production business. These price fluctuations can create uncertainty for investors, potentially impacting the share price.

- Regulatory Risks: GAIL operates in a highly regulated sector, where government policies and regulations have a significant impact. Any sudden changes, such as stricter environmental regulations, modifications to gas pricing policies, or unexpected taxation changes, could create challenges for the company. Unfavorable regulatory shifts could limit GAIL’s operational flexibility, causing concerns among investors.

- Competition from Renewable Energy: The global transition towards renewable energy sources poses a long-term challenge for GAIL. As more companies and countries invest in solar, wind, and other renewable energy technologies, the demand for natural gas could face pressure. If GAIL doesn’t diversify or adapt quickly enough to this shift, it may face reduced demand for its gas, affecting its growth prospects and share price.

-

Operational and Infrastructure Risks: GAIL’s extensive gas pipeline infrastructure requires regular maintenance and expansion. Any delays or issues in infrastructure development, such as pipeline leaks or accidents, could lead to operational disruptions and financial losses. These risks not only impact the company’s ability to deliver gas effectively but also shake investor confidence, which can negatively affect the share price.

Read Also:-

- CESC Share Price Target

- Infibeam Avenues Share Price Target

- Exide Share Price Target

- BCL Industries Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.