LT Foods Ltd is a leading Indian food company. LT Foods Share Price on NSE as of 18 September 2024 is 419.30 INR. On this page, you will find LT Foods Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as LT Foods latest News, LT Foods share price target tomorrow, LT Foods Share price target 2030, LT Foods Share Price Target 2040, and more Information.

LT Foods Ltd Company Details

LT Foods Ltd is a leading Indian food company known for its high-quality rice products, particularly Basmati rice. The company operates globally, offering a wide range of food products under popular brands like Daawat and Royal. Apart from rice, LT Foods is also involved in organic foods, health snacks, and value-added products. With a focus on innovation, sustainability, and maintaining high standards, the company has established a strong presence in both domestic and international markets.

| Official Website | ltgroup.in |

| Founded | 16 October 1990 |

| Headquarters | Gurugram |

| Number of employees | 1,188 (2024) |

| Subsidiaries | Daawat Foods Private Limited More |

| Category | Share Price |

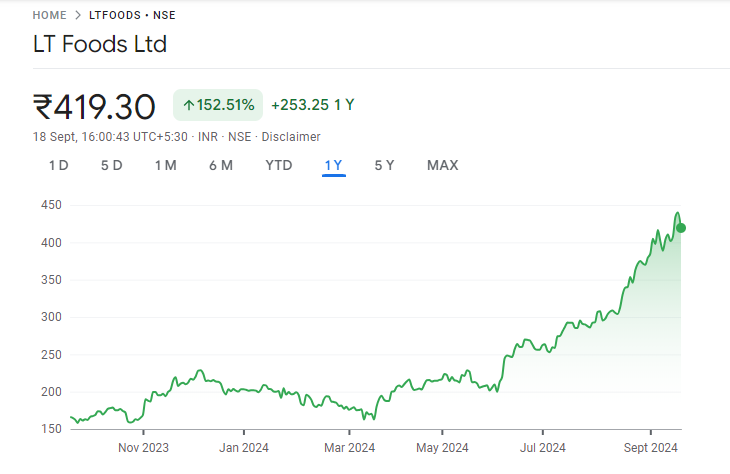

Current Market Overview Of LT Foods Share Price

- Open Price: ₹441.00

- High Price: ₹444.30

- Low Price: ₹416.90

- Current Price: ₹419.30

- Market Capitalization: ₹15.08K crore

- P/E Ratio: NA

- Div Yield: NA

- 52-Week High: ₹440.90

- 52-Week Low: ₹150.35

LT Foods Share Price Today Chart

Read Also:- Cressanda Solutions Share Price Target 2024, 2025 To 2030

LT Foods Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of LT Foods for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | LT Foods Share Price Target Years | SHARE PRICE TARGET |

| 1 | LT Foods Share Price Target 2024 | ₹455 |

| 2 | LT Foods Share Price Target 2025 | ₹723 |

| 3 | LT Foods Share Price Target 2026 | ₹975 |

| 4 | LT Foods Share Price Target 2027 | ₹1250 |

| 5 | LT Foods Share Price Target 2028 | ₹1530 |

| 6 | LT Foods Share Price Target 2029 | ₹1768 |

| 7 | LT Foods Share Price Target 2030 | ₹2034 |

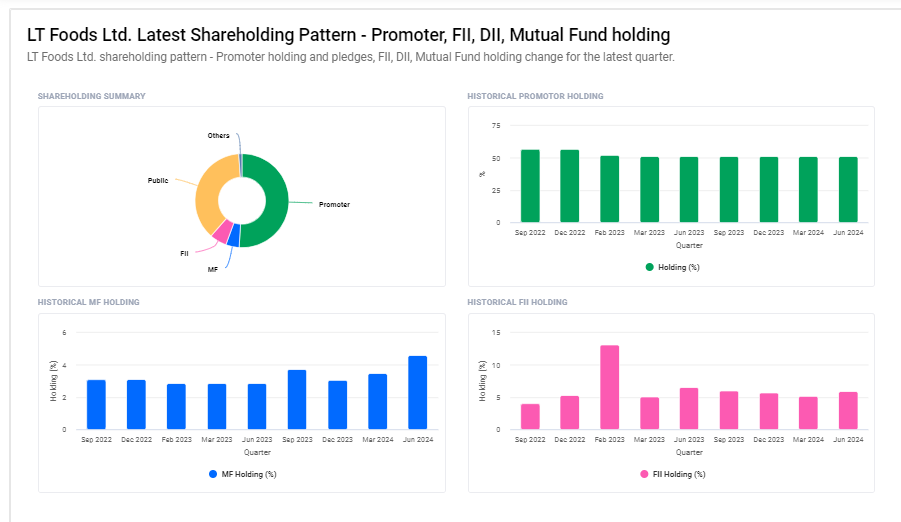

LT Foods Ltd Shareholding Pattern

- Promoters: 51.00%

- Retail and Others: 37.44%

- Foreign Institutions: 5.88%

- Mutual Funds: 4.60%

- Other Domestic Institutions: 1.07%

Key Factors Affecting LT Foods Share Price Growth

Here are six key factors affecting LT Foods’ share price growth:

- Demand for Basmati Rice: As a leading producer of Basmati rice, LT Foods’ share price is closely tied to the global and domestic demand for premium rice. An increase in demand, especially in export markets, can boost revenue and positively impact the share price.

- Expansion of Product Portfolio: LT Foods’ efforts to diversify its product range, such as offering organic foods and health snacks, can attract a wider customer base. Successful expansion into new product categories can drive growth and improve investor confidence.

- Global Market Presence: LT Foods has a strong international presence. Growth in export markets, especially in regions like the U.S. and Europe, can significantly contribute to revenue and share price appreciation.

- Brand Strength: The popularity of brands like Daawat and Royal contributes to LT Foods’ market leadership. Strong brand recognition and loyalty can lead to consistent sales, which supports long-term share price growth.

- Raw Material Costs: The cost of raw materials, particularly rice, can affect profit margins. Efficient cost management or favorable pricing for raw materials can improve profitability, which is a positive factor for the share price.

-

Sustainability and Organic Products: The growing demand for organic and sustainable food products presents a growth opportunity for LT Foods. Focusing on sustainable practices and increasing the share of organic products can attract environmentally conscious investors and support share price growth.

Read Also:-

- Sarveshwar Foods Share Price Target

- Premier Energies Share Price Target

- Nandan Denim Share Price Target

- Laurus Labs Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.