Apar Industries Ltd is an Indian company that operates in the power and oil sectors. Apar Industries Share Price on NSE as of 17 September 2024 is 10,110.00 INR. On this page, you will find Apar Industries Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Aparna Constructions Share Price target, APAR Industries share price screener, Apar Industries latest news, Why Apar Industries Share is falling, Apar industries share price target tomorrow, and more Information.

Apar Industries Ltd Company Details

Apar Industries Ltd is an Indian company that operates in the power and oil sectors, providing a range of products like power conductors, cables, and specialty oils. Established in 1958, the company has grown to become a leading player in its field, serving industries like power generation, transmission, and distribution. Apar Industries is known for its innovative solutions and quality products, catering to both domestic and international markets. Its focus on technology and sustainability helps it remain competitive in the global market.

| Official Website | apar.com |

| Headquarters | India |

| Number of employees | 2,045 (2024) |

| Subsidiaries | Uniflex Cables Ltd., Apar Lubricants Limited, and more |

| Category | Share Price |

Current Market Overview Of Apar Industries Share Price

- Opening Price: INR 10,597.00

- High Price: INR 10,597.00

- Low Price: INR 10,027.60

- Current Market Price: INR 9,960.00

- Market Capitalization: INR 40.64KCr

- P/E Ratio: 47.90

- Dividend Yield: 0.50%

- 52-Week High: INR 10,624.80

- 52-Week Low: INR 4,545.65

Apar Industries Share Price Today Chart

Read Also:- HDFC AMC Share Price Target 2024, 2025, 2026 To 2030

Apar Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Apar Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Apar Industries Share Price Target Years | SHARE PRICE TARGET |

| 1 | Apar Industries Share Price Target 2024 | ₹11055 |

| 2 | Apar Industries Share Price Target 2025 | ₹12378 |

| 3 | Apar Industries Share Price Target 2026 | ₹13573 |

| 4 | Apar Industries Share Price Target 2027 | ₹14795 |

| 5 | Apar Industries Share Price Target 2028 | ₹16106 |

| 6 | Apar Industries Share Price Target 2029 | ₹17178 |

| 7 | Apar Industries Share Price Target 2030 | ₹18676 |

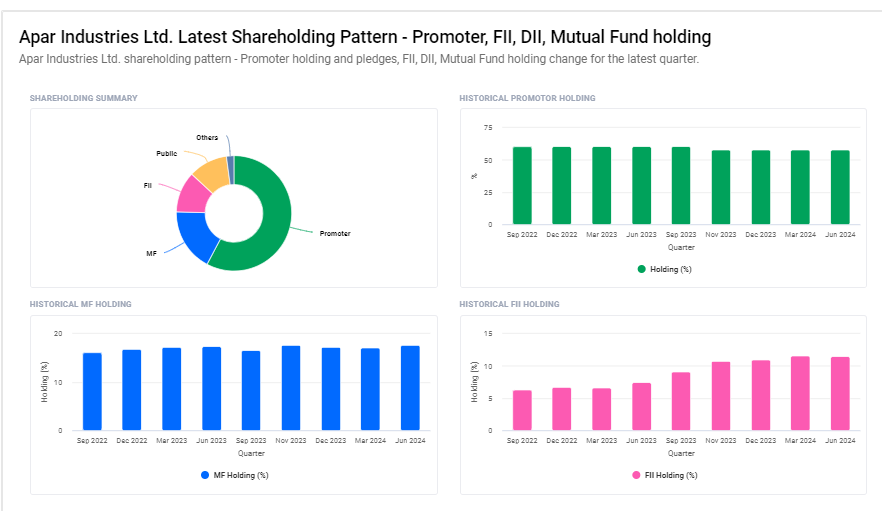

Apar Industries Ltd Shareholding Pattern

- Promoters: 57.8%

- DII: 19.7%

- Foreign institutions: 11.51%

- Public: 11.00%

Risks and Challenges to Apar Industries Share Price

Here are five key risks and challenges that can affect Apar Industries’ share price:

- Fluctuating Raw Material Costs: Apar Industries relies on raw materials like aluminum and copper for its products. Any significant increase in the cost of these materials could reduce profit margins and negatively impact the company’s share price.

- Global Economic Conditions: Being involved in both domestic and international markets, Apar Industries is affected by global economic conditions. Economic slowdowns or recessions in key markets can lead to lower demand for its products, potentially reducing revenue and affecting share price.

- Foreign Exchange Risk: As the company operates internationally, fluctuations in currency exchange rates can impact earnings from exports. A strong rupee against other currencies could reduce profitability, influencing the share price negatively.

- Competition: The company faces stiff competition in the power and oil sectors. Increased competition from both domestic and international players could affect market share and profitability, posing a risk to the company’s stock performance.

-

Regulatory Changes: Apar Industries operates in industries that are subject to various regulations, including environmental and safety standards. Any unfavorable regulatory changes or compliance costs could affect the company’s operations and profitability, impacting its share price.

Read Also:-

- Gujarat Gas Share Price Target

- ZUDIO Share Price Target

- Franklin Industries Share Price Target

- Federal Bank Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.