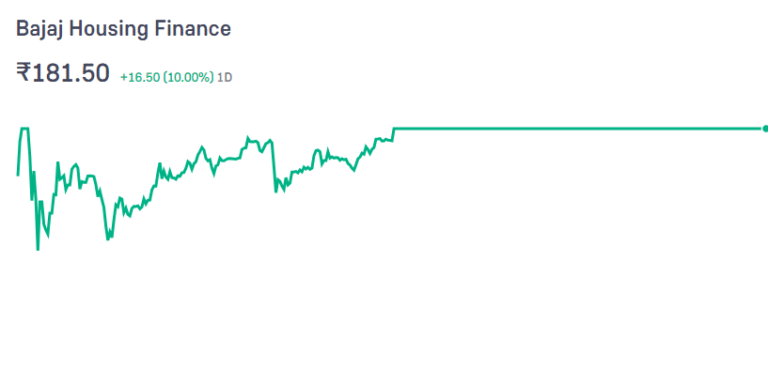

Bajaj Housing Finance Ltd is a subsidiary of Bajaj Finance Limited, providing a range of housing finance solutions. Bajaj Housing Finance Share Price on NSE as of 17 September 2024 is 181.50 INR. On this page, you will find Bajaj Housing Finance Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Bajaj Housing Finance share price tomorrow, Bajaj Housing Finance share price chart, Bajaj Housing Finance share price NSE, Bajaj Housing share price, Bajaj housing and finance share price, Bajaj housing finance share price today news, Bajaj housing finance share price target tomorrow, and more Information.

Bajaj Housing Finance Ltd Company Details

Bajaj Housing Finance Ltd is a subsidiary of Bajaj Finance Limited, providing a range of housing finance solutions. The company offers home loans, loans against property, and balance transfer options to individuals and businesses. With competitive interest rates and flexible repayment options, Bajaj Housing Finance aims to make homeownership more accessible. It is known for its quick approval process and customer-friendly services, catering to a wide range of financial needs related to housing and real estate. The company focuses on ensuring a smooth and transparent loan process for its customers.

| Official Website | bajajhousingfinance.in |

| Founded | 13 June 2008 |

| CEO | Atul Jain (2018–) |

| Category | Share Price |

Current Market Overview Of Bajaj Housing Finance Share Price

- Open Price – 175.50

- High Price – 181.50

- Low Price – 174.10

- Previous Close – 165.00

- 52 Week High – 181.50

- 52 Week Low – 70.00

- Volume – 246,750,377

- Value (Lacs) – 447,851.93

- VWAP – 179.05

- Mkt Cap (Rs. Cr.) – 151,155

- UC Limit – 181.50

- LC Limit – 148.50

- Face Value – 10

Bajaj Housing Finance Share Price Today Chart

Read Also:- Tata Motors Share Price Target 2024, 2025, to 2030 Prediction

Bajaj Housing Finance Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Bajaj Housing Finance for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Bajaj Housing Finance Share Price Target Years | SHARE PRICE TARGET |

| 1 | Bajaj Housing Finance Share Price Target 2024 | ₹210 |

| 2 | Bajaj Housing Finance Share Price Target 2025 | ₹450 |

| 3 | Bajaj Housing Finance Share Price Target 2026 | ₹620 |

| 4 | Bajaj Housing Finance Share Price Target 2027 | ₹839 |

| 5 | Bajaj Housing Finance Share Price Target 2028 | ₹1068 |

| 6 | Bajaj Housing Finance Share Price Target 2029 | ₹1202 |

| 7 | Bajaj Housing Finance Share Price Target 2030 | ₹1442 |

Bajaj Housing Finance Share Price IPO Details

- Price Range: ₹66-₹70 consistent with percentage

- Lot Size: 214 stocks

- Minimum Investment: ₹14,124

- Issue Size: ₹6,560 crore

Subscription Rates:

- Qualified Institutional Buyers: 209.36x

- Non-Institutional Investors: 41.37x

- Retail Individual Investors: 6.81x

- Employees: 1.94x

- Shareholders: 17.32x

Key Factors Affecting Bajaj Housing Finance Share Price Growth

Here are five key factors affecting Bajaj Housing Finance’s share price growth:

- Interest Rate Changes: The company’s profitability is influenced by interest rates. Lower interest rates can increase demand for housing loans, boosting revenues, while higher rates may reduce borrowing, impacting growth and share price.

- Real Estate Market Trends: The overall health of the real estate market directly affects Bajaj Housing Finance. A booming property market can drive more home loan applications, increasing business and positively impacting share price growth.

- Economic Conditions: Strong economic growth leads to higher disposable income, encouraging more people to invest in property. Positive economic conditions can drive demand for housing loans, supporting the company’s share price.

- Credit Risk Management: Effective management of credit risk, such as maintaining low default rates on loans, helps in protecting the company’s profits. Strong financial performance due to good risk management can positively impact investor confidence and share price growth.

-

Competitive Advantage: Bajaj Housing Finance’s ability to offer competitive interest rates, flexible loan terms, and excellent customer service can attract more borrowers. Gaining a larger market share can enhance revenues, boosting the company’s stock price over time.

Read Also:-

- BCL Industries Share Price Target

- Exide Share Price Target

- Infibeam Avenues Share Price Target

- Salasar Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.