BCL Industries Ltd is an Indian company involved in the edible oil and distillery business. BCL Industries Share Price on NSE as of 17 September 2024 is 62.68 INR. On this page, you will find BCL Industries Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as BCL Industries multibagger, BCL Industries stock split, Bcl Industries share price target Motilal Oswal, BCL Industries share price target tomorrow, BCL Industries share price target 2030, and more Information.

BCL Industries Ltd Company Details

BCL Industries Ltd is an Indian company involved in the edible oil and distillery business. It manufactures and refines a variety of edible oils, including soya, rice bran, and mustard oils. The company is also active in producing ethanol and other products in its distillery segment. BCL Industries focuses on delivering high-quality products to consumers and has a growing presence in both domestic and international markets. Its diverse portfolio and focus on sustainability contribute to its steady growth in the industry.

| Official Website | bcl.ind.in |

| Headquarters | India |

| Number of employees | 692 (2024) |

| Subsidiaries | Kissan Fats Limited, Ganpati Township Limited |

| Category | Share Price |

Current Market Overview Of BCL Industries Share Price

- Open Price: ₹63.80

- High Price: ₹63.94

- Low Price: ₹61.71

- Market Capitalization: ₹1.85K Crores

- P/E Ratio: 17.85

- Dividend Yield: 0.40%

- 52-Week High: ₹86.30

- 52-Week Low: ₹45.14

- Current Share Price: ₹62.68

BCL Industries Share Price Today Chart

Read Also:- ECOS Mobility Share Price Target 2024, 2025 To 2030 Prediction

BCL Industries Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of BCL Industries for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | BCL Industries Share Price Target Years | SHARE PRICE TARGET |

| 1 | BCL Industries Share Price Target 2024 | ₹95 |

| 2 | BCL Industries Share Price Target 2025 | ₹105 |

| 3 | BCL Industries Share Price Target 2026 | ₹180 |

| 4 | BCL Industries Share Price Target 2027 | ₹215 |

| 5 | BCL Industries Share Price Target 2028 | ₹295 |

| 6 | BCL Industries Share Price Target 2029 | ₹340 |

| 7 | BCL Industries Share Price Target 2030 | ₹410 |

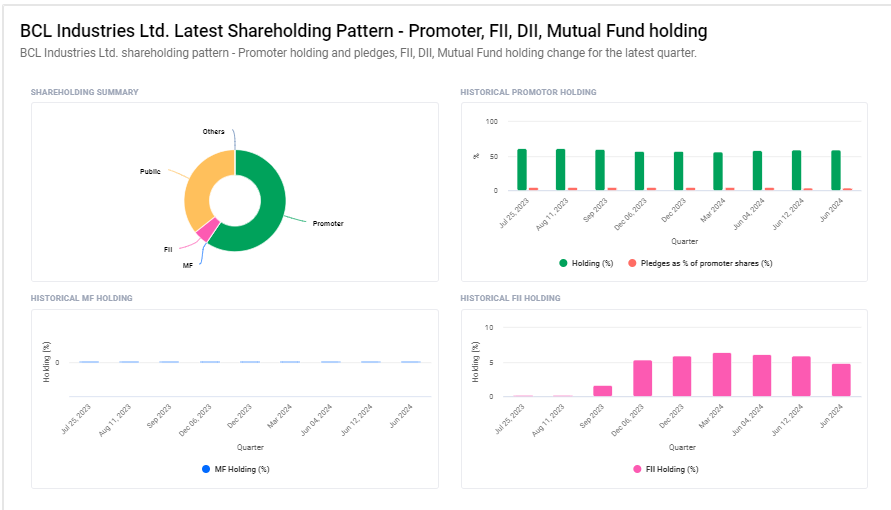

BCL Industries Ltd Shareholding Pattern

- Promoters: 59.47%

- Retail and Others: 35.69%

- Foreign Institutions: 4.84%

Key Factors Affecting BCL Industries Share Price Growth

Here are seven key factors affecting BCL Industries’ share price growth:

- Demand for Edible Oils: BCL Industries is a major player in the edible oil sector. The share price can grow as consumer demand for edible oils like soya and mustard increases, driven by population growth and changing dietary habits in India and abroad.

- Expansion in Ethanol Production: The company’s involvement in ethanol production, which is gaining importance due to government policies promoting biofuels, can positively impact growth. Increasing demand for ethanol as a renewable energy source could lead to higher revenues and an improved share price.

- Government Policies: BCL’s share price is influenced by government policies related to agriculture, oilseed production, and biofuels. Favorable policies, such as subsidies or incentives for ethanol production, can boost the company’s profitability and attract investors.

- Global Commodity Prices: The company’s performance is linked to global commodity prices, especially the prices of raw materials like oilseeds. A rise in global edible oil prices can lead to higher revenues, while a fall might impact margins, influencing the share price.

- Expansion of Distribution Network: BCL Industries’ growth is also affected by its ability to expand its distribution network across new regions and markets. A wider reach can boost sales and profitability, thus contributing to an increase in share price.

- Technological Advancements: The company’s investments in refining technology and innovation in ethanol production can make its processes more efficient and cost-effective. Improved efficiency can lead to higher profitability, positively influencing share price growth.

-

Sustainability and Green Initiatives: BCL’s focus on sustainable practices, particularly in the biofuel sector, aligns with growing environmental concerns. This can attract environmentally conscious investors, driving demand for the company’s shares and supporting long-term price appreciation.

Read Also:-

- Raymond Share Price Target

- Morepen Share Price Target

- BHEL Share Price Target

- KCP Sugar Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.