Infibeam Avenues Ltd is an Indian digital payments and e-commerce technology company. Infibeam Avenues Share Price on NSE as of 16 September 2024 is 28.00 INR. On this page, you will find Infibeam Avenues Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Infibeam Avenues News, Infibeam Avenues share price target tomorrow, Infibeam Avenues share price target 2030, Odigma share price Target 2025, Infibeam avenues share price target 2030, and more Information.

Infibeam Avenues Ltd Company Details

Infibeam Avenues Ltd is an Indian digital payments and e-commerce technology company. It provides a range of services, including payment processing solutions, e-commerce platforms, and digital marketing services. The company is known for its flagship payment gateway, CCAvenue, which facilitates secure online transactions for businesses and consumers. Infibeam Avenues supports both small and large enterprises in managing their online presence and payment systems, helping them grow in the digital economy. The company plays a key role in the expanding digital payments landscape in India.

| Official Website | ia.ooo |

| Founded | 2010 |

| Headquarters | Gandhinagar |

| Number of employees | 815 (2024) |

| Subsidiaries | Infibeam, Odigma Consultancy Solns |

| Category | Share Price |

Current Market Overview Of Infibeam Avenues Share Price

- Open Price: ₹28.57

- High Price: ₹28.57

- Low Price: ₹27.30

- Current Price: ₹28.00

- Mkt cap: ₹7.72KCr

- P/E ratio: 38.26

- Div yield: 0.18%

- 52-wk high: ₹42.50

- 52-wk low: ₹17.00

Infibeam Avenues Share Price Today Chart

Read Also:- Motisons Jewellers Share Price Target 2024, 2025, 2026, 2027 to 2030

Infibeam Avenues Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Infibeam Avenues for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Infibeam Avenues Share Price Target Years | Share Price Targets |

| 1 | Infibeam Avenues Share Price Target 2024 | ₹ 60 |

| 2 | Infibeam Avenues Share Price Target 2025 | ₹ 75 |

| 3 | Infibeam Avenues Share Price Target 2026 | ₹ 90 |

| 4 | Infibeam Avenues Share Price Target 2027 | ₹ 105 |

| 5 | Infibeam Avenues Share Price Target 2028 | ₹ 120 |

| 6 | Infibeam Avenues Share Price Target 2029 | ₹ 135 |

| 7 | Infibeam Avenues Share Price Target 2030 | ₹ 155 |

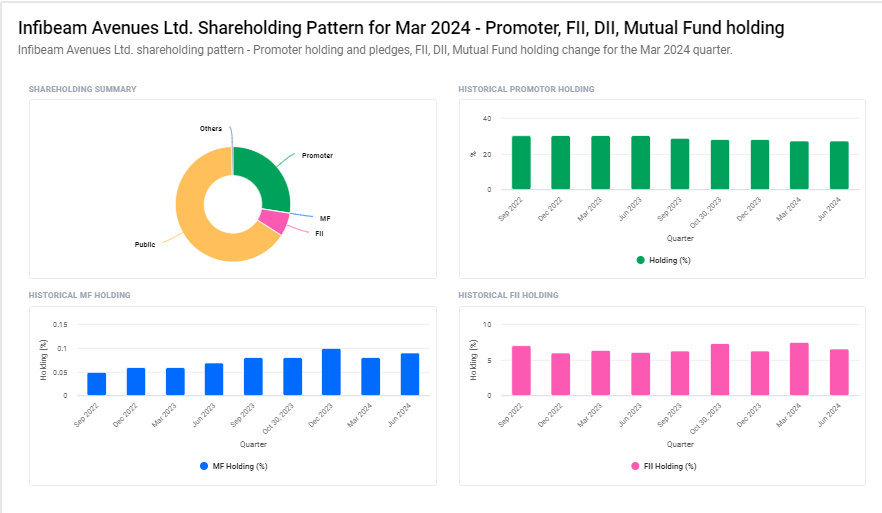

Infibeam Avenues Ltd. Shareholding Pattern

- Promoters: 27.4%

- Foreign Institutions: 6.6%

- Mutual Fund: 65.5%

- Domestic Institutions: 0.1%

- Other: 0.4%

Key Factors Affecting Infibeam Avenues Share Price Growth

Here are five key factors affecting Infibeam Avenues Ltd’s share price growth:

- Growth of Digital Payments Industry: As the digital payments sector in India and globally continues to expand, Infibeam Avenues stands to benefit. The increasing adoption of cashless transactions, driven by e-commerce growth, government initiatives like Digital India, and the rising use of mobile wallets, boosts the demand for the company’s payment gateway solutions. As more businesses and consumers move online, this growth potential can drive up the company’s revenue, positively affecting its share price.

- Technological Innovation and Offerings: Infibeam’s ability to continuously innovate and enhance its digital payment and e-commerce solutions is crucial for its market position. Introducing new features, improving the user experience, and ensuring secure transactions will help the company attract more customers. As the business expands its product offerings to meet the evolving needs of merchants and consumers, it can improve earnings, driving investor confidence and boosting share prices.

- Strategic Partnerships and Client Acquisition: The company’s growth also depends on forming strategic partnerships with large businesses, financial institutions, and government agencies. These partnerships can increase the company’s reach and bring in more revenue from high-value clients. Successfully securing new partnerships or acquiring large clients would likely lead to stronger financial performance, which can result in a positive impact on the share price.

- Regulatory Environment: As a digital payments company, Infibeam operates in a highly regulated environment. Government policies, new fintech regulations, and changes in the payment industry standards can directly influence its operations. Favorable regulations that encourage digital transactions can help the company grow, while strict regulations or compliance costs may affect profitability. Positive regulatory changes would support share price growth, while unfavorable ones may create challenges.

-

Expansion into International Markets: Infibeam’s success in expanding into international markets beyond India can contribute significantly to its revenue growth. Entering new regions with its payment gateway solutions and e-commerce platforms opens up opportunities to tap into global demand for digital payment services. A successful global expansion would diversify revenue sources and reduce dependence on the Indian market, which could positively impact share price growth.

Read Also:-

- HDFC AMC Share Price Target

- KEC International Share Price Target

- Mtnl Share Price Target

- Campus Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.