NALCO is a leading Indian public sector enterprise. NALCO Share Price on NSE as of 13 September 2024 is 182.66 INR. On this page, you will find NALCO Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as NALCO share News, NALCO share price target tomorrow, NALCO Share Price Target 2030, NALCO Share price target 2040, and more Information.

National Aluminium Company Limited Company Details

National Aluminium Company Limited (NALCO) is a leading Indian public sector enterprise that specializes in the production of aluminum and its related products. Established in 1981, NALCO is one of the largest integrated producers of bauxite, alumina, and aluminum in India. The company plays a crucial role in the country’s aluminum industry, with operations ranging from mining to refining and smelting.

| Official Website | nalcoindia.com |

| Chairman & MD | Sridhar Patra |

| Founded | 1981 |

| Headquarters |

Bhubaneswar, Odisha, India

|

| Number of employees | 4,858 (2024) |

| Category | Share Price |

Current Market Overview Of NALCO Share Price

- Open Price: ₹180.58

- High Price: ₹185.40

- Low Price: ₹180.20

- Market Capitalization: ₹33.55K Crores

- P/E Ratio: 14.96

- Dividend Yield: 2.74%

- 52-Week High: ₹209.00

- 52-Week Low: ₹88.60

- Current Price: ₹182.66

NALCO Share Price Today Chart

Read Also:- Jio Finance Share Price Target 2024, 2025, 2026, to 2030 and Forecast

NALCO Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of NALCO for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | NALCO Share Price Target Years | SHARE PRICE TARGET |

| 1 | NALCO Share Price Target 2024 | ₹215 |

| 2 | NALCO Share Price Target 2025 | ₹290 |

| 3 | NALCO Share Price Target 2026 | ₹365 |

| 4 | NALCO Share Price Target 2027 | ₹450 |

| 5 | NALCO Share Price Target 2028 | ₹529 |

| 6 | NALCO Share Price Target 2029 | ₹608 |

| 7 | NALCO Share Price Target 2030 | ₹690 |

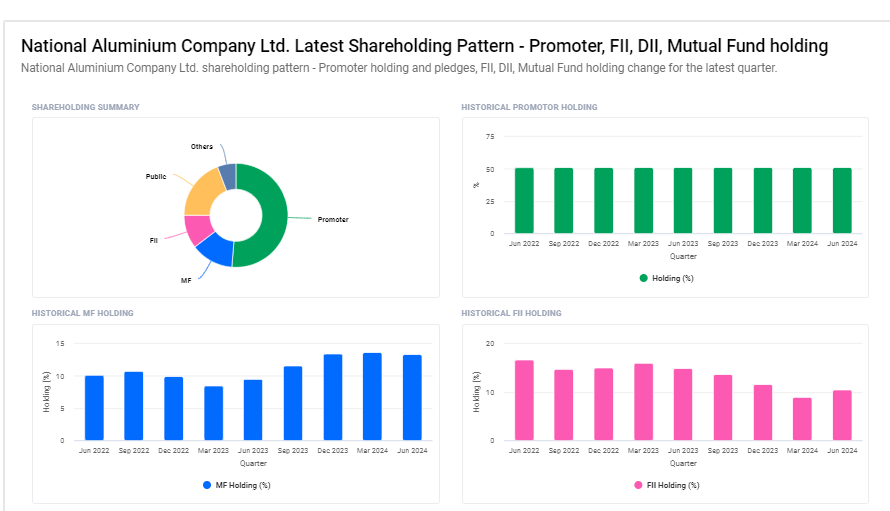

National Aluminium Company Limited Shareholding Pattern

- Promoters: 51.28%

- Retail And Others: 19.17%

- Mutual Funds: 13.31%

- Foreign Institutions: 10.43%

- Other Domestic Institutions: 5.81%

Key Factors Affecting NALCO Share Price Growth

Here are six key factors that can deeply affect NALCO’s share price growth:

- Global Aluminum Prices: NALCO’s revenue is highly dependent on global aluminum prices. Since aluminum is a commodity, its price fluctuates based on supply and demand in the global market. Factors like economic conditions, trade policies, and production levels of other major aluminum-producing countries can impact these prices. When global aluminum prices rise, NALCO’s profitability increases, which often leads to a positive movement in its share price.

- Bauxite and Alumina Supply: NALCO is an integrated producer of bauxite and alumina, which are critical raw materials for aluminum production. Any disruptions in the supply of these materials, such as mining restrictions, regulatory challenges, or environmental issues, could affect NALCO’s production capabilities and profitability. Consistent access to these resources helps the company maintain steady production, which can support share price growth.

- Government Policies and Export Incentives: As a public sector enterprise, NALCO is influenced by government policies, especially those related to the mining and metals industry. Favorable policies, such as export incentives or reduced duties on aluminum products, can boost the company’s competitiveness in international markets. Additionally, any policies promoting domestic consumption of aluminum can positively impact NALCO’s financial performance and, in turn, its share price.

- Operational Efficiency and Cost Control: NALCO’s ability to manage its operational costs, including energy and labor expenses, plays a crucial role in its profitability. The aluminum production process is energy-intensive, and fluctuations in energy costs can directly affect profit margins. If NALCO can maintain high levels of operational efficiency and control its costs, it can improve its bottom line, making the stock more attractive to investors and driving share price growth.

- Expansion Plans and New Projects: NALCO’s plans to expand its production capacity, invest in new technologies, or enter into joint ventures can significantly influence its future growth prospects. Successful execution of such expansion plans, including increased bauxite mining or setting up new smelters, can boost production volumes and revenues. Investors often view these growth initiatives positively, which can lead to an upward trend in the company’s share price.

-

Environmental and Sustainability Initiatives: NALCO’s commitment to environmental sustainability is increasingly important, especially in a global market that values green practices. Adopting eco-friendly technologies, reducing carbon emissions, and ensuring responsible mining practices can enhance NALCO’s reputation and attract socially responsible investors. A strong environmental record can help the company grow its customer base, leading to long-term financial success and share price appreciation.

Read Also:-

- Titagarh Share Price Target

- BEL Share Price Target

- IRFC Share Price Target

- Ola Electric Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.