Raymond Ltd is one of India’s leading textile and fashion companies. Raymond Share Price on NSE as of 11 September 2024 is 1,915.00 INR. On this page, you will find Raymond Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Raymond share News, Raymond share price target tomorrow, Why Raymond share price falling, Raymond share price target Motilal Oswal, Raymond Share Price Target 2040, and more Information.

Raymond Ltd Company Details

Raymond Ltd is one of India’s leading textile and fashion companies, known for its high-quality fabrics, clothing, and accessories. Established in 1925, Raymond has built a strong reputation for producing fine woolen and suiting fabrics, making it a popular choice for formal wear in India and abroad.

In addition to textiles, Raymond has expanded into ready-made garments, home furnishings, and personal care products. The company is recognized for its craftsmanship, innovation, and style, serving a wide range of customers while maintaining a strong presence in the global fashion industry.

| Official Website | raymond.in |

| Founded | 1925 |

| Headquarters | Mumbai |

| Number of employees | 6,707 (2024) |

| Category | Share Price |

Current Market Overview Of Raymond Share Price

- Open Price: ₹1,960.20

- High Price: ₹1,974.00

- Low Price: ₹1,910.00

- Current Price: ₹1,915.00

- Mkt cap: ₹12.74KCr

- P/E ratio: 1.61

- Div yield: 0.52%

- 52-wk high: ₹2,380.00

- 52-wk low: ₹920.12

Raymond Share Price Today Chart

Read Also:- KCP Sugar Share Price Target 2024, 2025, 2026 To 2030 Prediction

Raymond Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Raymond for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Raymond Share Price Target Years | Share Price Target |

| 1 | Raymond Share Price Target 2024 | ₹2921.6 |

| 2 | Raymond Share Price Target 2025 | ₹5943 |

| 3 | Raymond Share Price Target 2026 | ₹6801 |

| 4 | Raymond Share Price Target 2027 | ₹7785 |

| 5 | Raymond Share Price Target 2028 | ₹8910 |

| 6 | Raymond Share Price Target 2029 | ₹9997 |

| 7 | Raymond Share Price Target 2030 | ₹10785 |

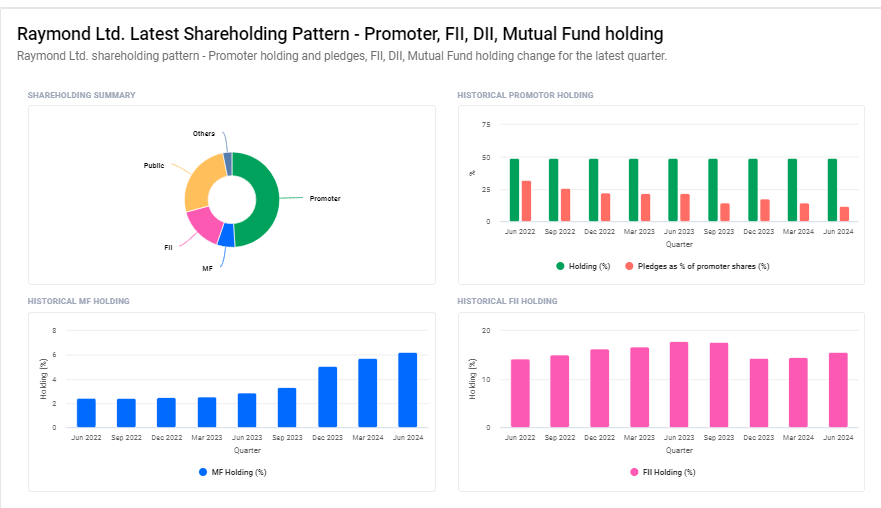

Raymond Ltd Shareholding Pattern

- Promoters: 49%

- Foreign Institutions: 15.6%

- Mutual Fund: 26.1%

- Domestic Institutions: 9.3%

Major Factors Affecting Raymond Share Price Share Price

Here are five major factors that can affect Raymond Ltd’s share price:

- Consumer Demand: Changes in consumer preferences and demand for textiles and fashion products can influence Raymond’s sales and revenue, impacting its share price.

- Raw Material Costs: Fluctuations in the cost of raw materials like wool and cotton can affect production costs. Rising material costs can squeeze profit margins and affect the stock price.

- Economic Conditions: Economic growth or slowdowns affect consumer spending on clothing and luxury items. A strong economy can boost sales for Raymond, positively influencing its share price.

- Retail Expansion: Raymond’s success in expanding its retail presence, both domestically and internationally, can lead to increased revenue and share price growth.

-

Brand Reputation: The company’s brand image and the quality of products play a significant role in attracting customers and maintaining market share. Positive consumer perception can support stock performance.

Risks and Challenges to Raymond Share Price

Here are five risks and challenges that could affect Raymond Ltd’s share price:

- Market Competition: Intense competition from other textile and fashion brands can impact Raymond’s market share and pricing power, which might put pressure on its stock price.

- Economic Downturns: Economic slowdowns can lead to reduced consumer spending on apparel and luxury goods, potentially affecting Raymond’s sales and share price.

- Fluctuating Raw Material Costs: Variations in the prices of raw materials like wool and cotton can increase production costs. If these costs rise significantly, it could impact Raymond’s profitability and share price.

- Changing Fashion Trends: Rapid changes in fashion trends can affect demand for Raymond’s products. If the company fails to adapt quickly, it could result in lower sales and impact the stock price.

-

Operational Challenges: Issues such as supply chain disruptions, manufacturing delays, or quality control problems can affect Raymond’s production and delivery, potentially influencing its financial performance and share price.

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.