Bharat Heavy Electricals Ltd (BHEL) is a leading Indian government-owned engineering and manufacturing company. BHEL Share Price on NSE as of 11 September 2024 is 258.30 INR. On this page, you will find BHEL Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as BHEL share price target tomorrow, BHEL Share Price Target 2040, Bhel share price target 2025 in Hindi, and more Information.

Bharat Heavy Electricals Ltd Company Details

Bharat Heavy Electricals Ltd (BHEL) is a leading Indian government-owned engineering and manufacturing company. Established in 1964, BHEL is known for producing power generation equipment, such as turbines, boilers, and transformers, and providing services for sectors like power, transportation, and defense.

The company plays a crucial role in India’s infrastructure development, particularly in the energy sector. BHEL is recognized for its engineering expertise and commitment to supporting India’s industrial growth. Its wide range of products and services makes it a significant player in the heavy electrical equipment industry.

| Official Website | bhel.com |

| Founded | 13 November 1964 |

| Founder | Government of India |

| Headquarters |

New Delhi, India

|

| Chairman & Managing Director | K S Murthy |

| Number of employees | 42,880 (2024) |

| Category | Share Price |

Current Market Overview Of BHEL Share Price

- Open Price: ₹265.05

- High Price: ₹267.20

- Low Price: ₹259.10

- Market Capitalization: ₹90.67K Crores

- P/E Ratio: Not available (N/A)

- Dividend Yield: 0.096%

- 52-Week High: ₹335.35

- 52-Week Low: ₹113.50

- Current Price: ₹260.40

BHEL Share Price Today Chart

Read Also:- Praj Industries Share Price Target 2024, 2025 To 2030 Prediction

BHEL Share Price Target Tomorrow From 2024 to 2030

Here are the estimated share prices of BHEL for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | BHEL Share Price Target Years | SHARE PRICE TARGET |

| 1 | BHEL Share Price Target 2024 | ₹390 |

| 2 | BHEL Share Price Target 2025 | ₹595 |

| 3 | BHEL Share Price Target 2026 | ₹687 |

| 4 | BHEL Share Price Target 2027 | ₹783 |

| 5 | BHEL Share Price Target 2028 | ₹897 |

| 6 | BHEL Share Price Target 2029 | ₹1024 |

| 7 | BHEL Share Price Target 2030 | ₹1174 |

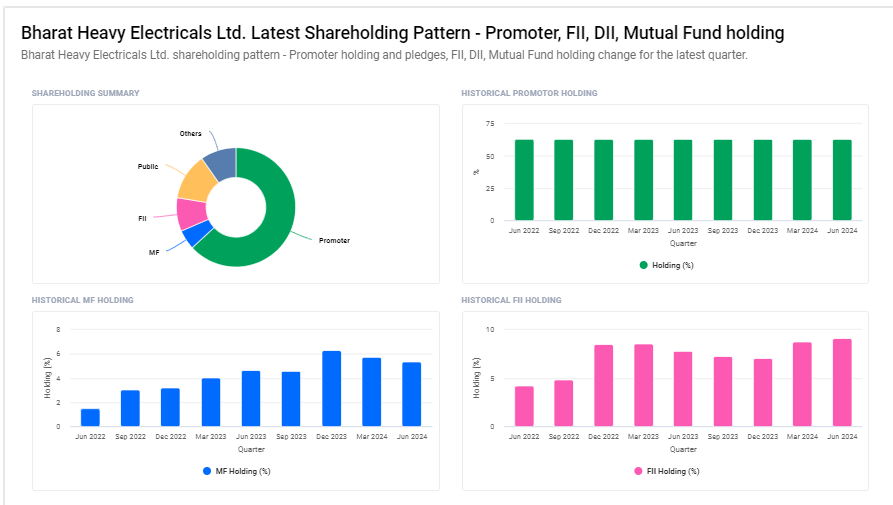

Bharat Heavy Electricals Ltd Shareholding Pattern

- Promoters: 63.17%

- Retail and Others: 12.71%

- Other Domestic Institutions: 9.66%

- Foreign Institutions: 9.10%

- Mutual Funds: 5.36%

Key Factors Affecting BHEL Share Price Growth

Here are six key factors that can affect Bharat Heavy Electricals Ltd (BHEL) share price growth:

- Infrastructure Projects: BHEL’s growth is linked to large infrastructure projects, especially in the power and energy sectors. Increasing government or private investment in these areas can boost the company’s revenues and drive share price growth.

- Government Policies: Supportive policies, such as initiatives for renewable energy or infrastructure development, can create more opportunities for BHEL, positively impacting its business and share price.

- Order Book Size: The size and value of new orders for equipment and services directly influence BHEL’s future revenue potential. A strong order book can boost investor confidence and increase share price.

- Competition: The level of competition in the heavy electrical equipment industry affects BHEL’s market share and pricing power. Maintaining a competitive edge through innovation or cost efficiency can help improve stock performance.

- Operational Efficiency: BHEL’s ability to manage costs, streamline operations, and deliver projects on time can improve profitability, which is an important factor in the company’s share price growth.

-

Energy Sector Demand: As BHEL is closely linked to the energy sector, rising demand for electricity, renewable energy, or modernization of existing power plants can create more business opportunities, supporting long-term share price growth.

Risks and Challenges to BHEL Share Price

Here are five risks and challenges that could affect Bharat Heavy Electricals Ltd (BHEL) share price:

- Slowdown in Infrastructure Projects: Any delays or reductions in large infrastructure or power projects can lower demand for BHEL’s products, impacting revenue growth and potentially leading to a decline in its share price.

- Dependence on Government Contracts: BHEL relies heavily on government orders. A slowdown in government spending or policy changes can reduce new contracts, posing a risk to the company’s earnings and stock performance.

- Intense Competition: The heavy electrical equipment industry is highly competitive, with domestic and international players. Increased competition can reduce BHEL’s market share and pressure profit margins, affecting its share price.

- Project Delays: Delays in completing projects or cost overruns can lead to lower profitability and impact investor confidence, which can negatively affect the share price.

-

Economic Slowdowns: A slowdown in the overall economy, especially in the energy and infrastructure sectors, can reduce investment in new projects, impacting BHEL’s business and leading to a fall in its share price.

Read Also:-

- KCP Sugar Share Price Target

- ECOS Mobility Share Price Target

- PFC Share Price Target

- GSK Pharma Share Price Target

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.