Titagarh Rail Systems Limited previously known as Titagarh Wagons Limited. Titagarh Rail Systems Ltd is a private sector company in India, specializing in rolling stock manufacturing. Titagarh Rail Systems Share Price on NSE as of 9 September 2024 is 1,388.70 INR. On this page, you will find Titagarh Share Price Target 2024, 2025, 2026, 2027 to 2030 as well as Titagarh Wagons latest news, Titagarh share price target tomorrow, Titagarh share price target Motilal Oswal, and more Information.

Titagarh Rail Systems Ltd Company Details

Titagarh Rail Systems Ltd is an Indian company known for manufacturing railway coaches, wagons, and other rail infrastructure. It plays a key role in building and supplying rail components, including metro coaches and freight wagons, for the Indian Railways and international markets. The company is also involved in producing defense equipment and heavy engineering products. With a focus on innovation and quality, Titagarh Rail Systems continues expanding its presence in domestic and global markets.

| Official Website | titagarh.in |

| Founded | 1984 |

| Headquarters |

Kolkata, West Bengal, India

|

| Number of employees | 870 (2024) |

| Chairman | Jagadish Prasad Chowdhary |

| Category | Share Price |

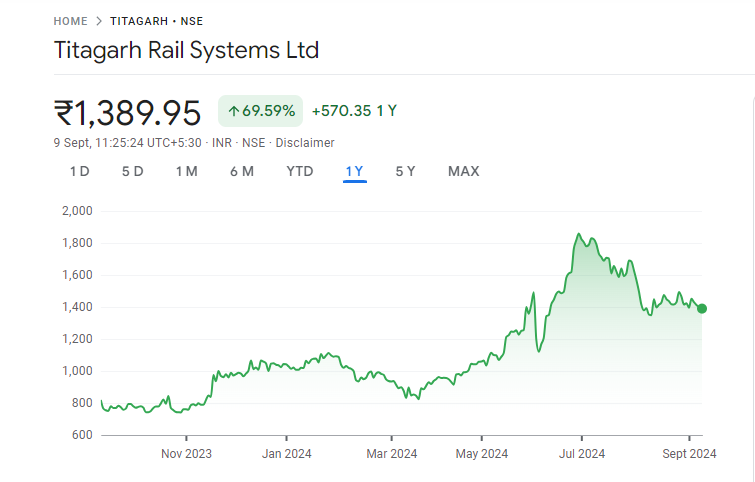

Current Market Overview Of Titagarh Share Price

- Open Price: ₹1,397.80

- High Price: ₹1,397.80

- Low Price: ₹1,362.90

- Market Capitalization: ₹18.68K Crores

- P/E Ratio: 62.37

- Dividend Yield: 0.058%

- 52-Week High: ₹1,896.95

- 52-Week Low: ₹681.00

- Current Price: ₹1,388.70

Titagarh Share Price Today Chart

Titagarh Share Price Target Tomorrow From 2024 To 2030

Here are the estimated share prices of Titagarh for the upcoming years, based solely on market valuation, enterprise trends, and professional predictions.

| S. No. | Titagarh Share Price Target Years | SHARE PRICE TARGET |

| 1 | Titagarh Share Price Target 2024 | ₹2058 |

| 2 | Titagarh Share Price Target 2025 | ₹3282 |

| 3 | Titagarh Share Price Target 2026 | ₹4329 |

| 4 | Titagarh Share Price Target 2027 | ₹4954 |

| 5 | Titagarh Share Price Target 2028 | ₹5669 |

| 6 | Titagarh Share Price Target 2029 | ₹6448 |

| 7 | Titagarh Share Price Target 2030 | ₹7426 |

Read Also:- Ola Electric Share Price Target 2024, 2025 to 2030 and More Details

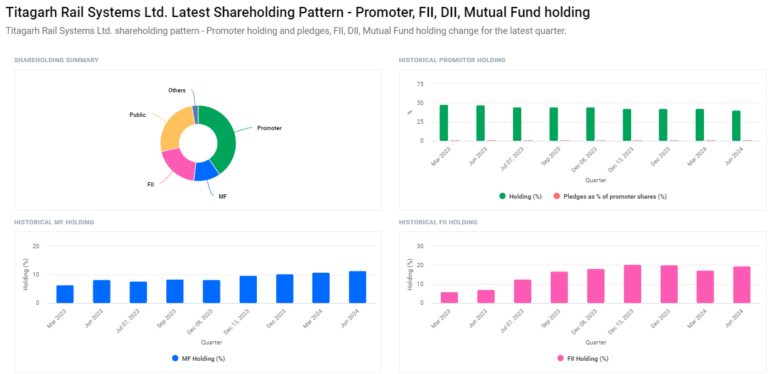

Titagarh Rail Systems Ltd Shareholding Pattern

- Promoters: 40.46% (Decreased from 40.46% in the previous place)

- Retail and Others: 25.85%

- Foreign Institutional Investors (FII/FPI): 19.56% (Increased from 17.27%)

- Mutual Funds: 11.44% (Increased from 10.83%)

- Other Domestic Institutions: 2.69%

Key Factors Affecting Titagarh Share Price Growth

Here are five key factors affecting Titagarh Industries’ share price growth:

- Order Book Strength: Titagarh’s share price can rise when the company secures large orders for railway coaches or wagons. A robust order book indicates future revenue streams, boosting investor confidence.

- Financial Performance: When Titagarh consistently reports strong financial results—like higher revenues, improved margins, or reduced debt—investors often bid up the share price in anticipation of sustained profitability.

- Industry Trends: Changes in the railway and transportation sectors directly impact Titagarh. Positive industry trends, such as increased government spending on infrastructure or urban transport projects, can drive up demand for Titagarh’s products, reflected in its share price.

- Global Economic Conditions: Titagarh’s share price is influenced by global economic factors. Economic growth in key markets, especially those with significant railway infrastructure projects, can expand Titagarh’s market opportunities and potentially elevate its stock price.

-

Regulatory Developments: Regulatory changes, especially in government policies related to railway procurement or transport infrastructure investments, can impact Titagarh’s operations and profitability. Positive regulatory developments often support share price growth by creating favorable business conditions.

Risks and Challenges to Titagarh Share Price

Here are five key risks and challenges that could affect Titagarh Industries’ share price:

- Dependence on Government Contracts: A large part of Titagarh’s business comes from government contracts. Any delays or reductions in government spending on railways and infrastructure projects could negatively impact the company’s earnings, affecting its share price.

- Economic Slowdowns: If there is a slowdown in the economy, both domestically and internationally, demand for railway and transport projects may decrease. This could limit growth opportunities for Titagarh and put pressure on its stock price.

- Rising Costs: Increased prices of raw materials like steel can raise production costs for Titagarh. If the company is unable to pass these costs onto its customers, it may face lower profit margins, which could result in a drop in share value.

- Competitive Pressure: The railway manufacturing sector is competitive, with both domestic and international players vying for contracts. If Titagarh loses market share or struggles to win new orders, it could see a decline in investor confidence, impacting its stock price.

-

Regulatory and Policy Risks: Changes in government regulations or policies, such as stricter environmental standards or shifts in transport priorities, could create new challenges for Titagarh. Adapting to such changes might increase operational costs or slow down projects, which may affect the company’s financial performance and share price.

Read Also:-

I am Ankita Vasishtha, passionate about trading and deeply committed to sharing my knowledge and insights with individuals like you. With a solid understanding of market dynamics and a knack for identifying trends, I strive to empower you with the information you need to thrive in trading.